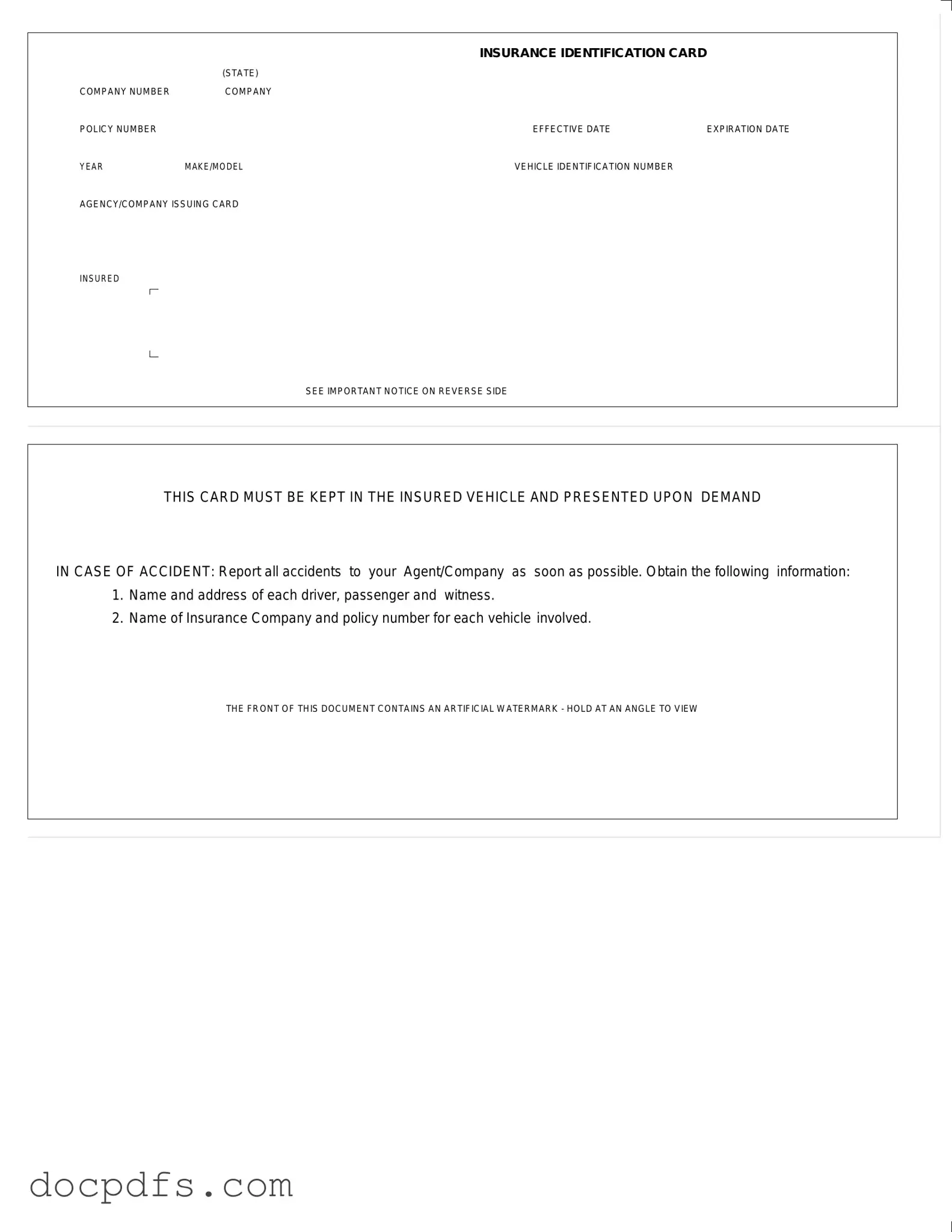

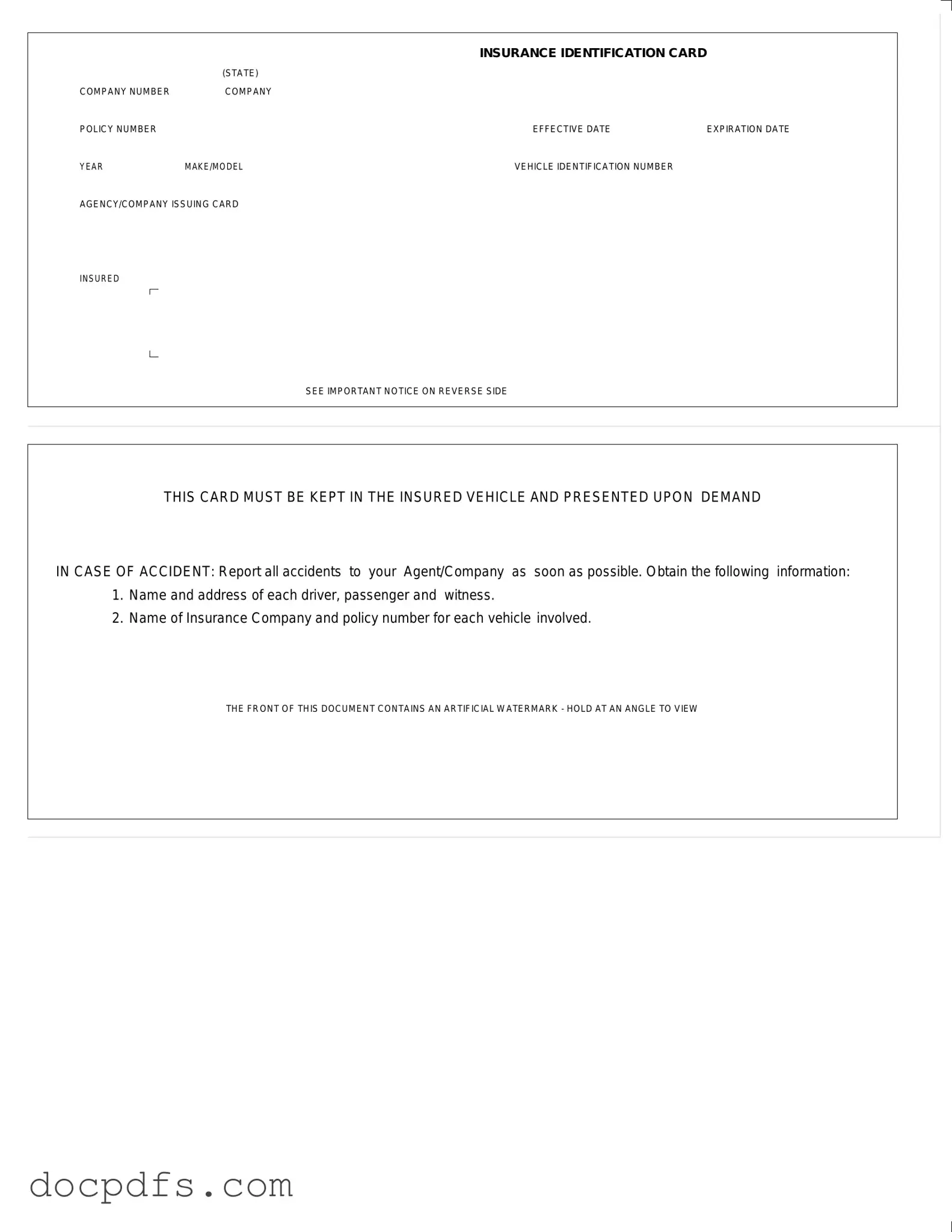

Auto Insurance Card Template in PDF

The Auto Insurance Card is an essential document that proves you have insurance coverage for your vehicle. It includes important details like your policy number, effective dates, and vehicle identification information. Always keep this card in your car and present it if you're involved in an accident.

Open Auto Insurance Card Editor Now

Auto Insurance Card Template in PDF

Open Auto Insurance Card Editor Now

Open Auto Insurance Card Editor Now

or

⇓ Auto Insurance Card

Finish this form the fast way

Complete Auto Insurance Card online with a smooth editing experience.