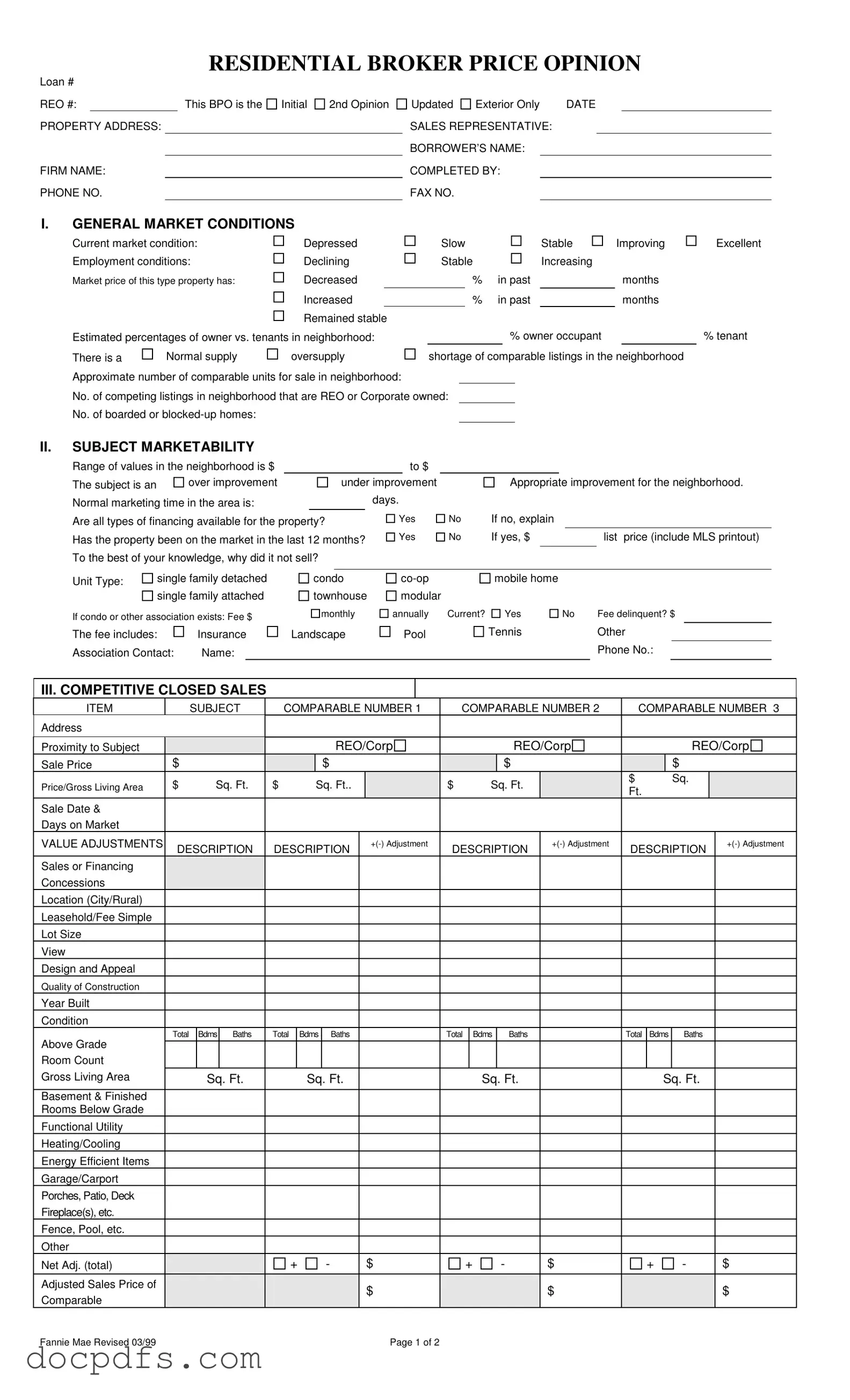

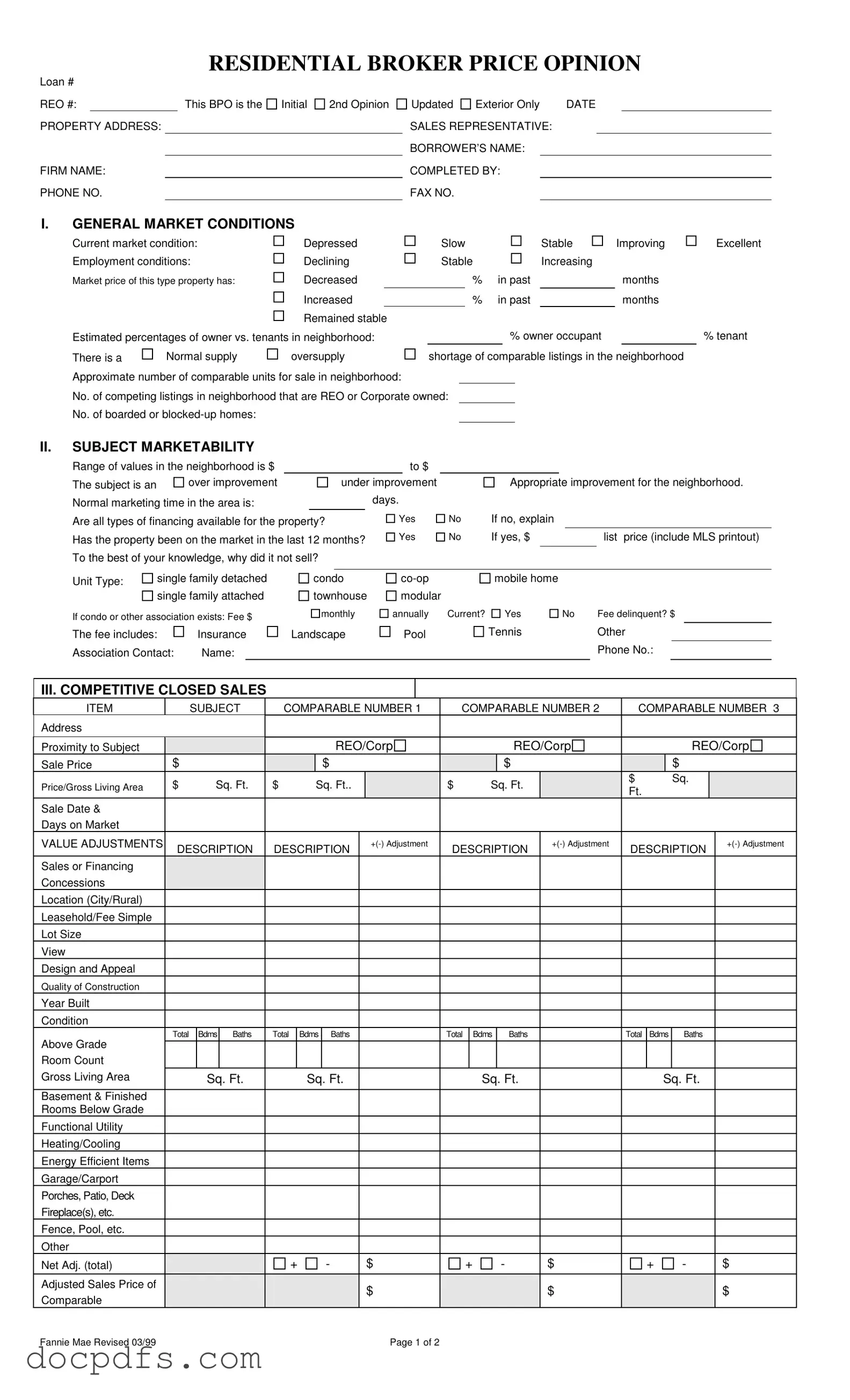

What is a Broker Price Opinion (BPO)?

A Broker Price Opinion is a professional assessment of a property's market value. It is typically prepared by a licensed real estate broker or agent. The BPO helps lenders, investors, and homeowners understand the current value of a property based on various factors, including recent sales of comparable properties, market conditions, and the property's condition.

Who typically requests a BPO?

Financial institutions, mortgage companies, and real estate investors commonly request BPOs. They use these opinions to make informed decisions regarding property sales, foreclosures, or refinancing. Homeowners may also seek a BPO for personal knowledge about their property’s value.

A BPO typically includes:

-

General market conditions and employment status

-

Details about the subject property, including its condition and improvements

-

Comparative analysis with similar properties that have sold recently

-

Current listings of comparable properties

-

Marketing strategies and suggested repairs

This comprehensive data helps create a well-rounded view of the property's market value.

How is the value of a property determined in a BPO?

The value is determined through a combination of factors, including:

-

Analysis of comparable properties that have recently sold

-

Consideration of the current market conditions

-

Adjustments made for differences in features, location, and condition

By comparing these elements, the broker can provide a realistic estimate of the property's worth.

What is the difference between a BPO and an appraisal?

While both a BPO and an appraisal aim to determine property value, they differ in purpose and depth. An appraisal is a more formal, detailed analysis performed by a licensed appraiser, often required for financing purposes. A BPO, on the other hand, is generally quicker and less formal, focusing on current market trends and comparable sales.

How long does it take to complete a BPO?

The time required to complete a BPO can vary. Generally, it can take anywhere from a few days to a week, depending on the complexity of the property and the availability of comparable sales data. Brokers strive to provide timely and accurate assessments to meet client needs.

Can a BPO be used for legal purposes?

While a BPO can provide valuable insights into property value, it is not typically used as a legal document. Its informal nature means it may not hold up in court as an appraisal would. For legal matters, a formal appraisal is recommended.

What should I do if I disagree with the BPO value?

If you disagree with the BPO value, consider gathering additional data to support your position. This might include recent sales data of comparable properties or information about unique features of your property. You can then discuss your concerns with the broker who prepared the BPO or seek a second opinion from another professional.

Is there a cost associated with obtaining a BPO?

Yes, there is typically a fee for obtaining a BPO, which can vary depending on the broker or agency providing the service. It is advisable to ask about the costs upfront to ensure transparency and avoid surprises.