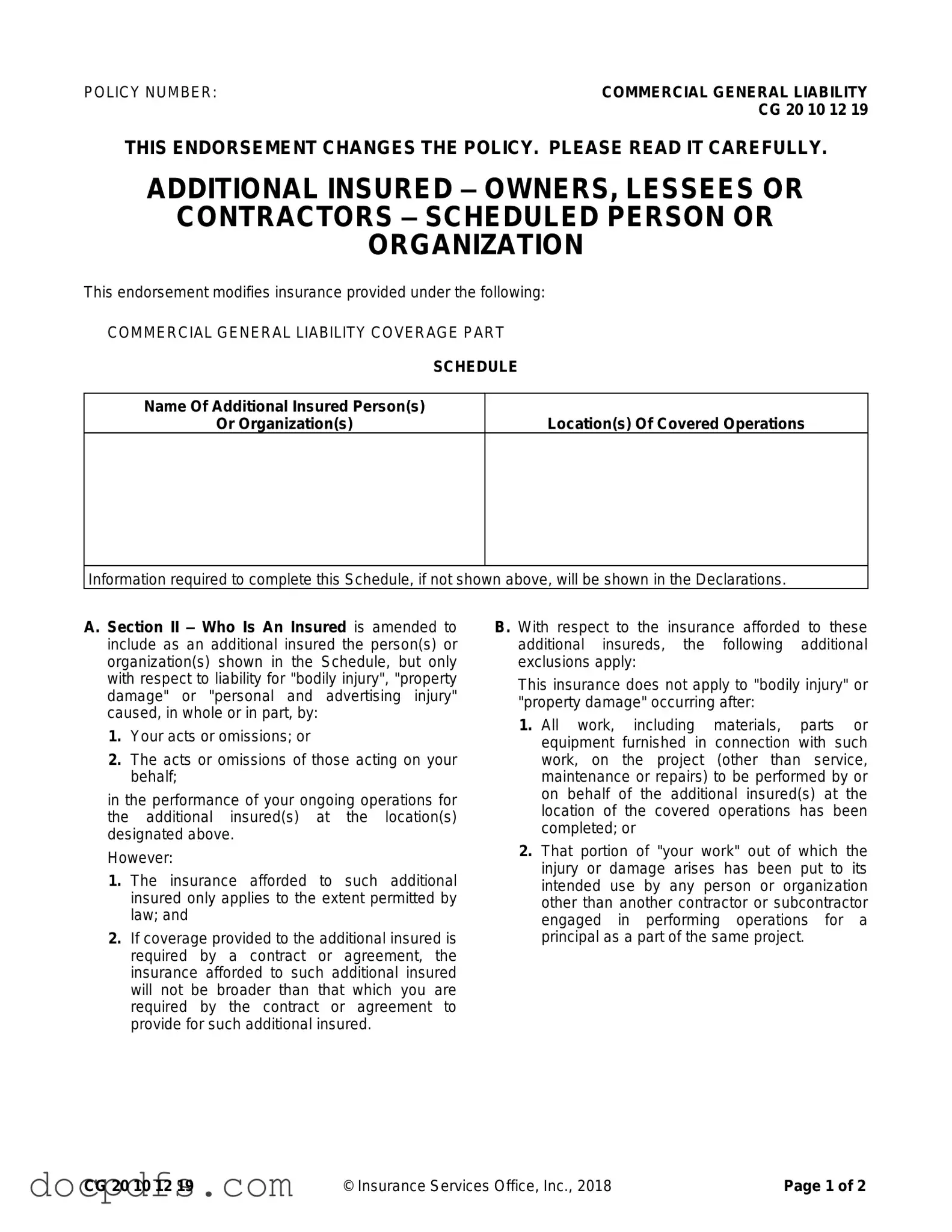

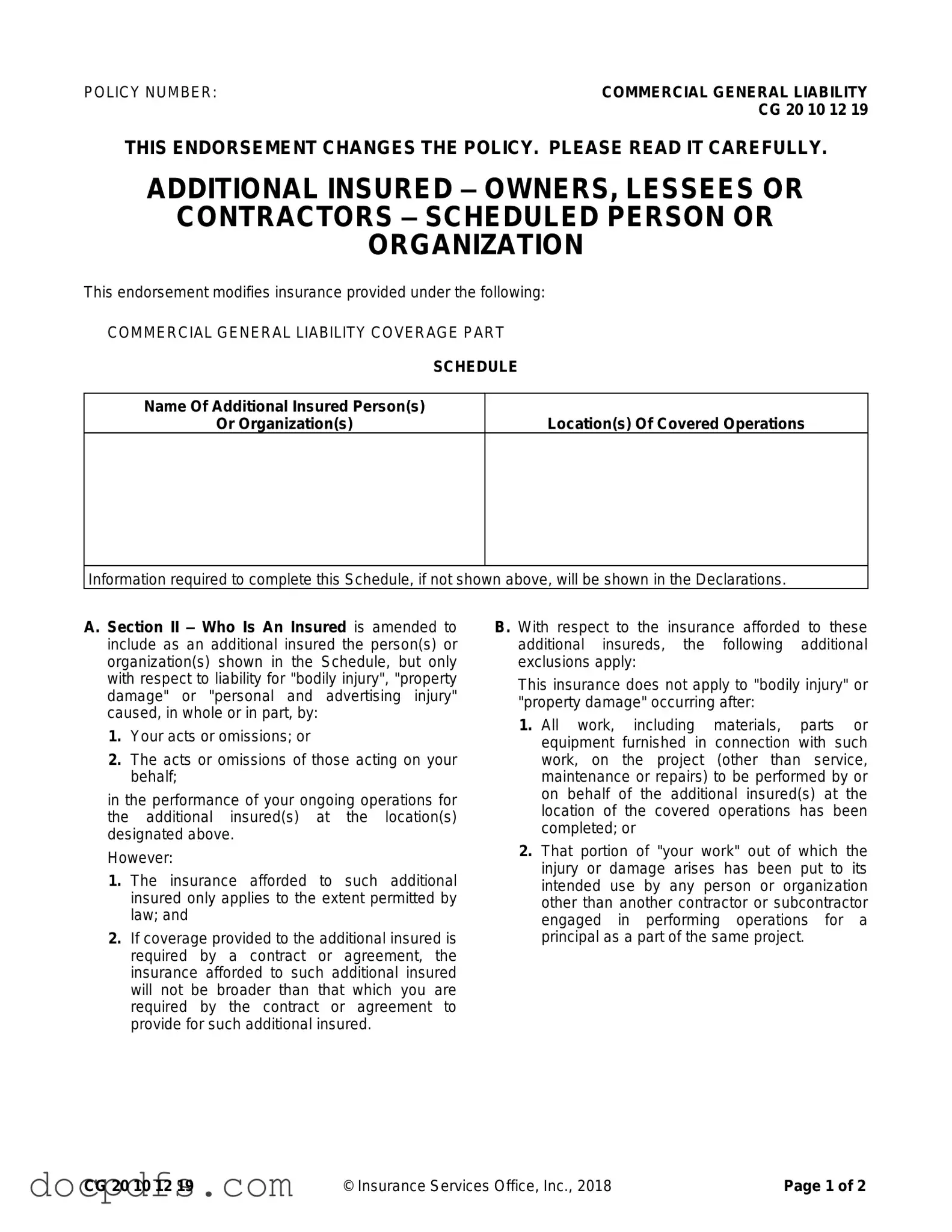

Cg 20 10 07 04 Liability Endorsement Template in PDF

The CG 20 10 07 04 Liability Endorsement form is an important document that modifies the coverage provided under a Commercial General Liability policy. It specifically adds certain individuals or organizations as additional insureds, protecting them from liability related to bodily injury, property damage, or personal and advertising injury linked to your operations. Understanding this endorsement is crucial for ensuring compliance with contractual obligations and safeguarding all parties involved.

Open Cg 20 10 07 04 Liability Endorsement Editor Now

Cg 20 10 07 04 Liability Endorsement Template in PDF

Open Cg 20 10 07 04 Liability Endorsement Editor Now

Open Cg 20 10 07 04 Liability Endorsement Editor Now

or

⇓ Cg 20 10 07 04 Liability Endorsement

Finish this form the fast way

Complete Cg 20 10 07 04 Liability Endorsement online with a smooth editing experience.