What is a Quitclaim Deed in California?

A Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another without any warranties or guarantees. In California, this form is commonly used among family members, during divorce settlements, or in situations where the property owner wants to relinquish their interest in the property.

How does a Quitclaim Deed differ from a Warranty Deed?

The primary difference between a Quitclaim Deed and a Warranty Deed lies in the level of protection offered to the buyer. A Warranty Deed provides guarantees that the seller holds clear title to the property and has the right to sell it. In contrast, a Quitclaim Deed transfers whatever interest the seller has in the property without any assurances regarding the title.

When should I use a Quitclaim Deed?

A Quitclaim Deed is appropriate in several situations, including:

-

Transferring property between family members

-

Adding or removing a spouse from the title after marriage or divorce

-

Clearing up title issues

-

Transferring property into a trust

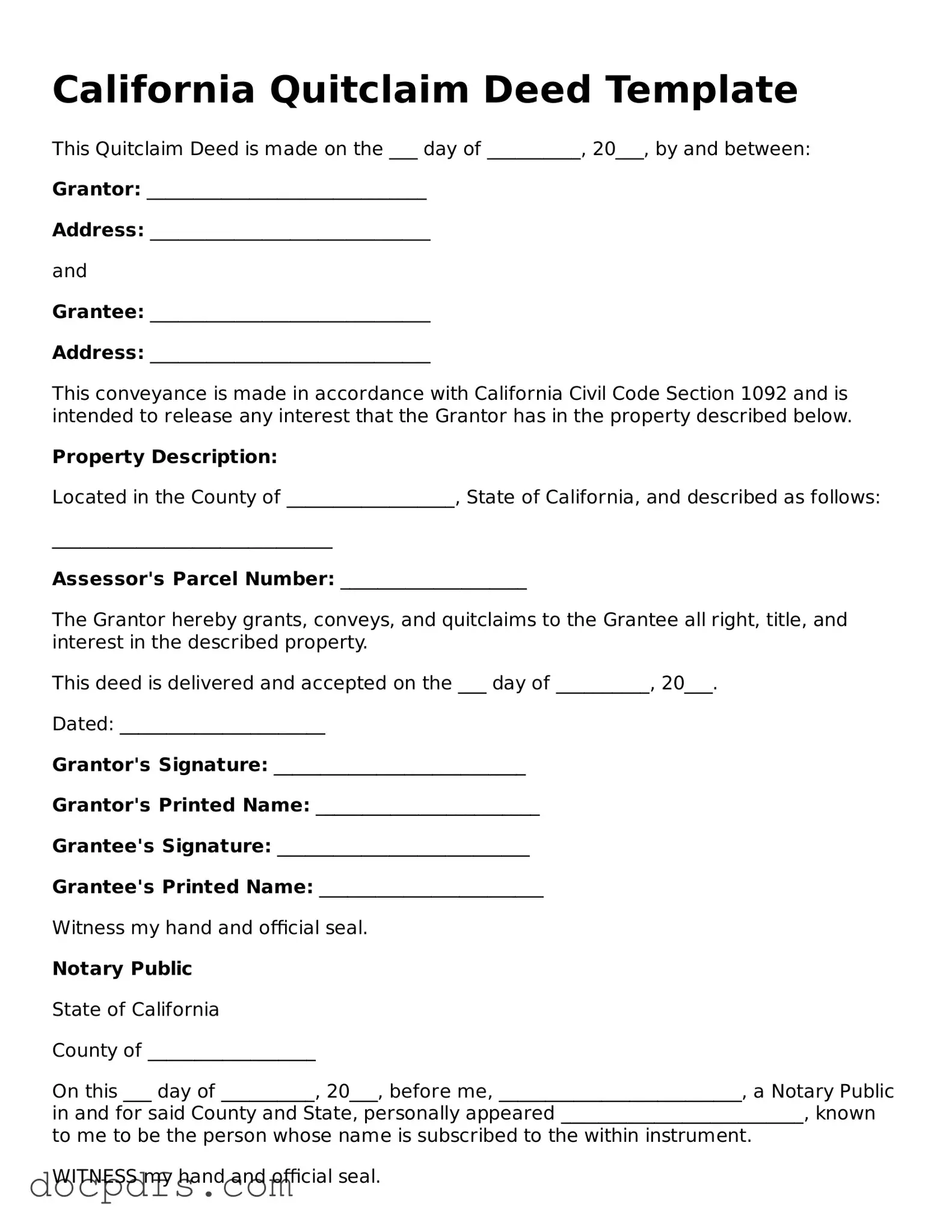

To complete a Quitclaim Deed in California, you will need the following information:

-

The names and addresses of the granter (the person giving up their interest) and the grantee (the person receiving the interest)

-

A legal description of the property being transferred

-

The date of the transfer

-

The signature of the granter, which must be notarized

Do I need to file a Quitclaim Deed with the county?

Yes, it is necessary to file the Quitclaim Deed with the county recorder’s office where the property is located. Filing ensures that the transfer of ownership is officially recorded and becomes part of the public record. This step is crucial for protecting the rights of the new property owner.

Are there any fees associated with filing a Quitclaim Deed?

Yes, there are typically fees for filing a Quitclaim Deed, which can vary by county. It is advisable to check with the local county recorder’s office for specific fee amounts and any additional requirements that may apply.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked unilaterally. However, if both parties agree, they can execute a new deed to reverse the transaction. Legal advice may be necessary to navigate this process effectively.

Is legal assistance required to complete a Quitclaim Deed?

While legal assistance is not required to complete a Quitclaim Deed, it can be beneficial, especially if there are complexities involved, such as disputes over property rights or tax implications. Consulting with a legal professional can help ensure that the deed is completed correctly and that all parties' interests are protected.