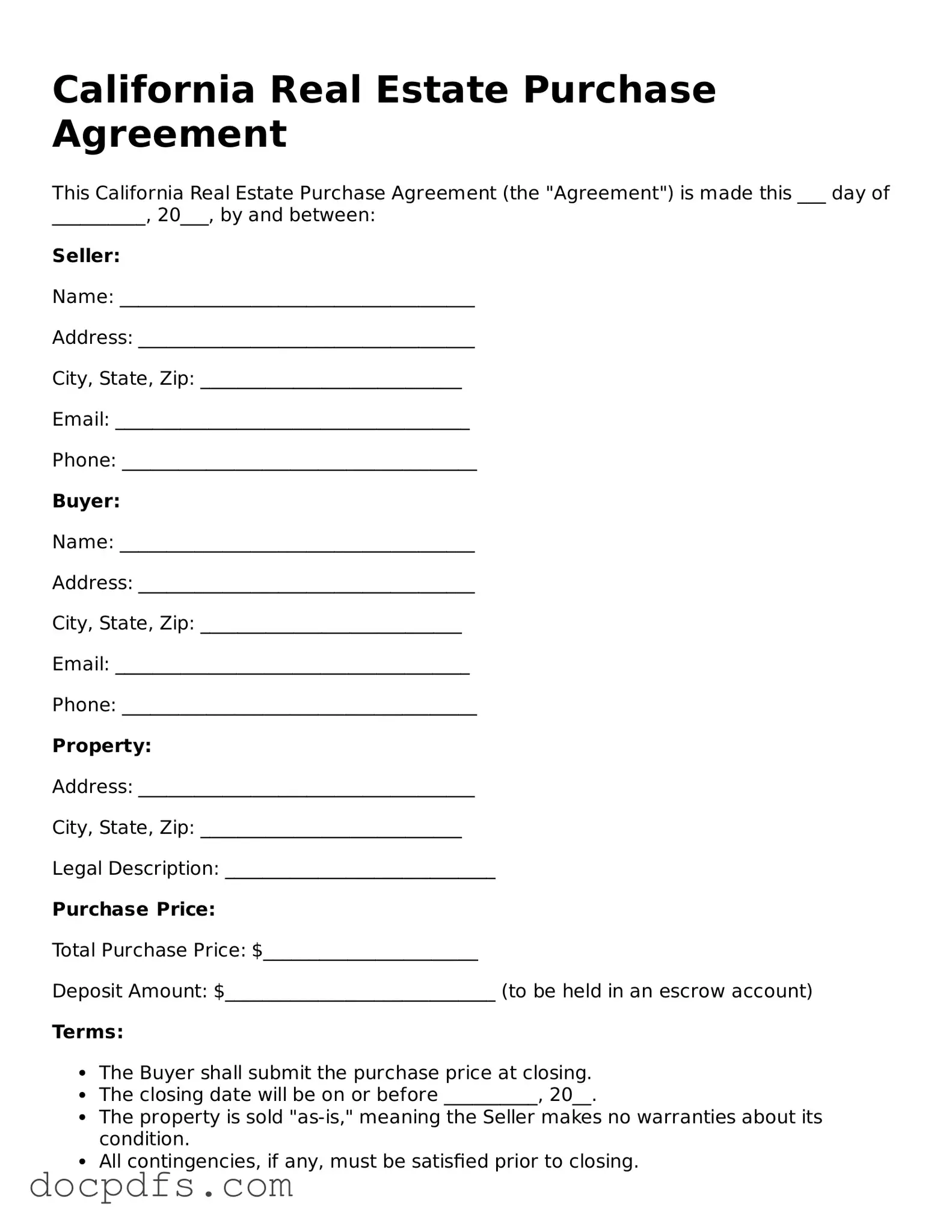

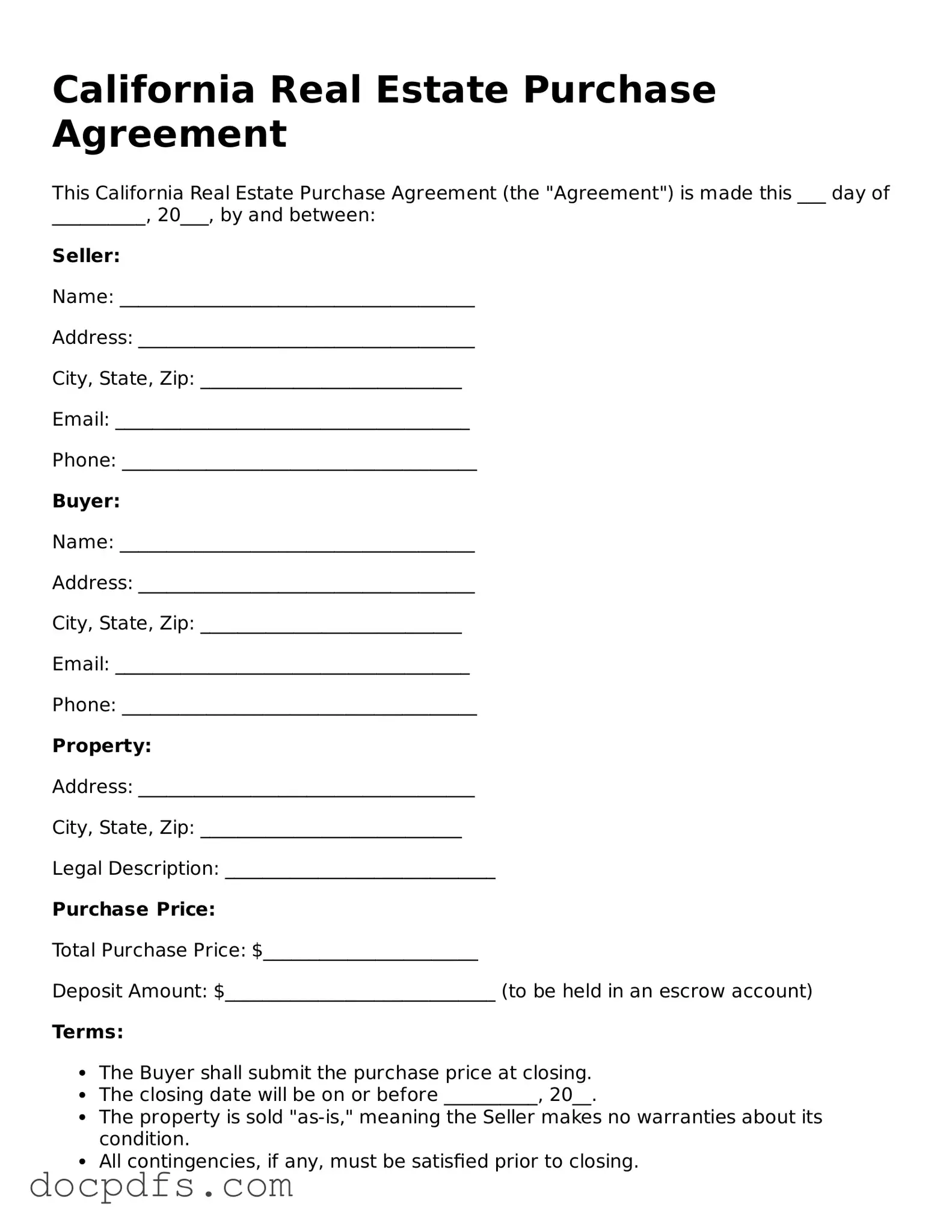

Free California Real Estate Purchase Agreement Form

The California Real Estate Purchase Agreement form is a legally binding document that outlines the terms and conditions for the sale of real property in California. This form serves as a crucial tool for buyers and sellers, ensuring that both parties clearly understand their rights and obligations during the transaction. By detailing essential elements such as the purchase price, financing, and contingencies, the agreement facilitates a smoother real estate process.

Open Real Estate Purchase Agreement Editor Now

Free California Real Estate Purchase Agreement Form

Open Real Estate Purchase Agreement Editor Now

Open Real Estate Purchase Agreement Editor Now

or

⇓ Real Estate Purchase Agreement

Finish this form the fast way

Complete Real Estate Purchase Agreement online with a smooth editing experience.