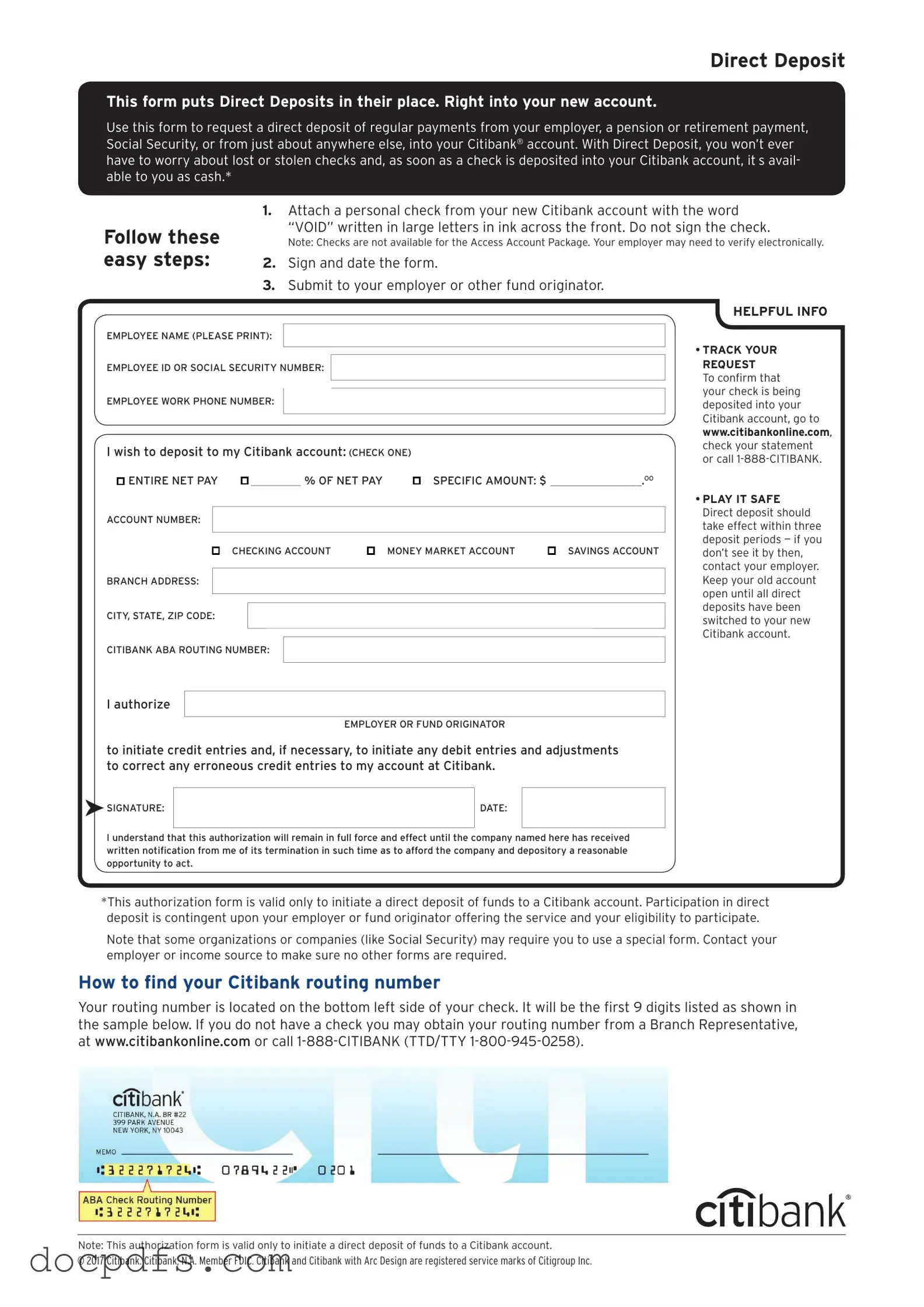

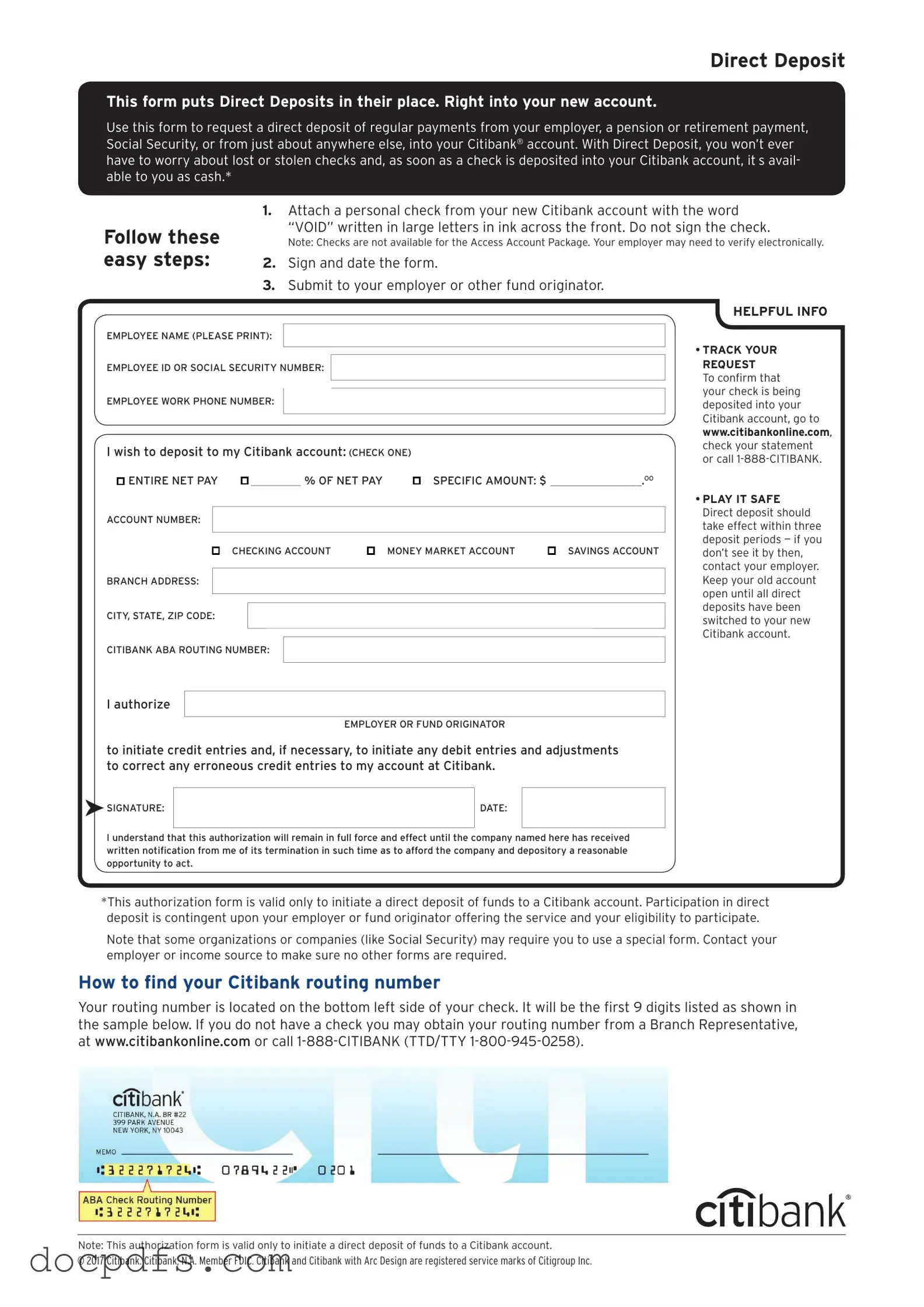

Citibank Direct Deposit Template in PDF

The Citibank Direct Deposit form is a document that allows individuals to authorize automatic deposits of their paychecks or government benefits directly into their Citibank accounts. This convenient process eliminates the need for physical checks, ensuring timely access to funds. Completing this form is a straightforward way to manage your finances efficiently.

Open Citibank Direct Deposit Editor Now

Citibank Direct Deposit Template in PDF

Open Citibank Direct Deposit Editor Now

Open Citibank Direct Deposit Editor Now

or

⇓ Citibank Direct Deposit

Finish this form the fast way

Complete Citibank Direct Deposit online with a smooth editing experience.