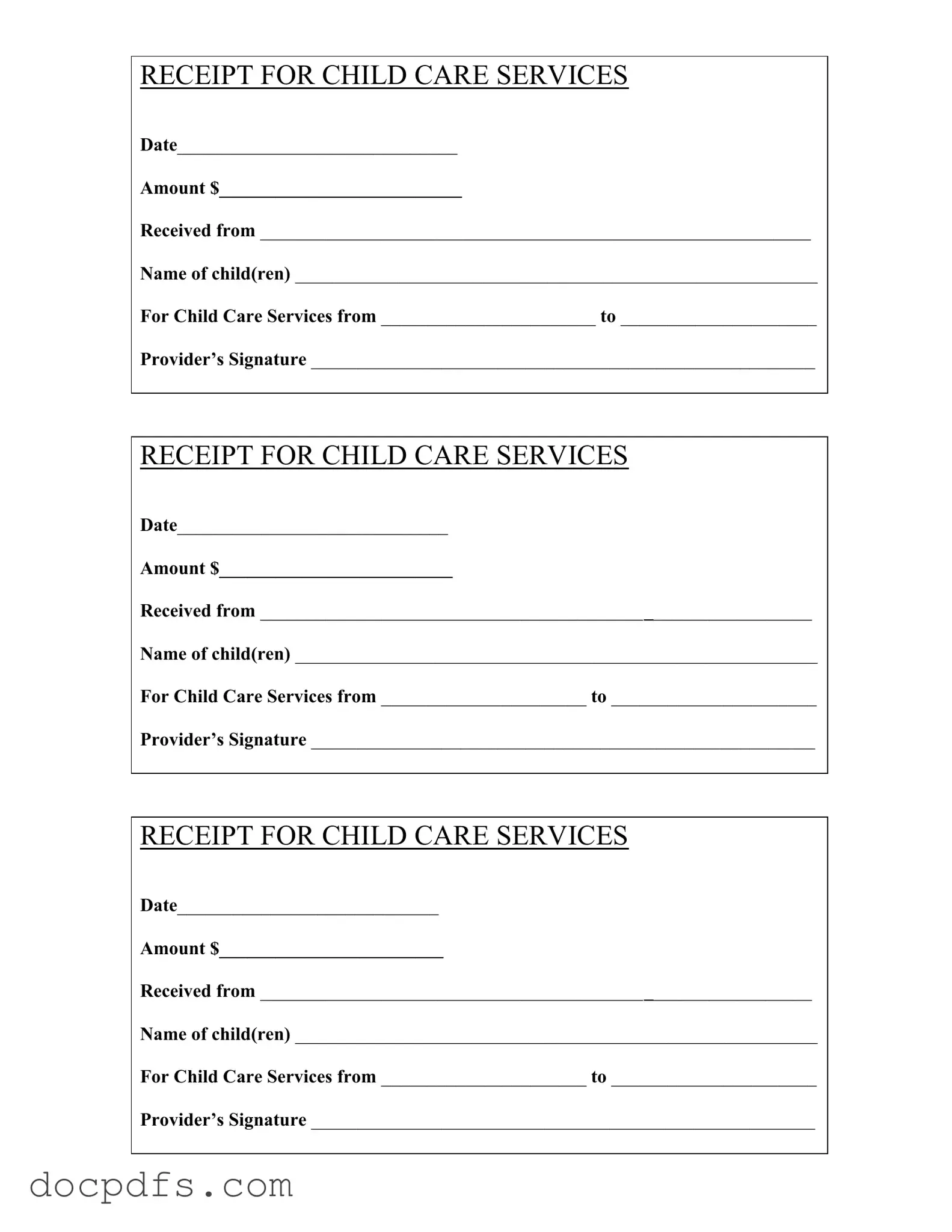

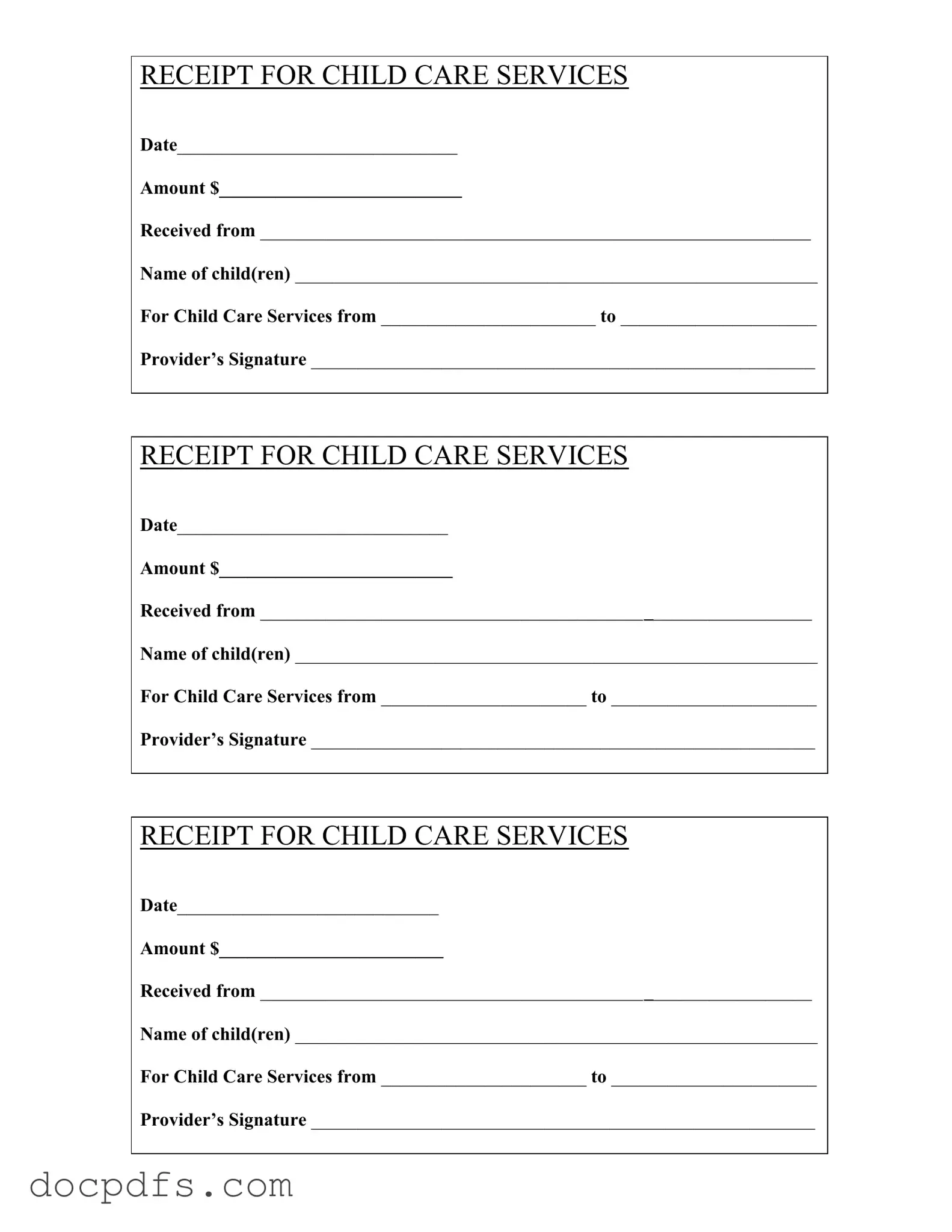

Childcare Receipt Template in PDF

The Childcare Receipt form is a document that confirms payment for childcare services. It includes essential details such as the date, amount paid, and the names of the children receiving care. This form serves as proof of payment for parents and can be useful for tax purposes or reimbursement claims.

Open Childcare Receipt Editor Now

Childcare Receipt Template in PDF

Open Childcare Receipt Editor Now

Open Childcare Receipt Editor Now

or

⇓ Childcare Receipt

Finish this form the fast way

Complete Childcare Receipt online with a smooth editing experience.