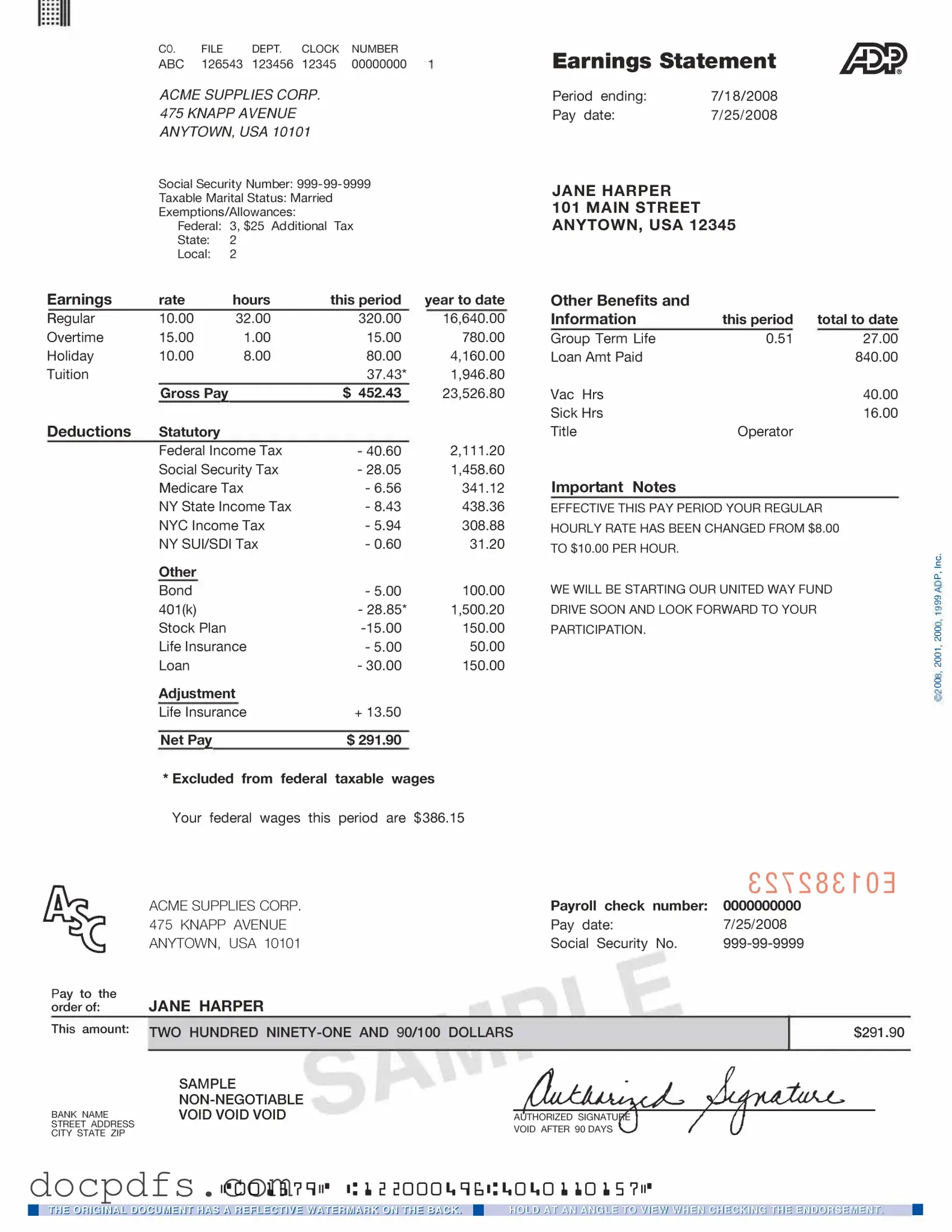

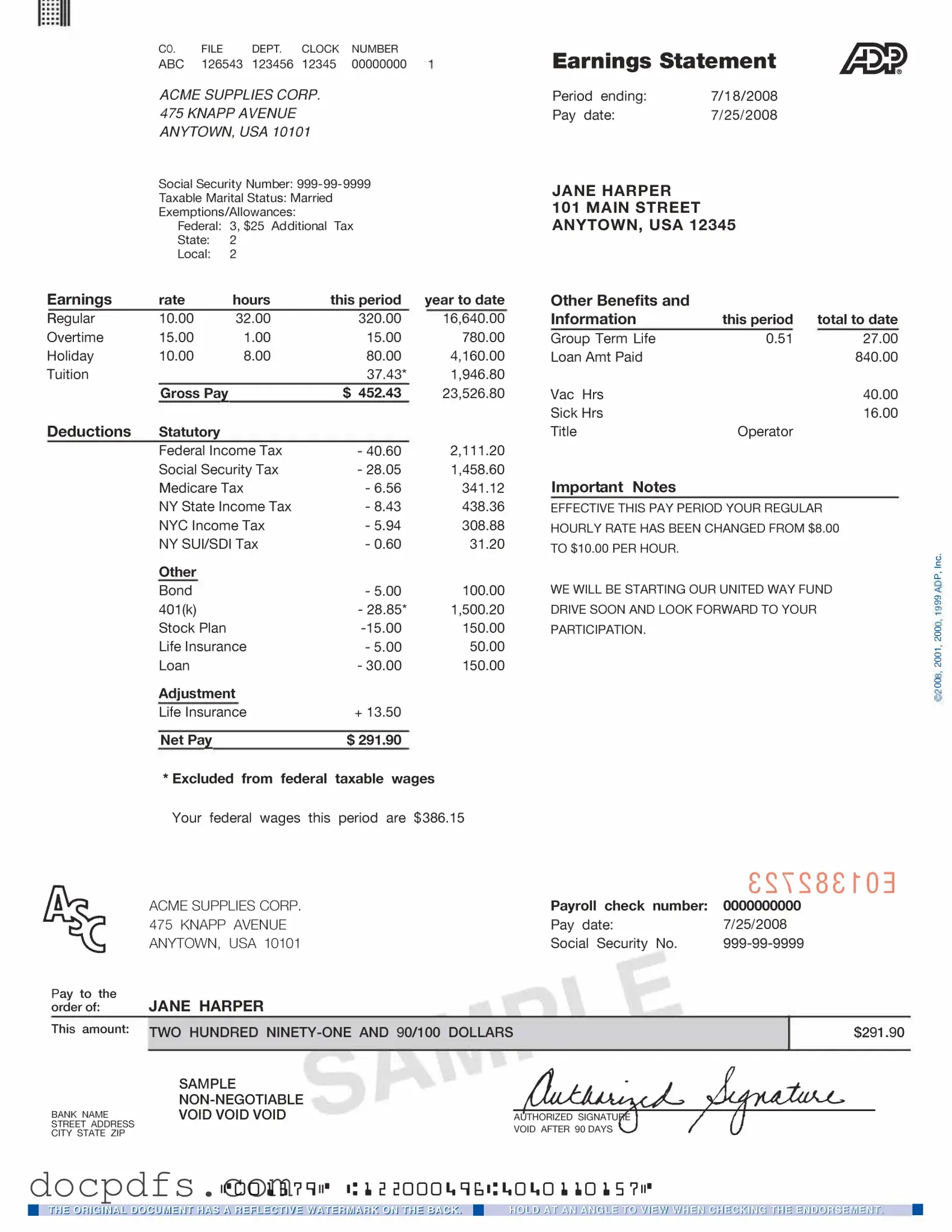

Adp Pay Stub Template in PDF

The ADP Pay Stub form is a document that provides employees with a detailed breakdown of their earnings and deductions for each pay period. It serves as an essential tool for understanding gross pay, net pay, taxes withheld, and other deductions. Familiarity with this form is crucial for both employees and employers to ensure accurate payroll management and compliance.

Open Adp Pay Stub Editor Now

Adp Pay Stub Template in PDF

Open Adp Pay Stub Editor Now

Open Adp Pay Stub Editor Now

or

⇓ Adp Pay Stub

Finish this form the fast way

Complete Adp Pay Stub online with a smooth editing experience.