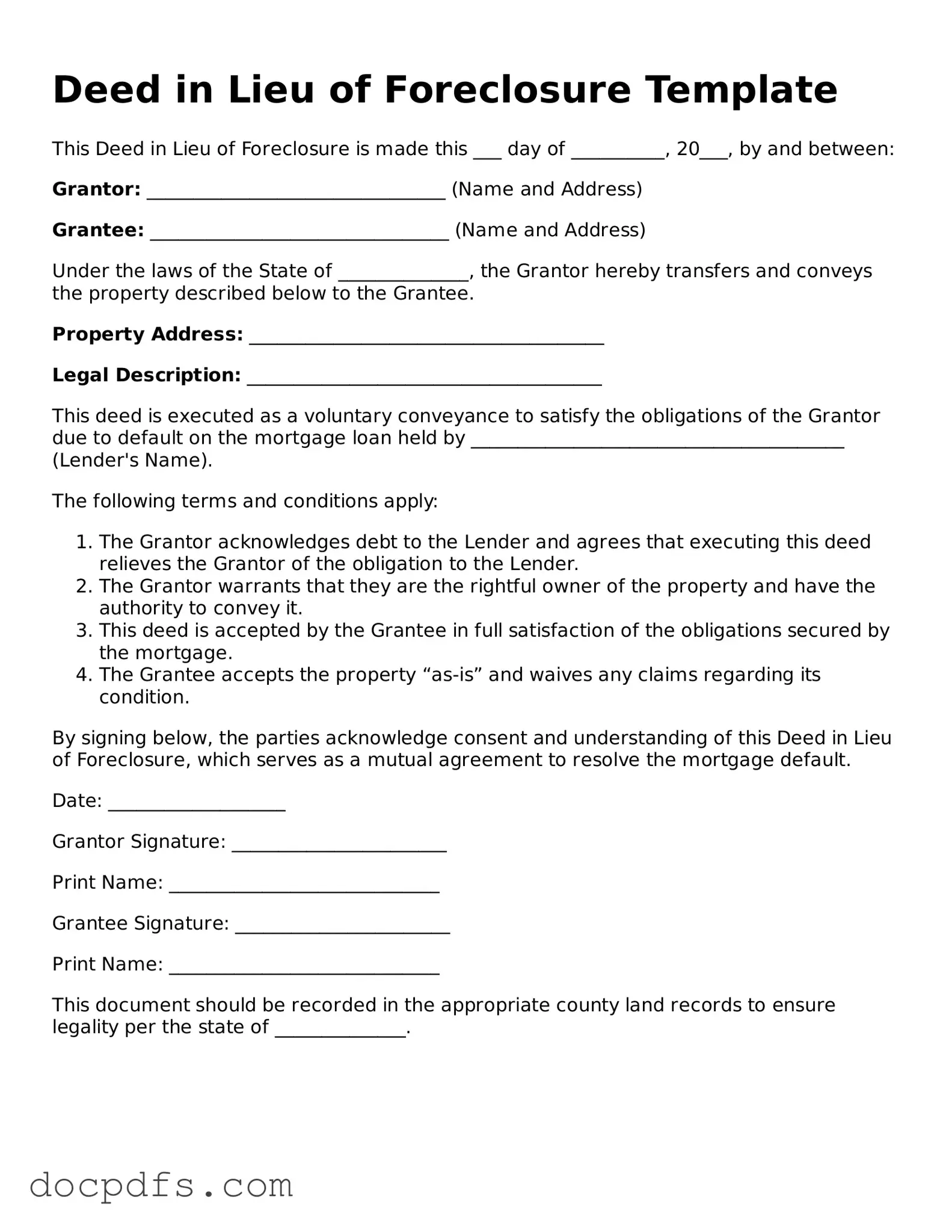

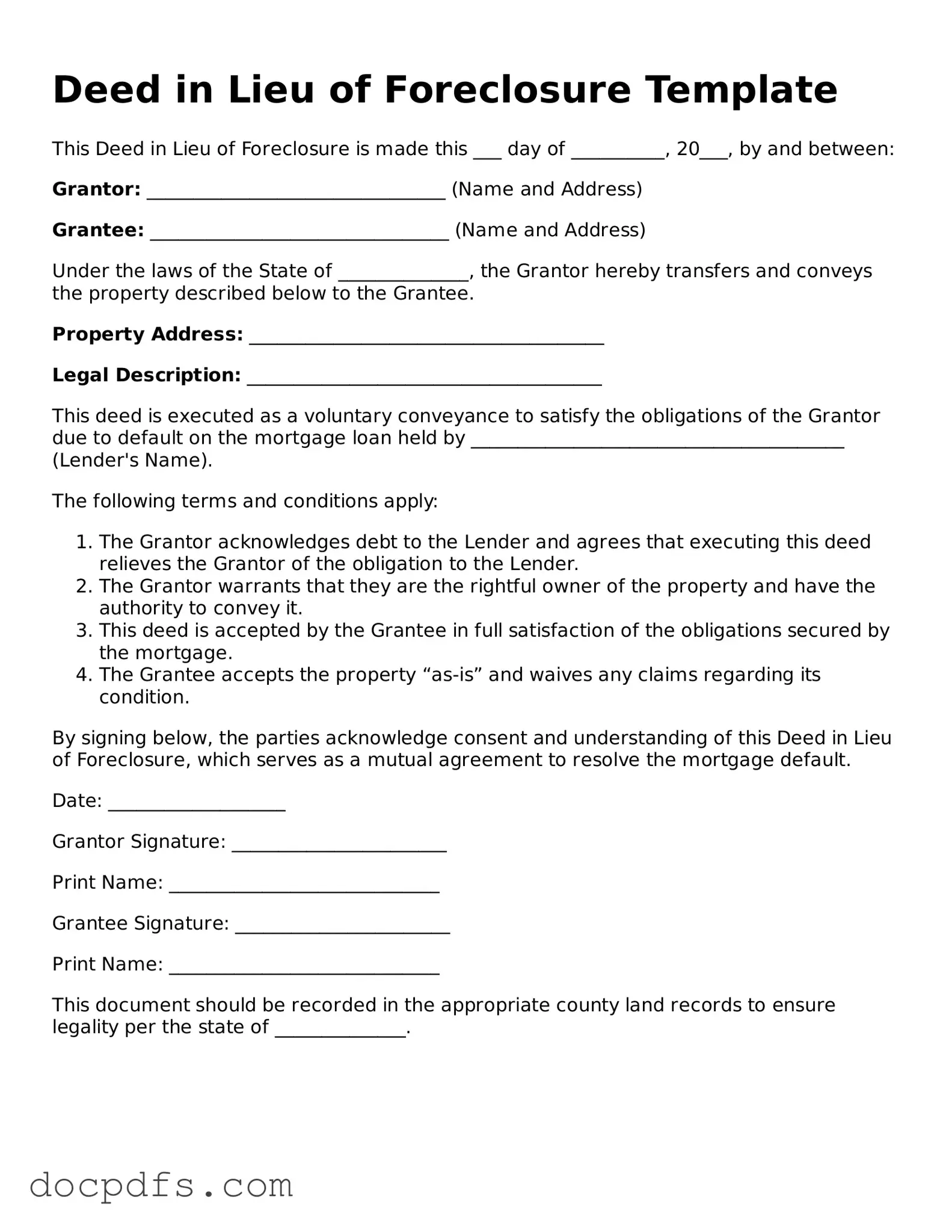

Legal Deed in Lieu of Foreclosure Document

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer the title of their property to the lender in order to avoid foreclosure. This option can provide a more straightforward and less stressful way to resolve mortgage default issues. Understanding this form can help homeowners make informed decisions during challenging financial times.

Open Deed in Lieu of Foreclosure Editor Now

Legal Deed in Lieu of Foreclosure Document

Open Deed in Lieu of Foreclosure Editor Now

Open Deed in Lieu of Foreclosure Editor Now

or

⇓ Deed in Lieu of Foreclosure

Finish this form the fast way

Complete Deed in Lieu of Foreclosure online with a smooth editing experience.