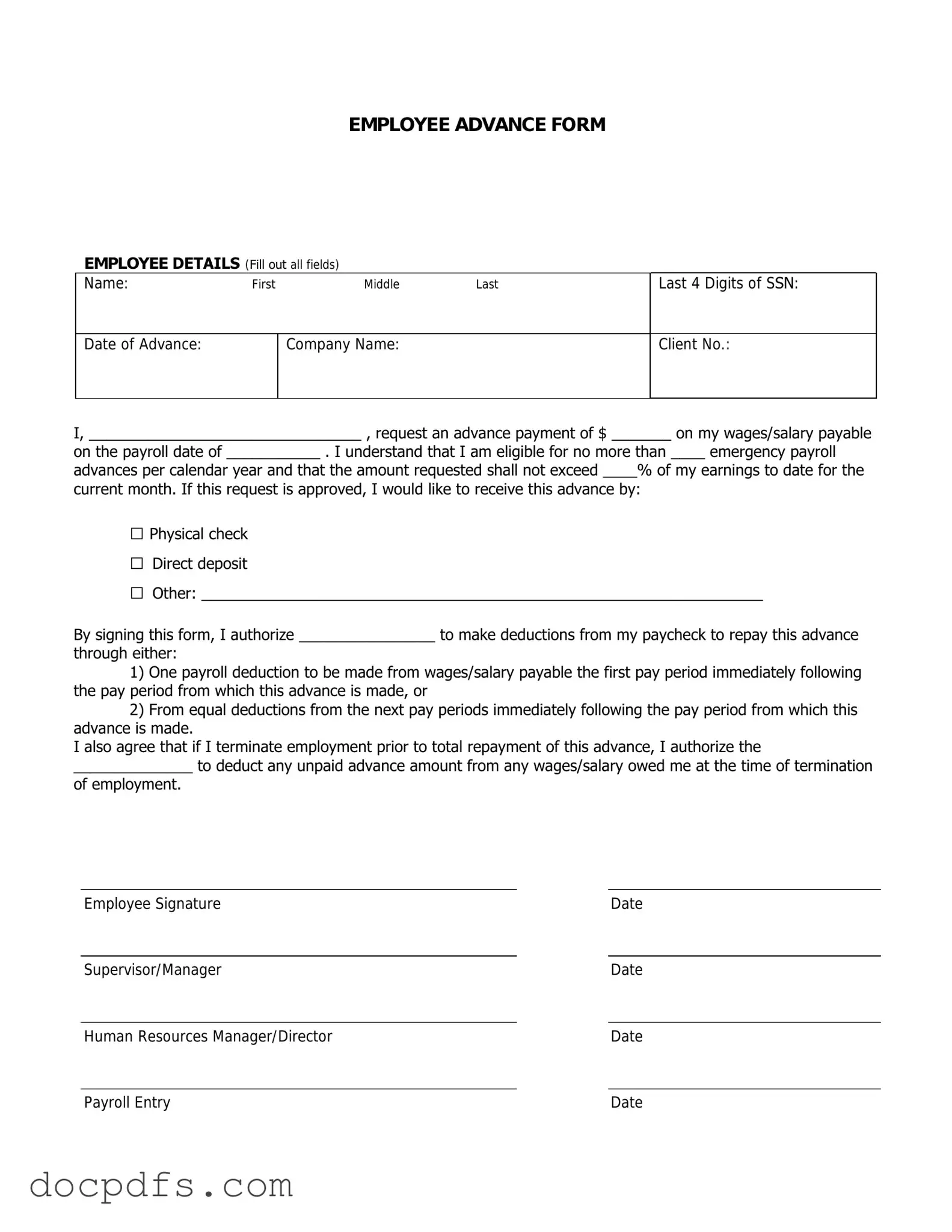

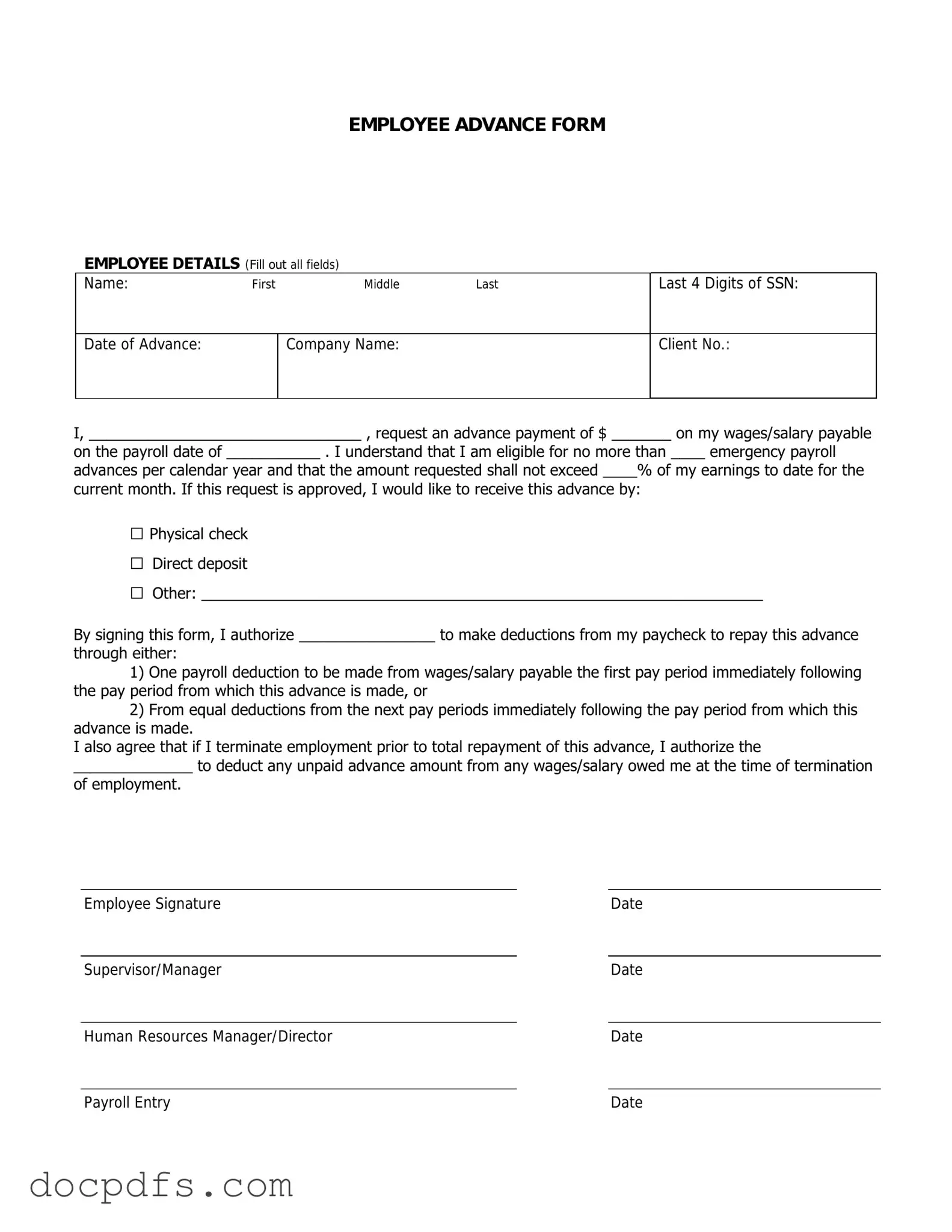

The Employee Advance form is a document that allows employees to request an advance on their salary or wages. This form is typically used in situations where an employee faces unexpected expenses and requires immediate financial assistance. By submitting this form, employees can formally communicate their need for an advance to their employer, who will then review the request and decide whether to approve it.

Who is eligible to request an advance?

Eligibility for requesting an advance typically depends on company policy. Generally, full-time employees who have completed a certain period of employment may be eligible. Some companies may have specific criteria regarding the length of service or the reason for the advance. It is advisable to review your company's employee handbook or consult with the HR department for specific eligibility requirements.

The Employee Advance form usually requires several key pieces of information, including:

-

Your name and employee identification number.

-

The amount of the advance you are requesting.

-

The reason for the advance.

-

Your signature and the date of submission.

Some forms may also ask for additional details, such as your current salary or wages and any other outstanding advances.

How is the advance amount determined?

The amount of the advance is often determined by company policy and the employee's current salary. Employers may set a limit on how much can be advanced, which is typically a percentage of the employee's pay. Additionally, the reason for the advance may influence the amount approved. Employers will assess the request based on the employee's financial need and their repayment capability.

