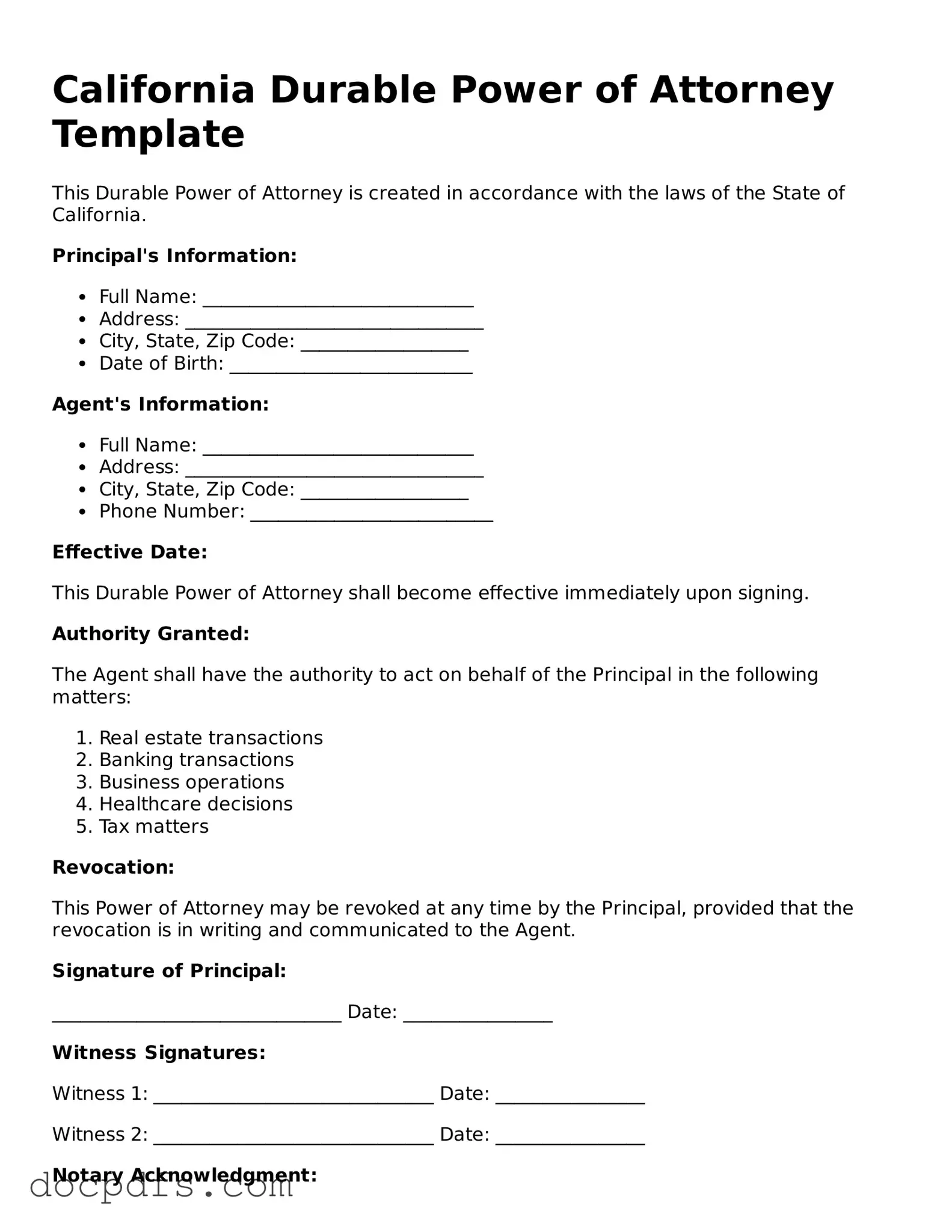

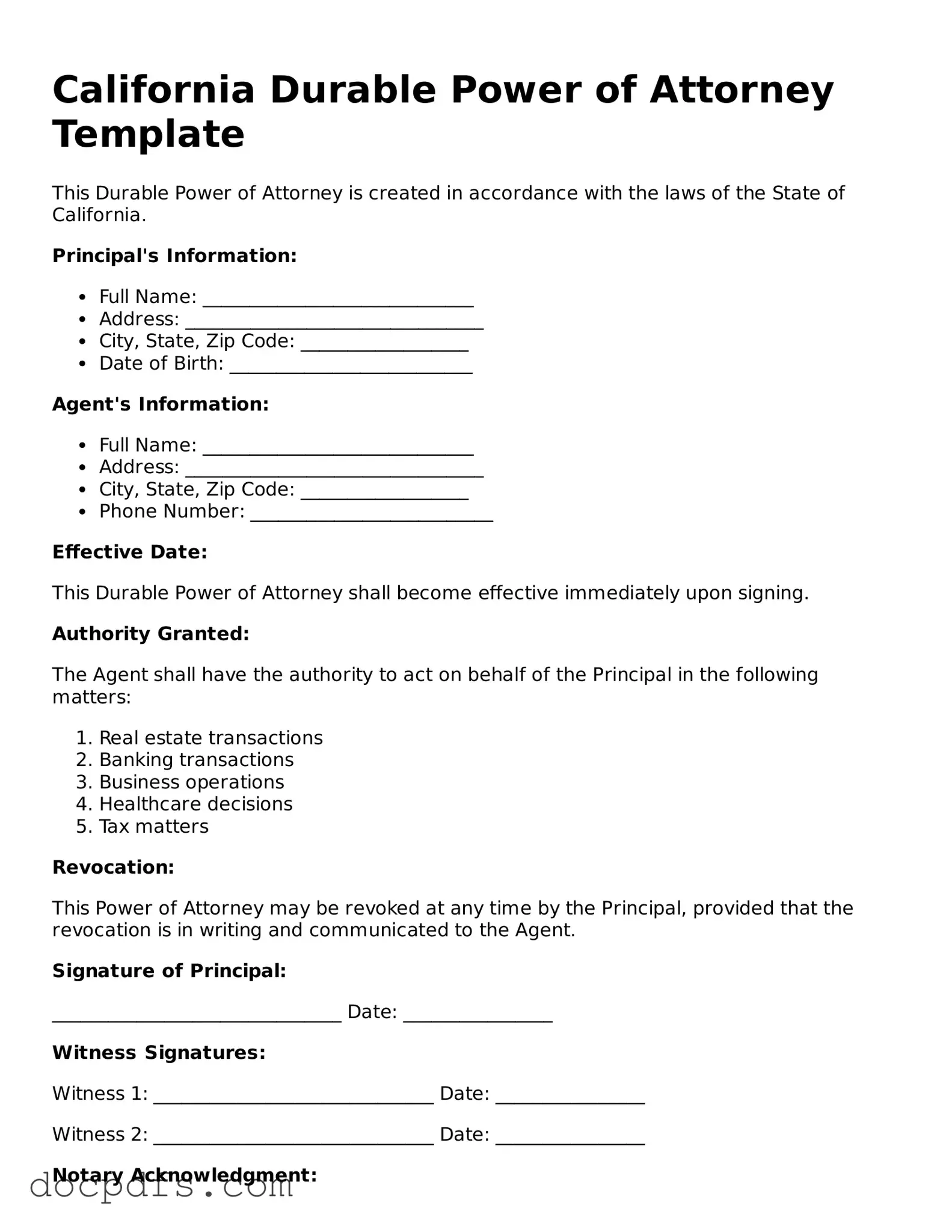

Free California Durable Power of Attorney Form

A California Durable Power of Attorney form is a legal document that allows you to designate someone you trust to make decisions on your behalf when you are unable to do so. This can include financial matters, healthcare choices, and other important decisions. Understanding how this form works is essential for ensuring your wishes are respected during challenging times.

Open Durable Power of Attorney Editor Now

Free California Durable Power of Attorney Form

Open Durable Power of Attorney Editor Now

Open Durable Power of Attorney Editor Now

or

⇓ Durable Power of Attorney

Finish this form the fast way

Complete Durable Power of Attorney online with a smooth editing experience.