What is a Business Bill of Sale?

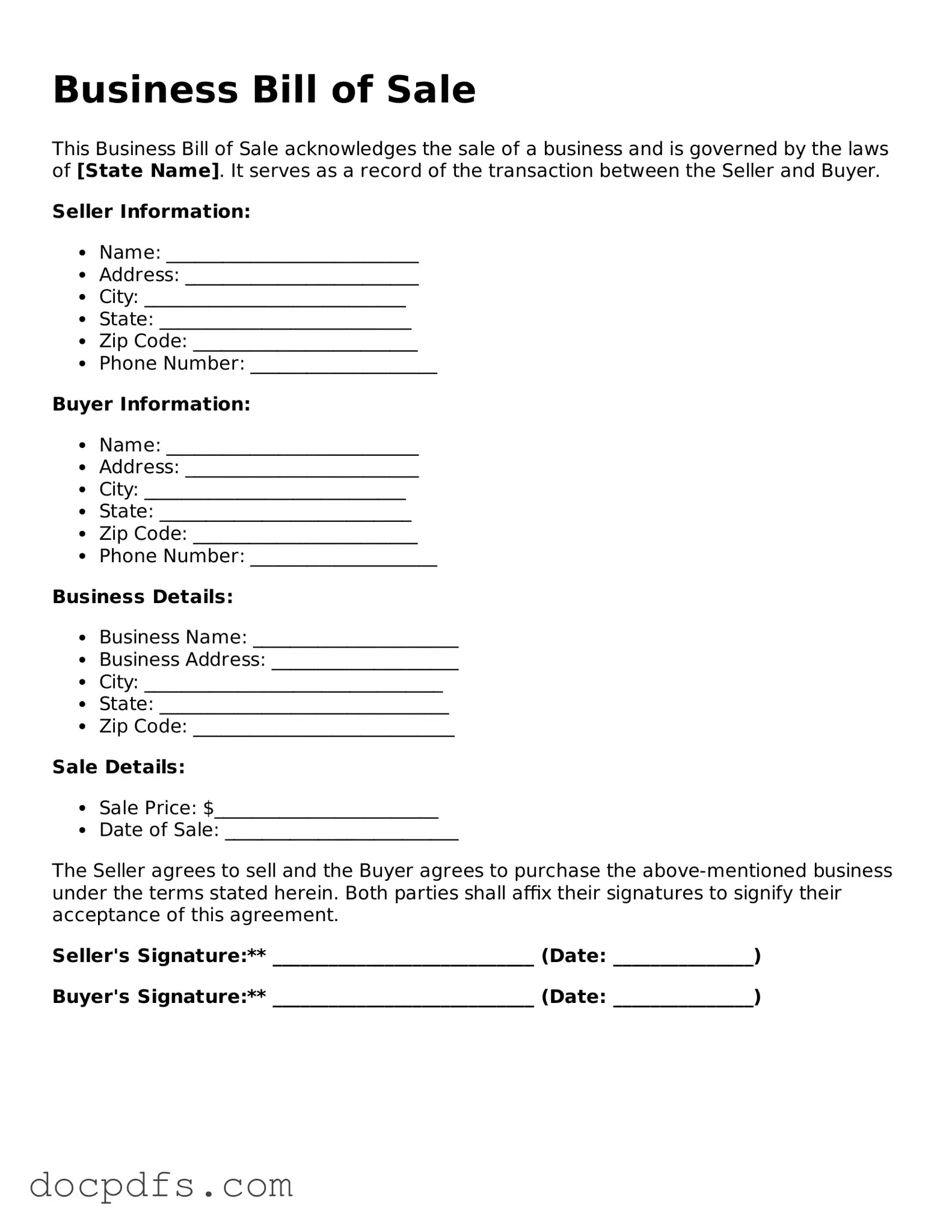

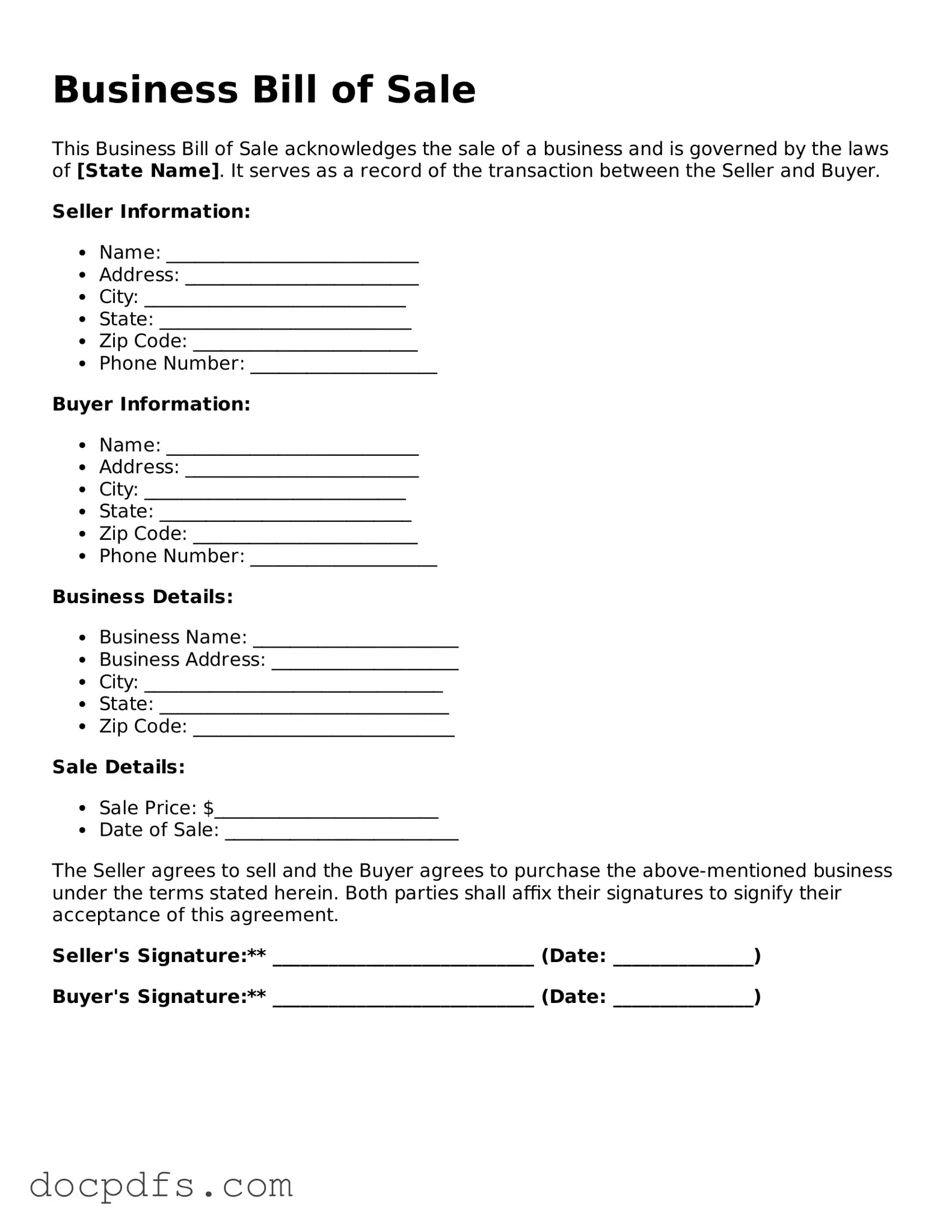

A Business Bill of Sale is a legal document that transfers ownership of a business or its assets from one party to another. This document outlines the details of the transaction, including the parties involved, the items being sold, and the terms of the sale. It serves as proof of the transaction and can be important for tax and legal purposes.

When do I need a Business Bill of Sale?

You typically need a Business Bill of Sale when you are buying or selling a business or specific business assets. This can include equipment, inventory, or even the entire business. It is crucial for ensuring that both parties have a clear understanding of what is being transferred and under what conditions.

A comprehensive Business Bill of Sale generally includes the following information:

-

The names and addresses of the buyer and seller

-

A detailed description of the business or assets being sold

-

The purchase price

-

The date of the transaction

-

Any warranties or representations made by the seller

-

Signatures of both parties

Do I need a lawyer to create a Business Bill of Sale?

While it is not mandatory to have a lawyer draft a Business Bill of Sale, consulting with one can be beneficial. A lawyer can help ensure that all necessary details are included and that the document complies with local laws. However, many people choose to use templates or online services to create their own documents.

Is a Business Bill of Sale required by law?