Once the Employee Advance form is submitted, it will be reviewed by your supervisor or the HR department. They will evaluate the request based on company policies and the information provided. You should expect to receive a response within a specified timeframe, which may vary by organization. If approved, the advance will typically be processed and included in your next paycheck or distributed separately, depending on company procedures.

How do I repay the advance?

Repayment terms for the advance are usually outlined in the company's policy. Commonly, the amount advanced will be deducted from future paychecks over a specified period. This repayment schedule will be communicated to you upon approval of the advance. It’s important to understand these terms clearly to avoid any confusion about future paychecks.

Can I request multiple advances?

Requesting multiple advances may be possible, but it largely depends on your employer's policies. Some companies may limit the number of advances an employee can request within a certain timeframe. If you find yourself needing multiple advances, it is essential to discuss your situation with HR or your supervisor to understand the implications and any potential impact on your employment status.

Is the advance subject to taxes?

Yes, advances are generally considered taxable income. When you receive an advance, it may be subject to withholding taxes, similar to your regular wages. The exact tax implications can vary based on your overall income and tax situation. It is advisable to consult with a tax professional or your HR department for guidance on how an advance may affect your tax obligations.

What if my request is denied?

If your request for an advance is denied, you should receive an explanation from your employer. Understanding the reasons behind the denial can help you address any issues or concerns. If you believe your situation warrants reconsideration, you may have the option to appeal the decision or seek alternative financial assistance through other company programs or external resources.