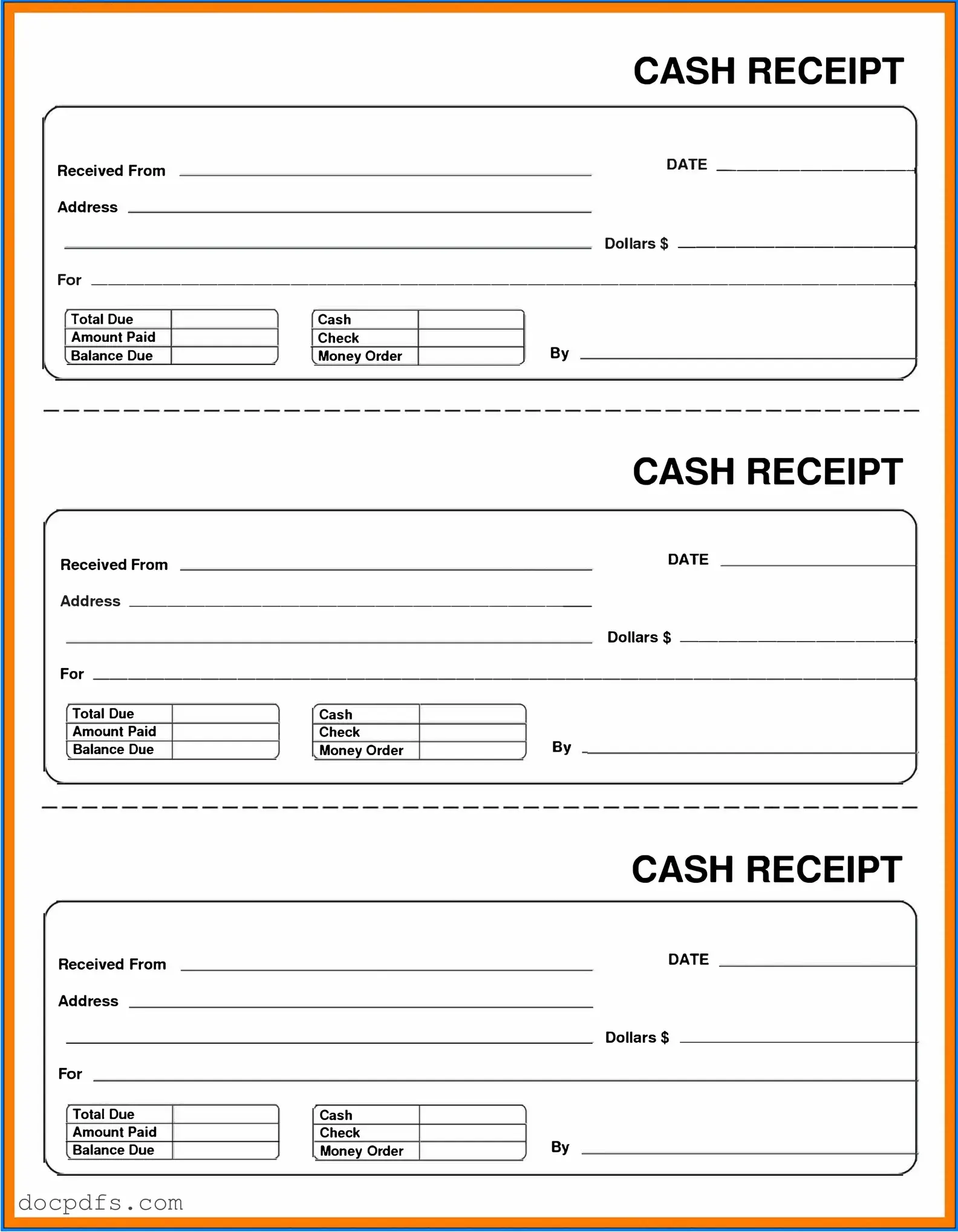

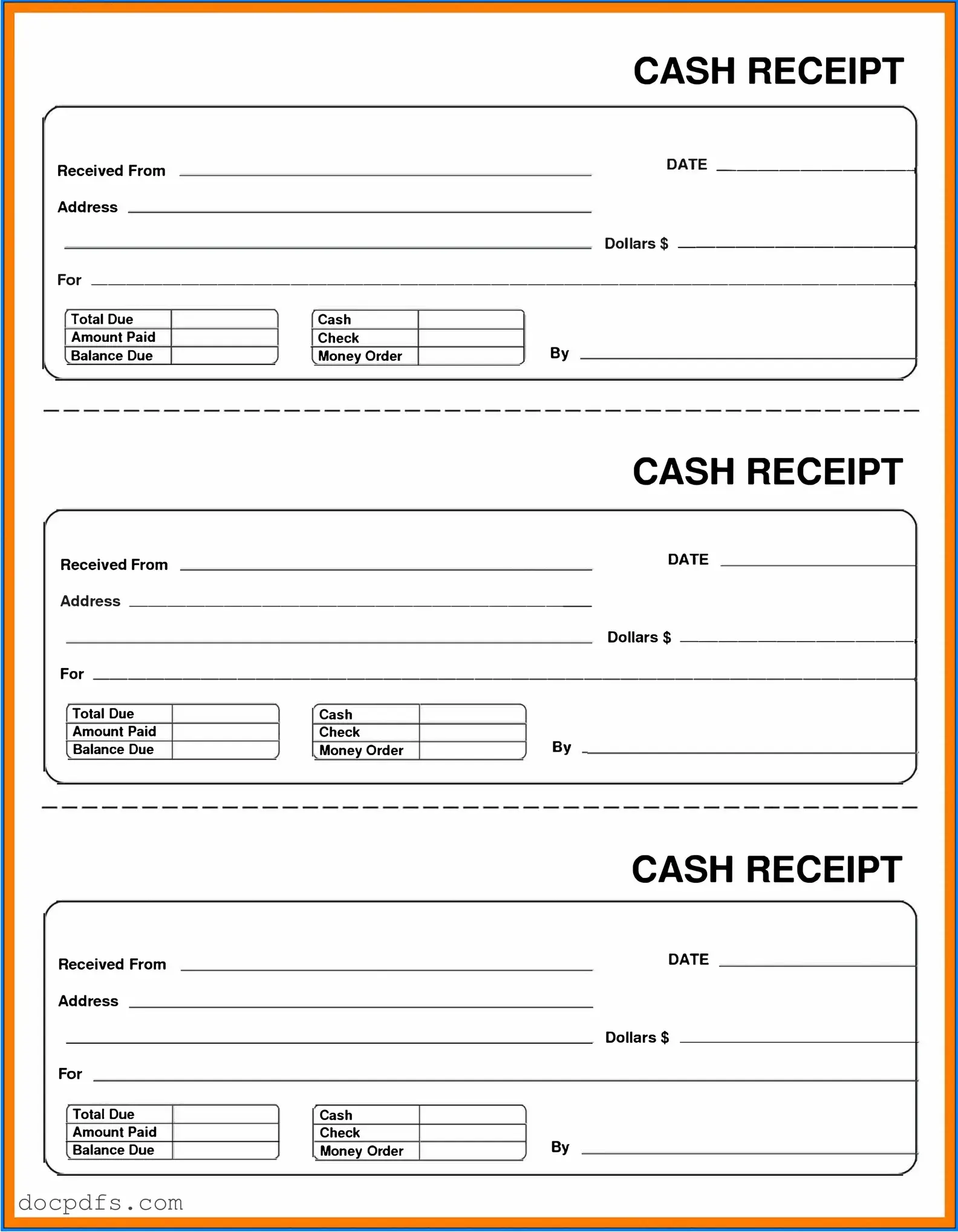

A Cash Receipt form is a document used to acknowledge the receipt of cash payments. It serves as proof that a transaction has occurred, detailing the amount received, the date of the transaction, and the purpose of the payment. This form is essential for both record-keeping and accounting purposes, ensuring that all cash transactions are properly documented.

The Cash Receipt form is crucial for several reasons:

-

It provides a clear record of cash transactions, which is vital for accurate financial reporting.

-

It helps prevent disputes between parties by offering proof of payment.

-

It assists in maintaining accountability within an organization, ensuring that all cash received is properly recorded.

Any business or organization that receives cash payments should utilize a Cash Receipt form. This includes retail businesses, service providers, non-profits, and educational institutions. By using this form, organizations can ensure they have a reliable record of all cash transactions, which is beneficial for both internal audits and external reviews.

A well-structured Cash Receipt form typically includes the following information:

-

Date of the transaction

-

Name of the payer

-

Amount received

-

Purpose of the payment

-

Signature of the person receiving the cash

-

Receipt number for tracking purposes

Including these details ensures that the form is comprehensive and serves its intended purpose effectively.

Cash Receipt forms should be stored in a secure and organized manner. It is advisable to keep both physical and digital copies. Physical forms can be filed in a locked cabinet, while digital versions should be saved in a secure cloud storage or a dedicated accounting software. Regular backups of digital records are also recommended to prevent loss of information.

While it is possible to modify a Cash Receipt form, any changes should be made with caution. Alterations can lead to confusion or disputes regarding the transaction. If a mistake is made, it is best to issue a new receipt rather than changing the original. Always ensure that all parties involved are aware of any modifications to maintain transparency.

Generally, it is recommended to retain Cash Receipt forms for at least seven years. This timeframe aligns with the IRS guidelines for keeping records related to tax purposes. However, specific retention policies may vary based on organizational requirements or state regulations, so it’s wise to consult with an accountant or legal advisor for tailored advice.

If a Cash Receipt form is lost, it is important to take prompt action. First, notify the payer about the situation and assure them that you are addressing it. Then, create a new Cash Receipt form that reflects the original transaction details. Make a note of the loss in your records and inform your accounting department to ensure that all financial records remain accurate and up-to-date.