What is a California Deed?

A California Deed is a legal document that transfers ownership of real property from one party to another. It serves as proof of the transfer and must be recorded with the county to be effective against third parties. There are different types of deeds, such as grant deeds and quitclaim deeds, each serving different purposes.

What are the different types of California Deeds?

In California, the most common types of deeds include:

-

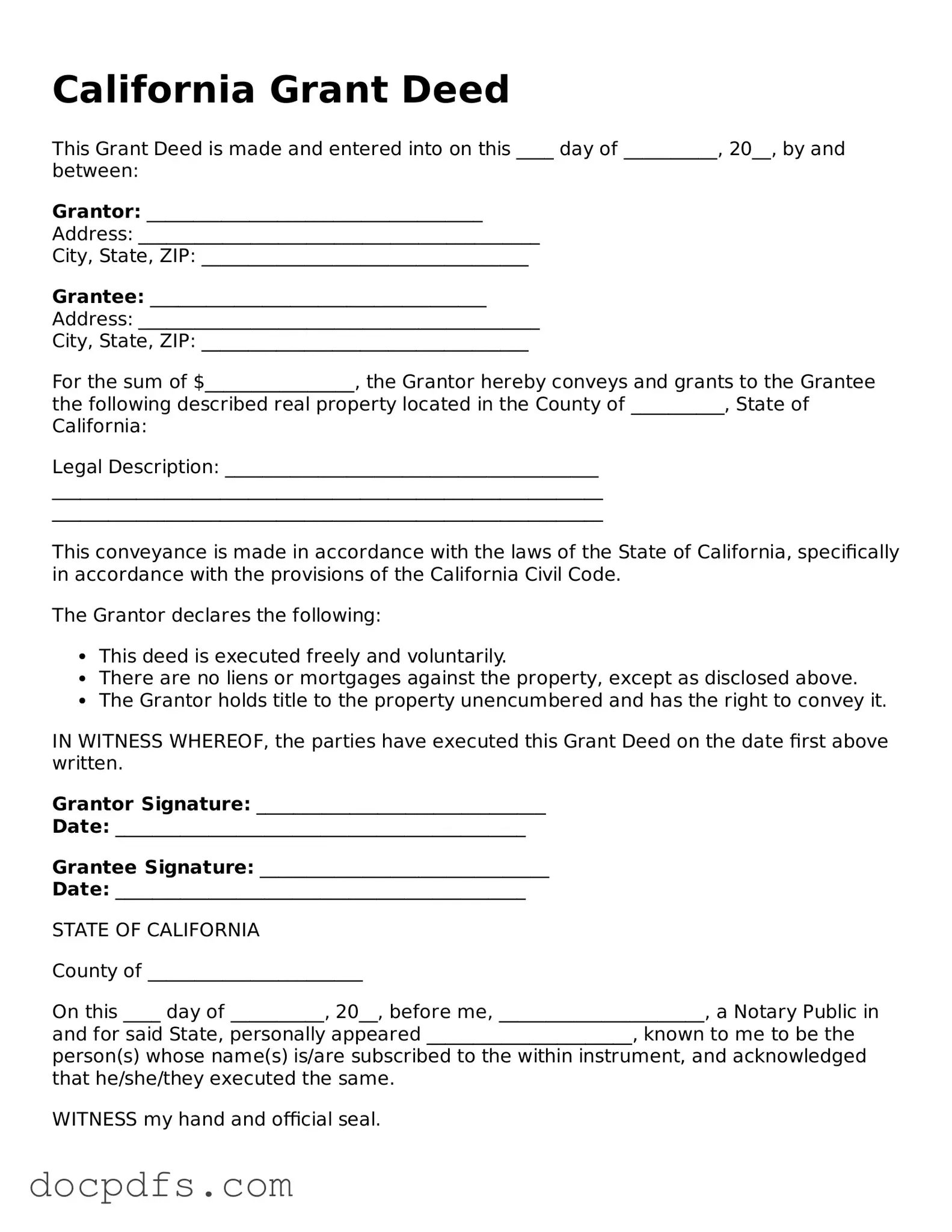

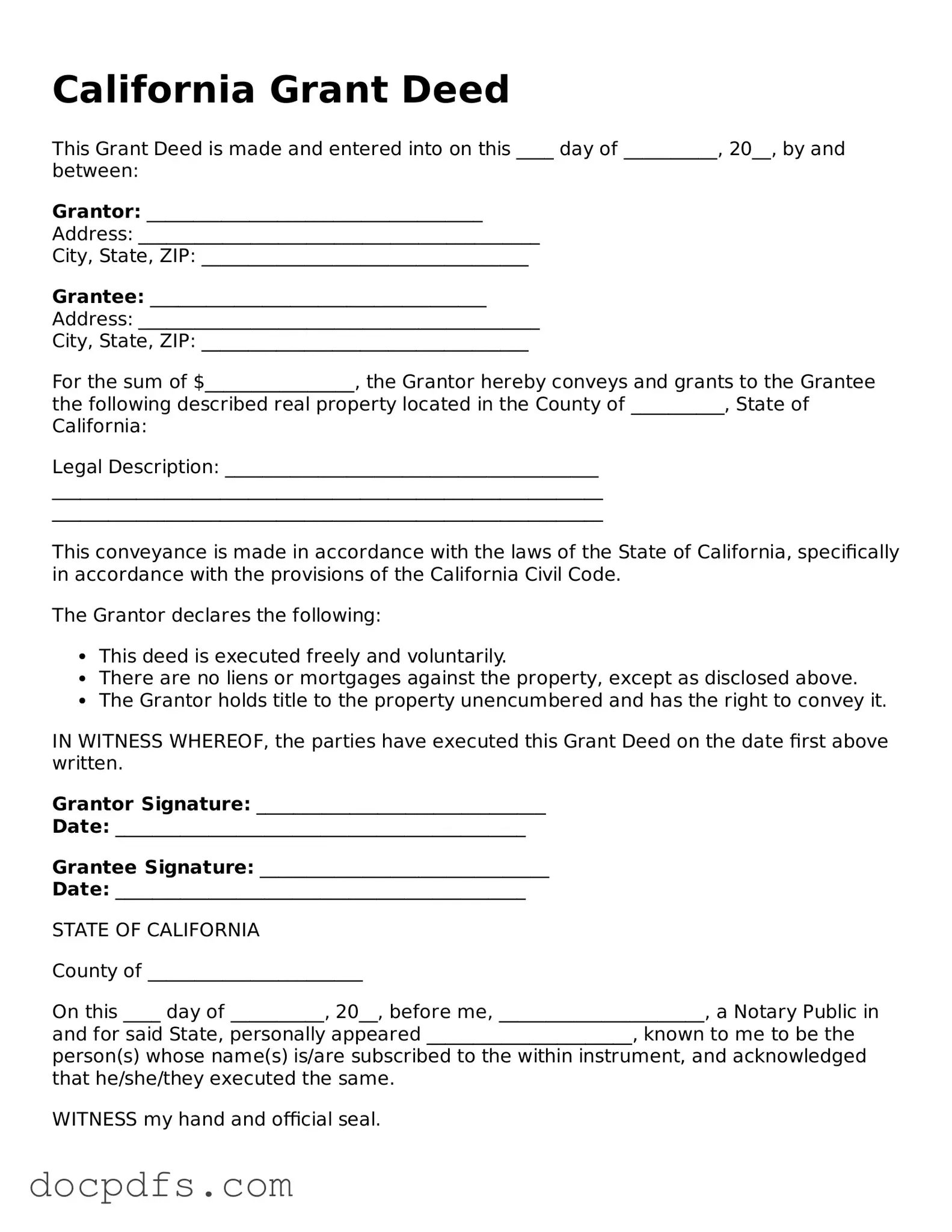

Grant Deed:

This deed guarantees that the seller has not transferred the property to anyone else and that the property is free of any encumbrances, except those disclosed.

-

Quitclaim Deed:

This deed transfers whatever interest the seller has in the property, without any guarantees. It is often used between family members or in divorce settlements.

-

Warranty Deed:

This deed provides the highest level of protection to the buyer, ensuring that the property is free from any claims or liens.

How do I fill out a California Deed?

To fill out a California Deed, follow these steps:

-

Identify the parties involved: Include the names of the grantor (seller) and grantee (buyer).

-

Describe the property: Provide a legal description of the property, including its address and parcel number.

-

State the consideration: Mention the amount paid for the property or state if it is a gift.

-

Sign the deed: The grantor must sign the deed in front of a notary public.

Do I need a notary to complete a California Deed?

Yes, a notary public must witness the signature of the grantor for the deed to be valid. The notary will also provide a seal, which is necessary for recording the deed with the county.

How do I record a California Deed?

To record a California Deed, take the following steps:

-

Visit the county recorder's office where the property is located.

-

Submit the signed and notarized deed along with any required fees.

-

Request a copy of the recorded deed for your records.

Is there a fee to record a California Deed?

Yes, there is typically a fee to record a California Deed. The fee varies by county, so it is advisable to check with your local county recorder's office for the exact amount. Additional fees may apply for copies or special requests.

What happens after I record the California Deed?

After recording the California Deed, the transfer of ownership is officially documented. The county will keep a public record of the deed, which can be accessed by anyone. It is important to keep a copy of the recorded deed for your personal records.

Can I change a California Deed after it has been recorded?

Once a California Deed has been recorded, it cannot be changed. If you need to make changes, you will have to create a new deed that reflects the desired changes and record it again. Consult with a legal professional to ensure that the new deed is properly executed.