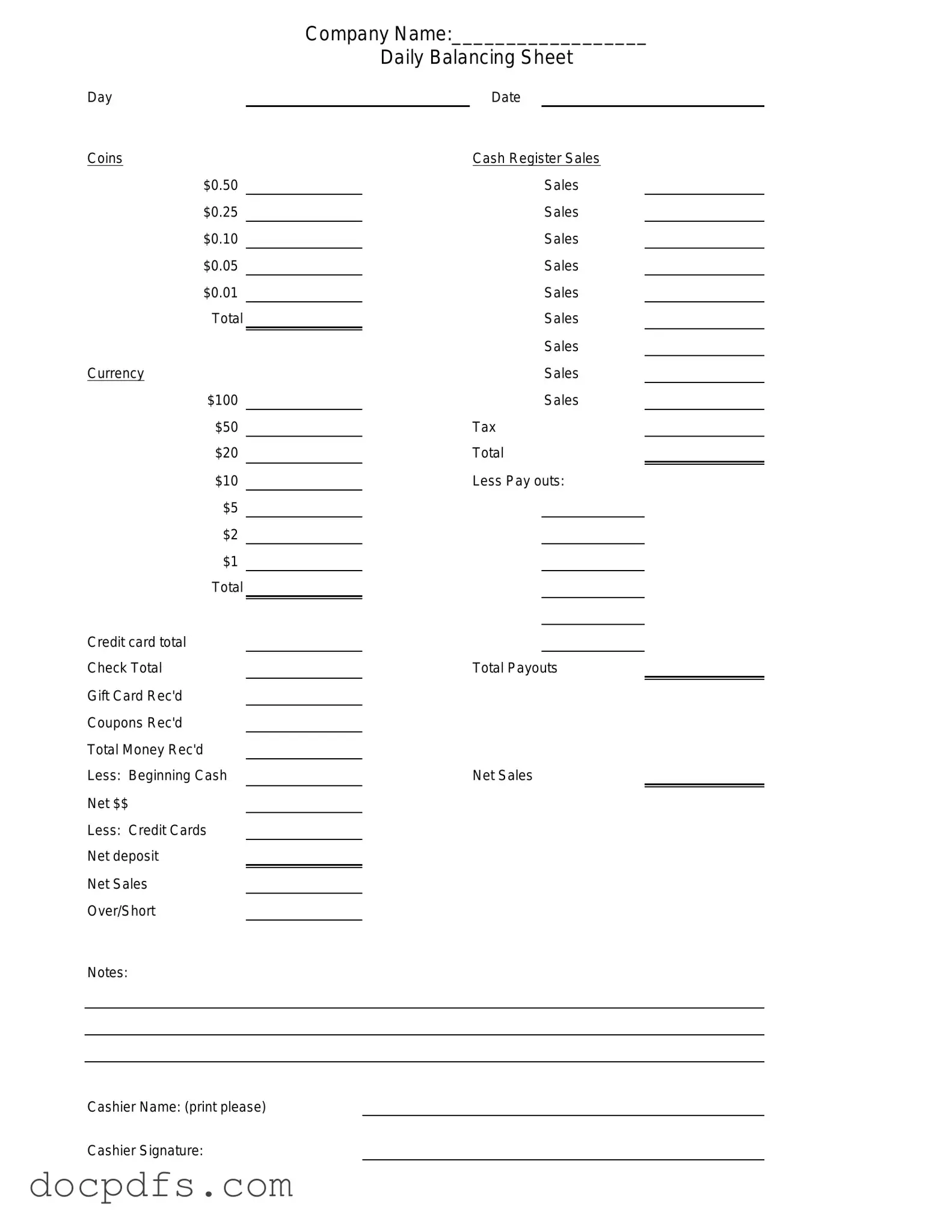

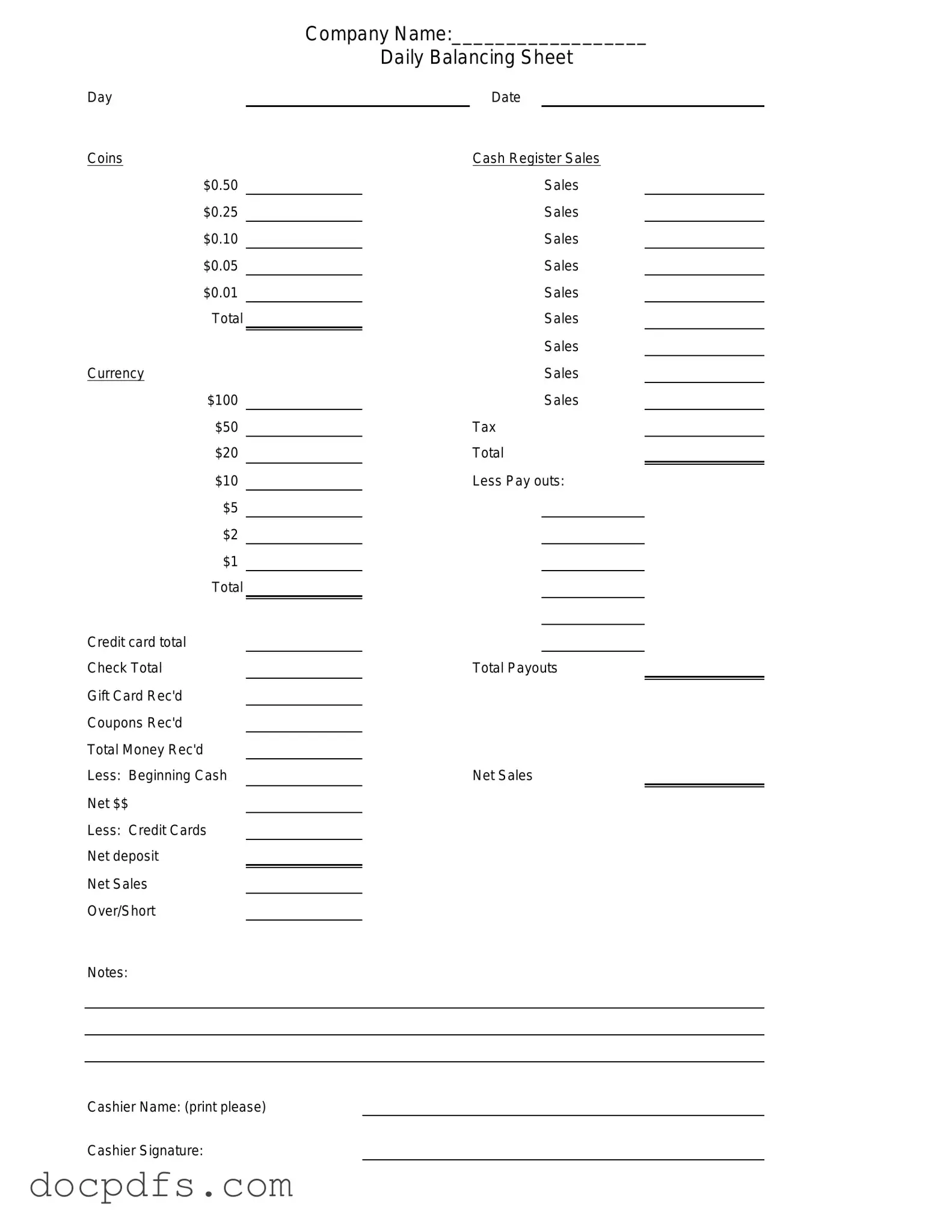

Cash Drawer Count Sheet Template in PDF

The Cash Drawer Count Sheet is a vital tool used by businesses to track and manage cash transactions effectively. This form helps ensure that the amount of cash in the drawer matches the recorded sales, promoting accountability and accuracy. By utilizing this sheet, businesses can identify discrepancies and maintain financial integrity.

Open Cash Drawer Count Sheet Editor Now

Cash Drawer Count Sheet Template in PDF

Open Cash Drawer Count Sheet Editor Now

Open Cash Drawer Count Sheet Editor Now

or

⇓ Cash Drawer Count Sheet

Finish this form the fast way

Complete Cash Drawer Count Sheet online with a smooth editing experience.