What are Articles of Incorporation?

Articles of Incorporation are legal documents that establish a corporation in the United States. They outline the basic information about the corporation, including its name, purpose, and structure. This document is filed with the state government and is essential for a business to operate as a corporation.

Why do I need to file Articles of Incorporation?

Filing Articles of Incorporation is crucial for several reasons:

-

It legally creates your corporation, giving it a separate identity from its owners.

-

It limits the personal liability of the owners for the debts and obligations of the business.

-

It allows your corporation to raise capital by issuing shares.

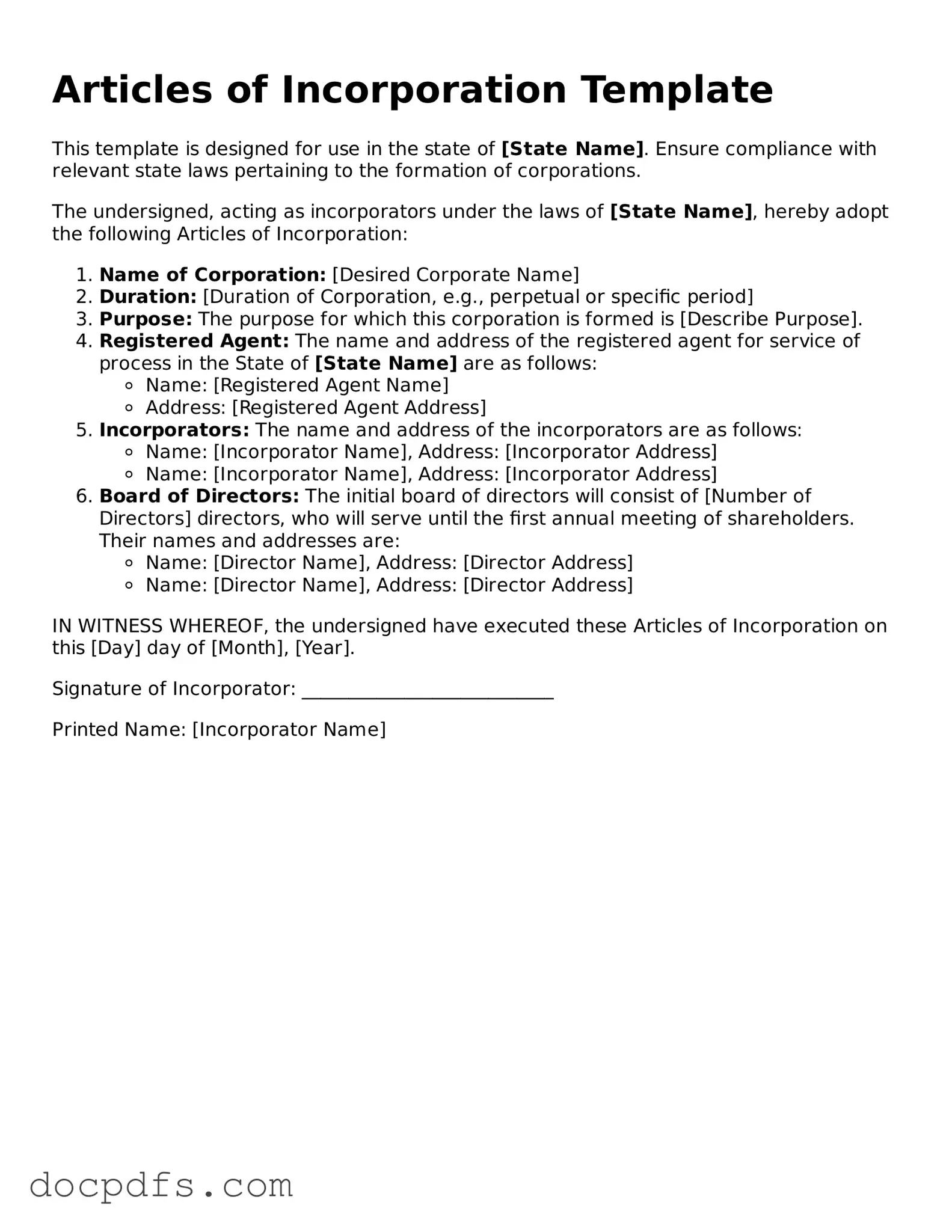

What information is required in the Articles of Incorporation?

Typically, the Articles of Incorporation must include:

-

The name of the corporation.

-

The purpose of the corporation.

-

The registered agent's name and address.

-

The number of shares the corporation is authorized to issue.

-

The names and addresses of the incorporators.

How do I file Articles of Incorporation?

Filing Articles of Incorporation generally involves these steps:

-

Prepare the Articles of Incorporation form with the required information.

-

Submit the completed form to the appropriate state agency, usually the Secretary of State.

-

Pay the required filing fee, which varies by state.

How long does it take to process Articles of Incorporation?

The processing time for Articles of Incorporation can vary by state. Generally, it takes anywhere from a few days to several weeks. Some states offer expedited processing for an additional fee, which can significantly reduce the waiting time.

Can I amend my Articles of Incorporation later?

Yes, you can amend your Articles of Incorporation if changes are needed. This may include changes to the corporation's name, purpose, or structure. To do this, you will need to file an amendment form with the state and pay any associated fees.

What happens if I don’t file Articles of Incorporation?

If you do not file Articles of Incorporation, your business will not be recognized as a corporation. This means that you will not have the benefits of limited liability, and your personal assets could be at risk if the business incurs debts or legal issues.

Do I need a lawyer to file Articles of Incorporation?

While it is not legally required to hire a lawyer to file Articles of Incorporation, many business owners choose to do so for guidance. A lawyer can help ensure that the documents are completed correctly and in compliance with state laws. However, many resources are available for those who prefer to handle the process independently.

What is the cost of filing Articles of Incorporation?

The cost to file Articles of Incorporation varies by state and can range from $50 to several hundred dollars. Additional fees may apply for expedited processing or for obtaining certified copies of the documents. It’s advisable to check with your state’s Secretary of State office for specific fee information.