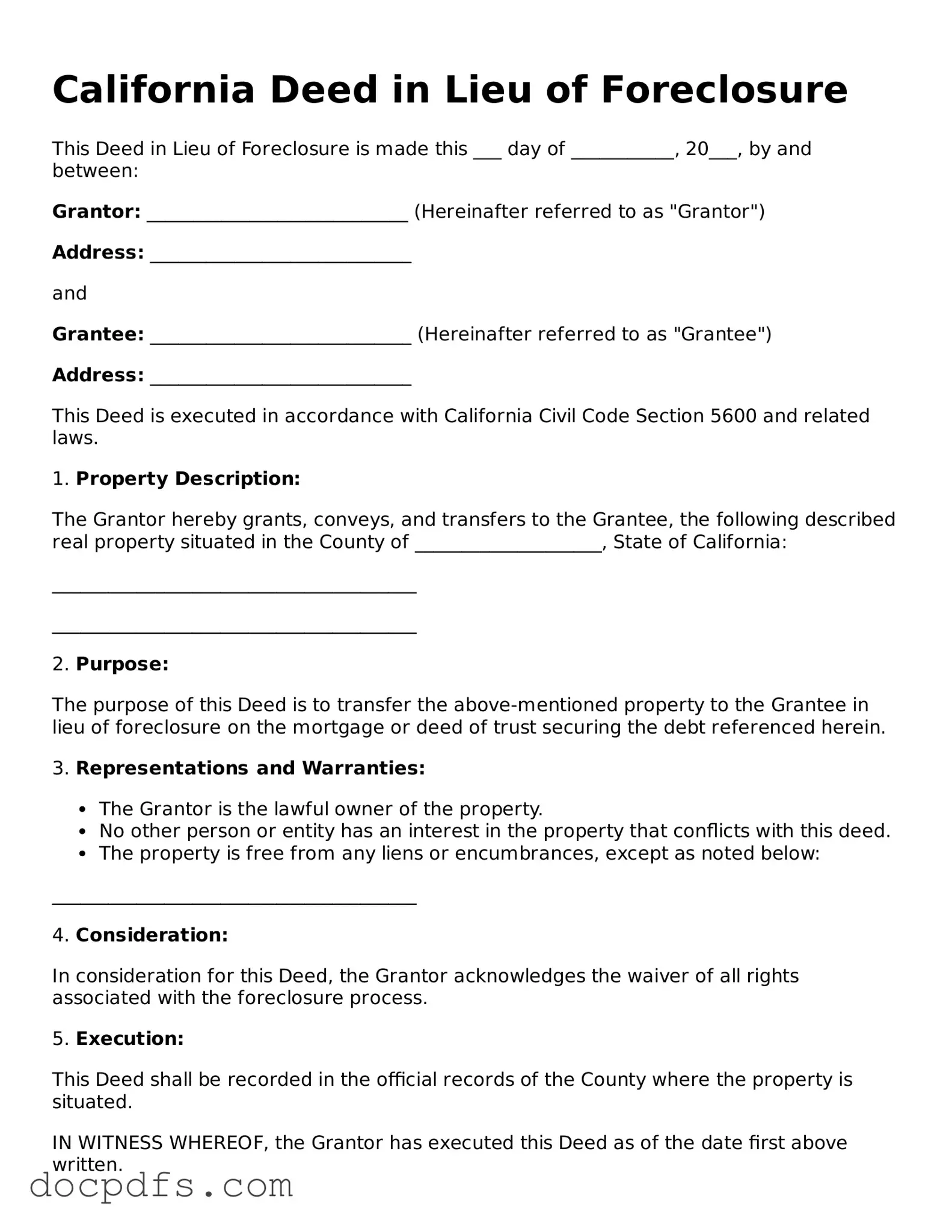

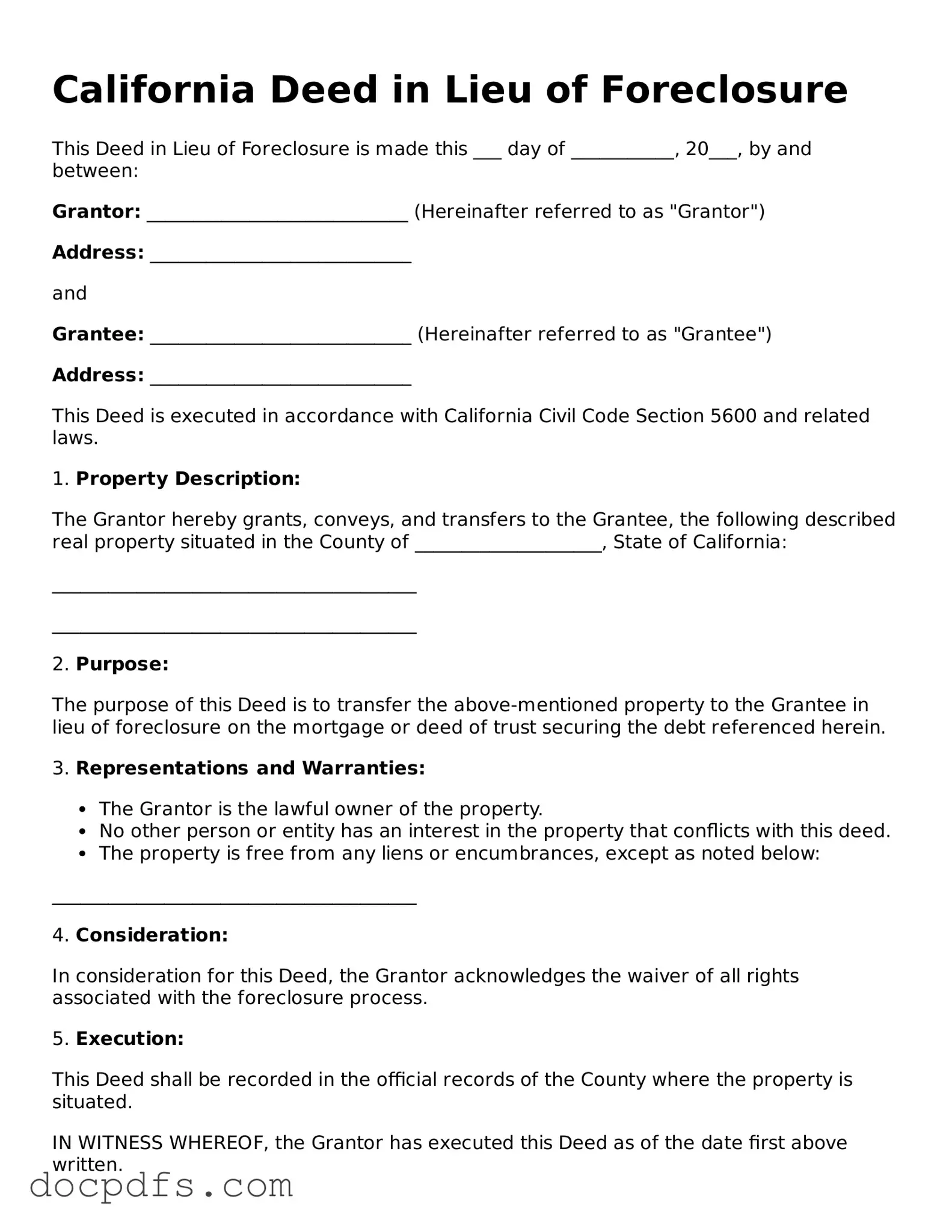

Free California Deed in Lieu of Foreclosure Form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer the title of their property to the lender in order to avoid the foreclosure process. This arrangement can provide a more efficient resolution for both parties, as it typically allows the homeowner to walk away from the mortgage obligation while the lender gains possession of the property without the need for court intervention. In California, specific forms and procedures govern this process, ensuring that both the lender and borrower are protected during the transaction.

Open Deed in Lieu of Foreclosure Editor Now

Free California Deed in Lieu of Foreclosure Form

Open Deed in Lieu of Foreclosure Editor Now

Open Deed in Lieu of Foreclosure Editor Now

or

⇓ Deed in Lieu of Foreclosure

Finish this form the fast way

Complete Deed in Lieu of Foreclosure online with a smooth editing experience.