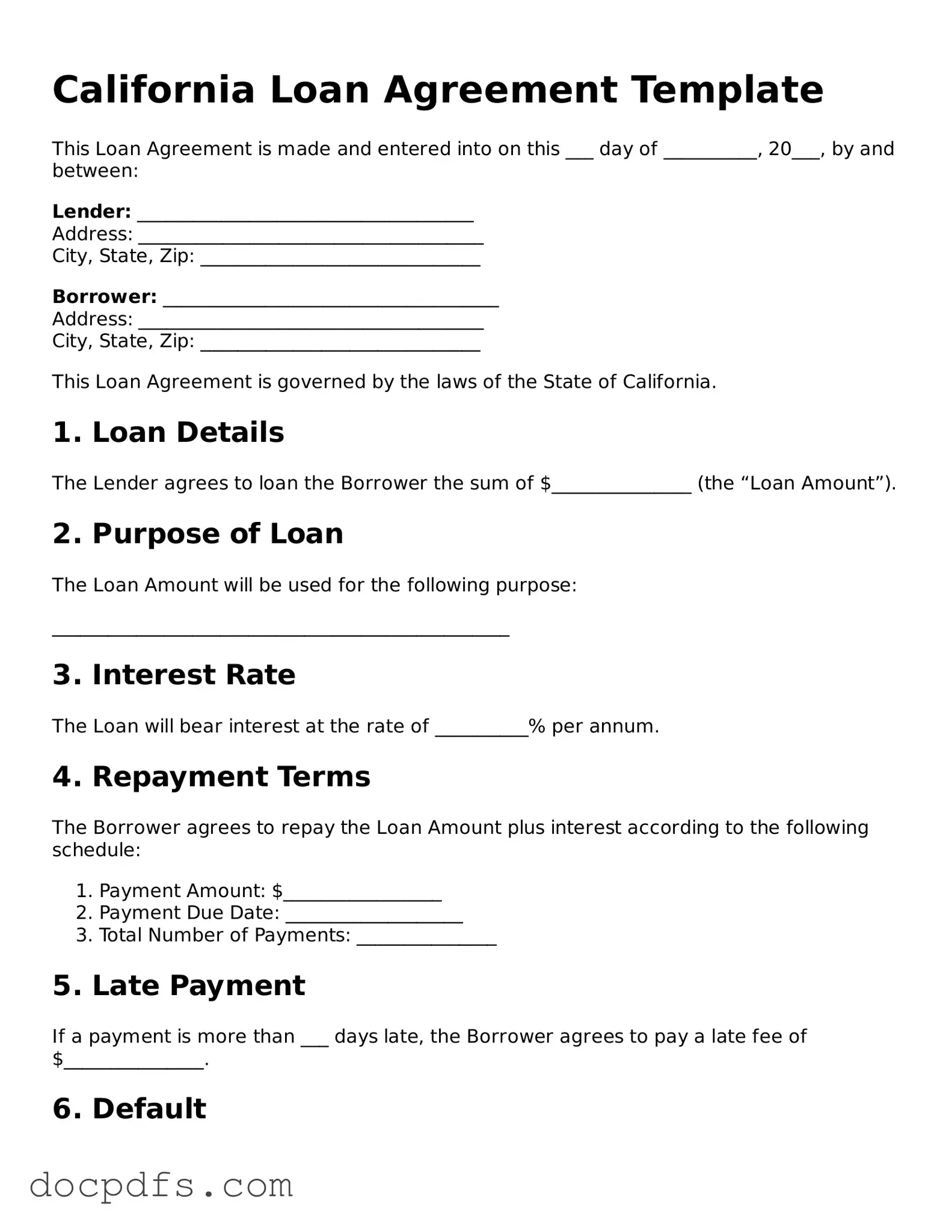

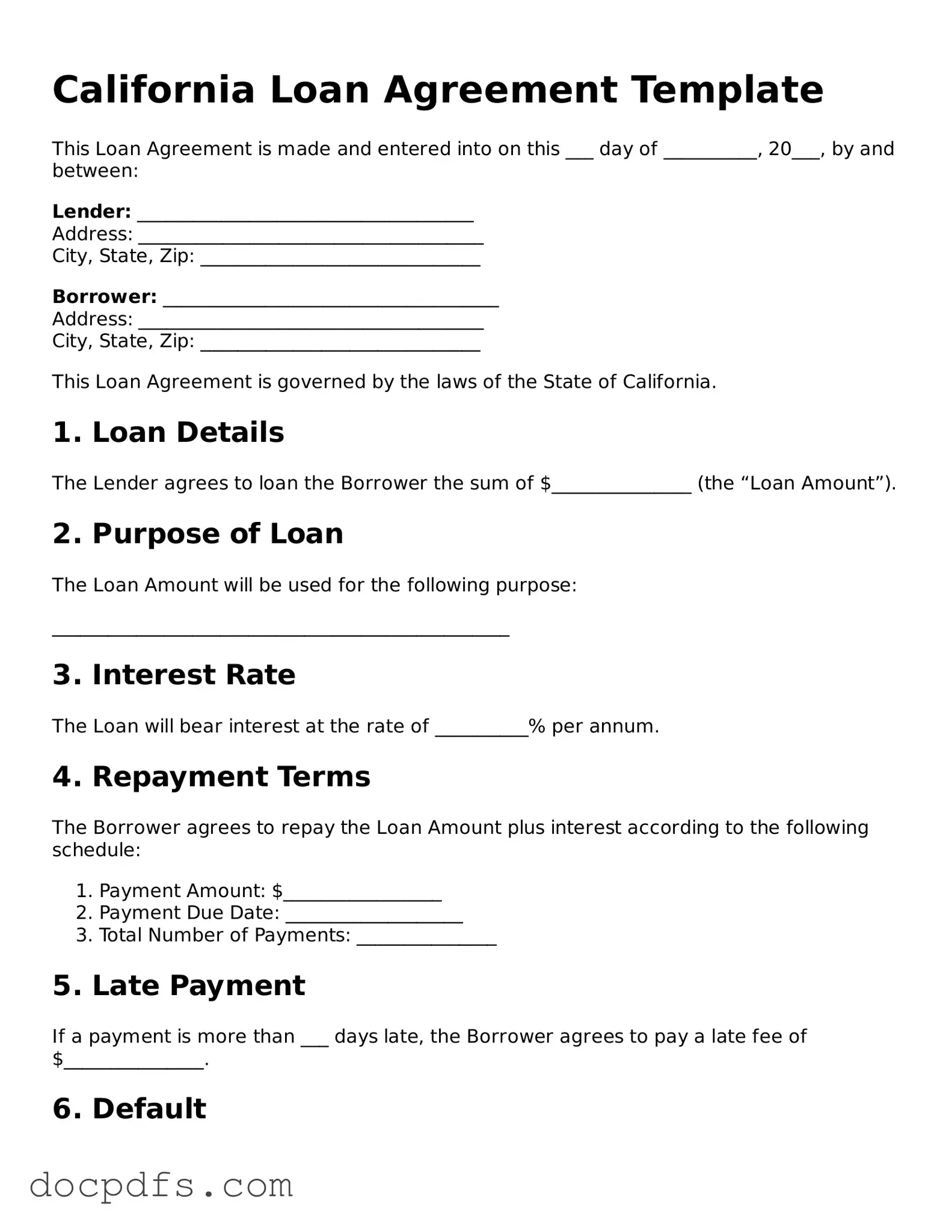

A California Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This form specifies the amount borrowed, interest rates, repayment schedule, and any collateral involved. It serves as a written record to protect both parties and ensure clarity in the loan transaction.

Who can use a California Loan Agreement?

Any individual or business in California seeking to lend or borrow money can use this form. Whether it's for personal loans between friends or family, or for business purposes, this agreement helps formalize the arrangement. It's important for both parties to understand their rights and obligations under the agreement.

What are the key components of a California Loan Agreement?

A typical California Loan Agreement includes the following key components:

-

Loan Amount:

The total sum of money being borrowed.

-

Interest Rate:

The percentage charged on the loan amount, which can be fixed or variable.

-

Repayment Terms:

Details about how and when the borrower will repay the loan.

-

Collateral:

Any assets pledged by the borrower to secure the loan.

-

Default Terms:

Conditions under which the lender can take action if the borrower fails to repay.

Is a California Loan Agreement legally binding?

Yes, a California Loan Agreement is legally binding, provided it meets certain requirements. Both parties must agree to the terms, and the document should be signed and dated. It’s also advisable to have the agreement witnessed or notarized to enhance its enforceability.

Do I need a lawyer to draft a California Loan Agreement?

While it is not mandatory to hire a lawyer, consulting one can be beneficial, especially for complex loans or significant amounts. A lawyer can help ensure that the agreement complies with California laws and adequately protects your interests.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender has several options. They may pursue legal action to recover the owed amount, which could include filing a lawsuit. If collateral was provided, the lender might also have the right to seize it. The specific consequences should be clearly outlined in the Loan Agreement.

Can the terms of a California Loan Agreement be modified?

Yes, the terms of a California Loan Agreement can be modified if both parties agree to the changes. It is important to document any modifications in writing and have both parties sign the updated agreement to avoid misunderstandings in the future.

Are there limits on interest rates in California?

Yes, California law imposes limits on the maximum interest rates that can be charged, depending on the type of loan and the lender. For example, loans under $2,500 may have different caps compared to larger loans. It is crucial to ensure that the interest rate in the agreement complies with state regulations to avoid legal issues.

A California Loan Agreement form can be obtained from various sources, including legal websites, office supply stores, or through a lawyer. Many online platforms offer customizable templates that can be tailored to meet specific needs. Always ensure that the form you choose complies with California laws.