In most cases, a Business Bill of Sale is not legally required, but it is highly recommended. Having this document protects both the buyer and seller by providing a record of the transaction. In certain situations, such as when transferring ownership of a registered business entity, a bill of sale may be necessary for legal compliance.

Can a Business Bill of Sale be modified after signing?

Once a Business Bill of Sale is signed, it is generally considered a binding agreement. However, if both parties agree to changes, they can create an amendment or a new document that outlines the modifications. It’s essential to ensure that both parties sign any changes to maintain clarity and legal standing.

What happens if I lose my Business Bill of Sale?

If you lose your Business Bill of Sale, it can be challenging but not impossible to recover. You may be able to recreate the document by gathering information from the original transaction, such as emails, payment receipts, or witness statements. If necessary, you could also ask the other party to sign a new bill of sale to reaffirm the transaction.

Can I use a Business Bill of Sale for personal property?

Yes, a Business Bill of Sale can also be used for personal property, especially if it is related to a business transaction. However, for personal property sales, a simpler bill of sale may suffice. Always ensure that the document accurately reflects the nature of the transaction and the items involved.

How do I ensure my Business Bill of Sale is valid?

To ensure your Business Bill of Sale is valid, follow these steps:

-

Include all necessary information as mentioned earlier.

-

Have both parties sign the document.

-

Consider having the document notarized to add an extra layer of authenticity.

-

Keep copies for both parties and store them in a safe place.