What is a California Tractor Bill of Sale?

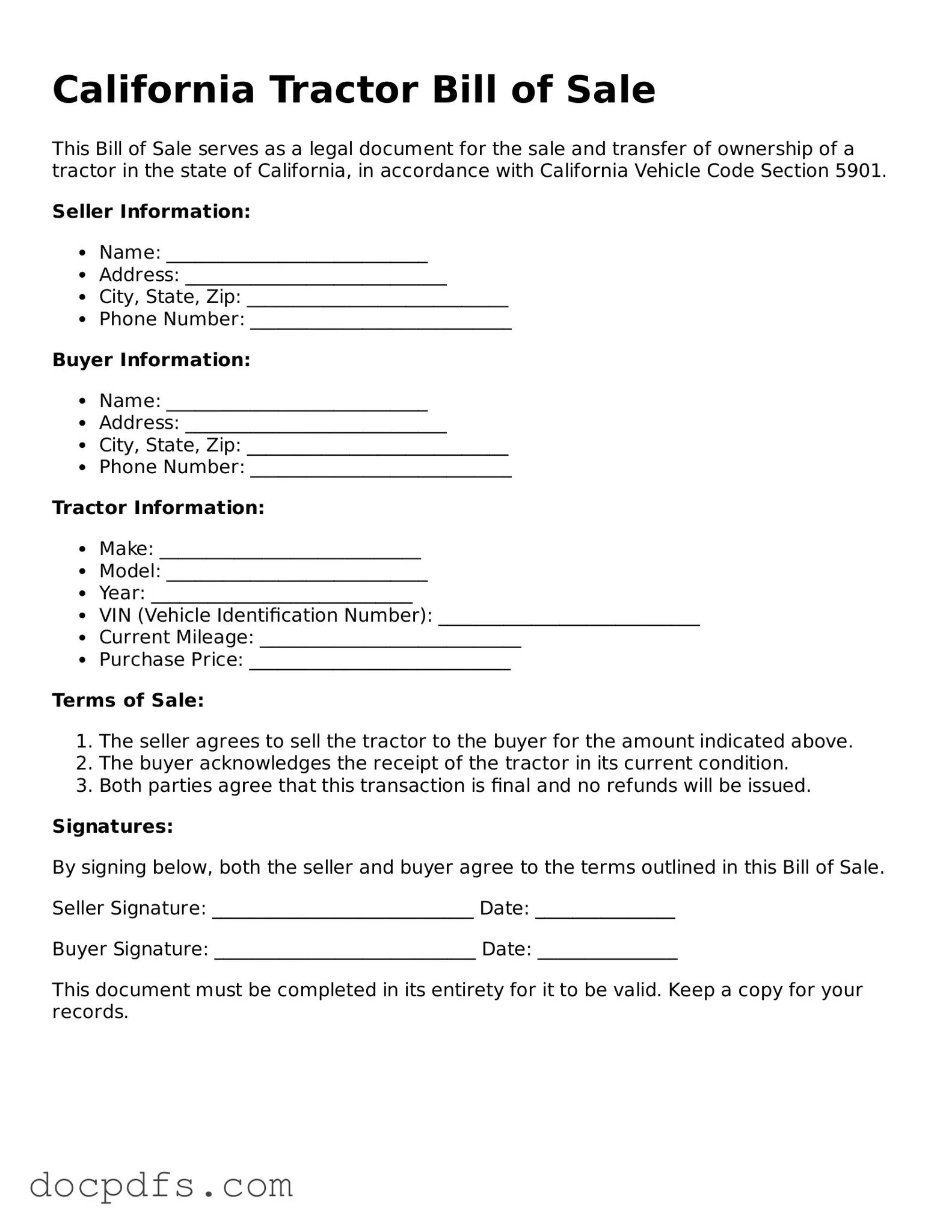

A California Tractor Bill of Sale is a legal document used to record the sale of a tractor in the state of California. This form provides proof of the transaction between the buyer and the seller, detailing important information about the tractor and the parties involved.

Why do I need a Bill of Sale for my tractor?

A Bill of Sale is essential for several reasons:

-

It serves as proof of ownership transfer.

-

It protects both the buyer and the seller by documenting the terms of the sale.

-

It may be required for registration or titling purposes with the California Department of Motor Vehicles (DMV).

The form typically includes the following details:

-

The names and addresses of the buyer and seller.

-

A description of the tractor, including make, model, year, and Vehicle Identification Number (VIN).

-

The sale price and payment method.

-

The date of the sale.

-

Signatures of both the buyer and the seller.

Do I need to have the Bill of Sale notarized?

Notarization is not required for a Bill of Sale in California. However, having it notarized can add an extra layer of protection and authenticity to the document. It may also help in case of future disputes.

Is a Bill of Sale required for all tractor sales in California?

While a Bill of Sale is not legally required for all tractor sales, it is highly recommended. It provides important documentation that can help prevent misunderstandings or disputes between the buyer and seller.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. However, it is essential to include all necessary information to ensure it is valid. Using a template or form specifically designed for tractor sales can help ensure you do not miss any important details.

What if I lose the Bill of Sale?

If you lose the Bill of Sale, it may be challenging to prove ownership. It is advisable to keep a copy in a safe place. If necessary, you can request a duplicate from the seller, provided they still have their records.

How does the Bill of Sale affect registration?

The Bill of Sale is often required when registering the tractor with the DMV. It provides proof of purchase and helps establish the new owner’s rights to the vehicle. Without it, registration may be delayed or denied.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and the seller should keep a signed copy for their records. The buyer should also take the document to the DMV to register the tractor in their name.

Where can I find a California Tractor Bill of Sale template?

You can find templates online through legal websites or by searching for "California Tractor Bill of Sale template." Many resources provide free or paid options that you can customize to fit your needs.