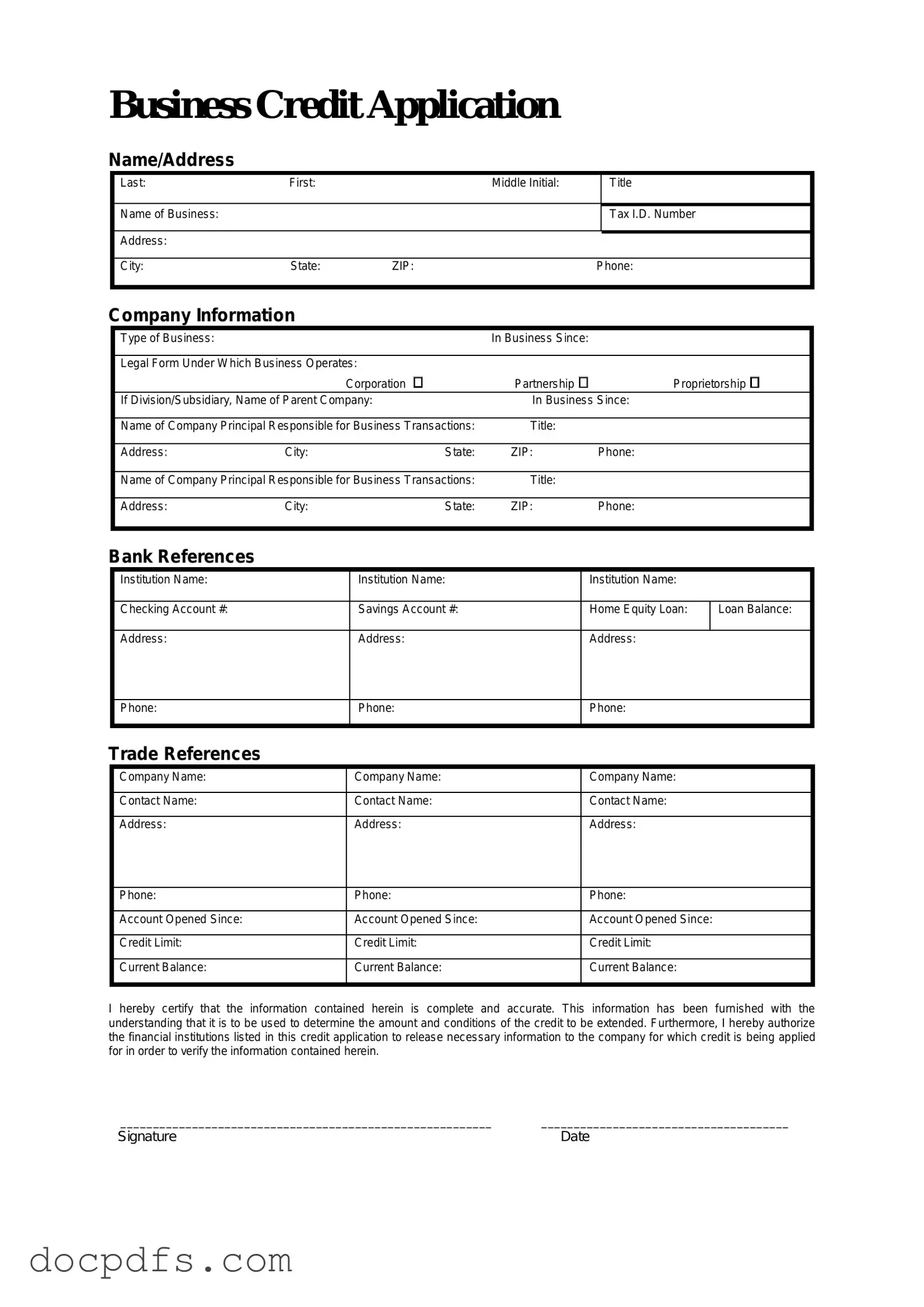

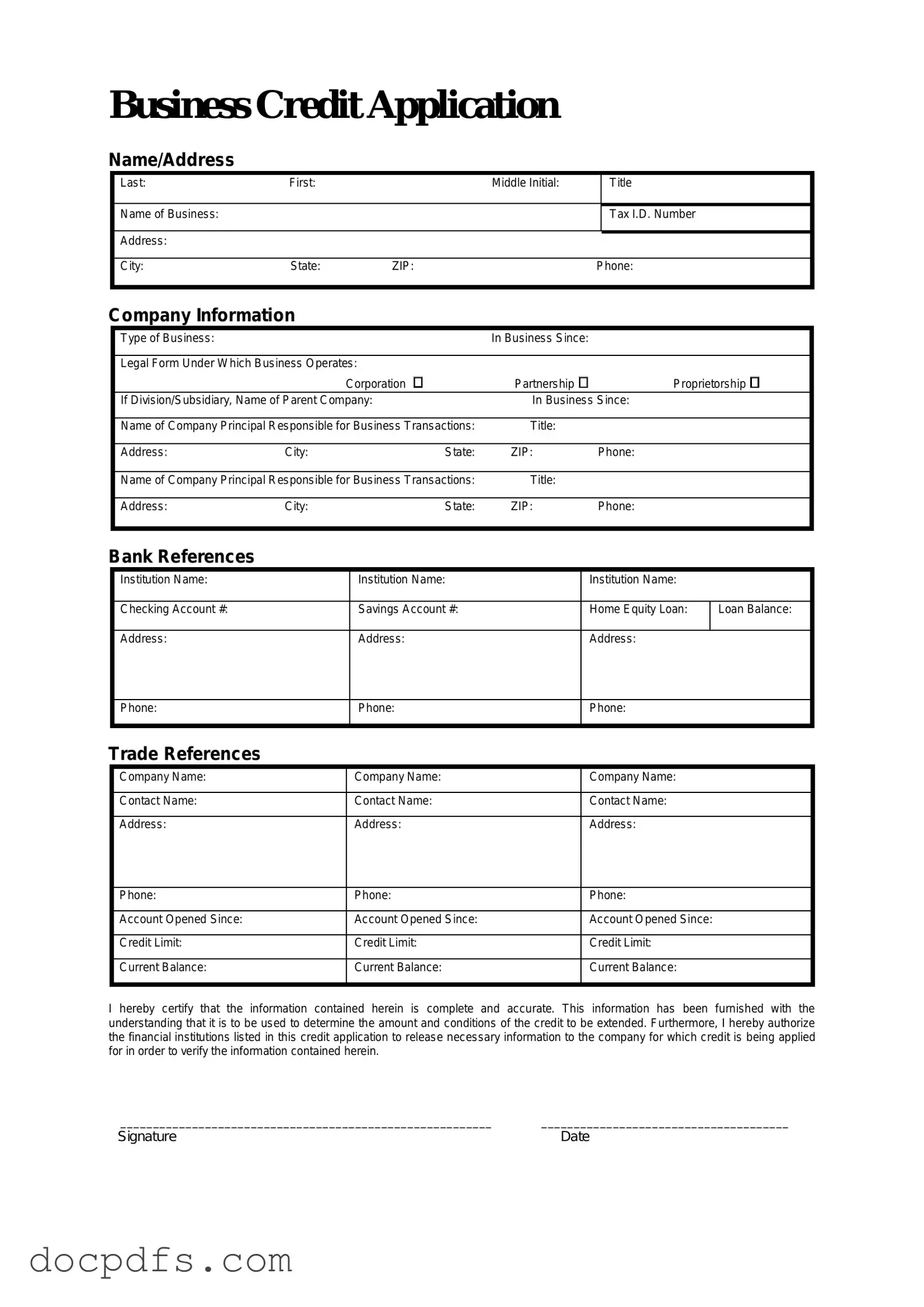

Business Credit Application Template in PDF

A Business Credit Application form is a document used by companies to request credit from suppliers or lenders. This form collects essential information about the business's financial status, ownership, and credit history. Completing it accurately is crucial for securing favorable credit terms and maintaining healthy business relationships.

Open Business Credit Application Editor Now

Business Credit Application Template in PDF

Open Business Credit Application Editor Now

Open Business Credit Application Editor Now

or

⇓ Business Credit Application

Finish this form the fast way

Complete Business Credit Application online with a smooth editing experience.