Free Florida Articles of Incorporation Form

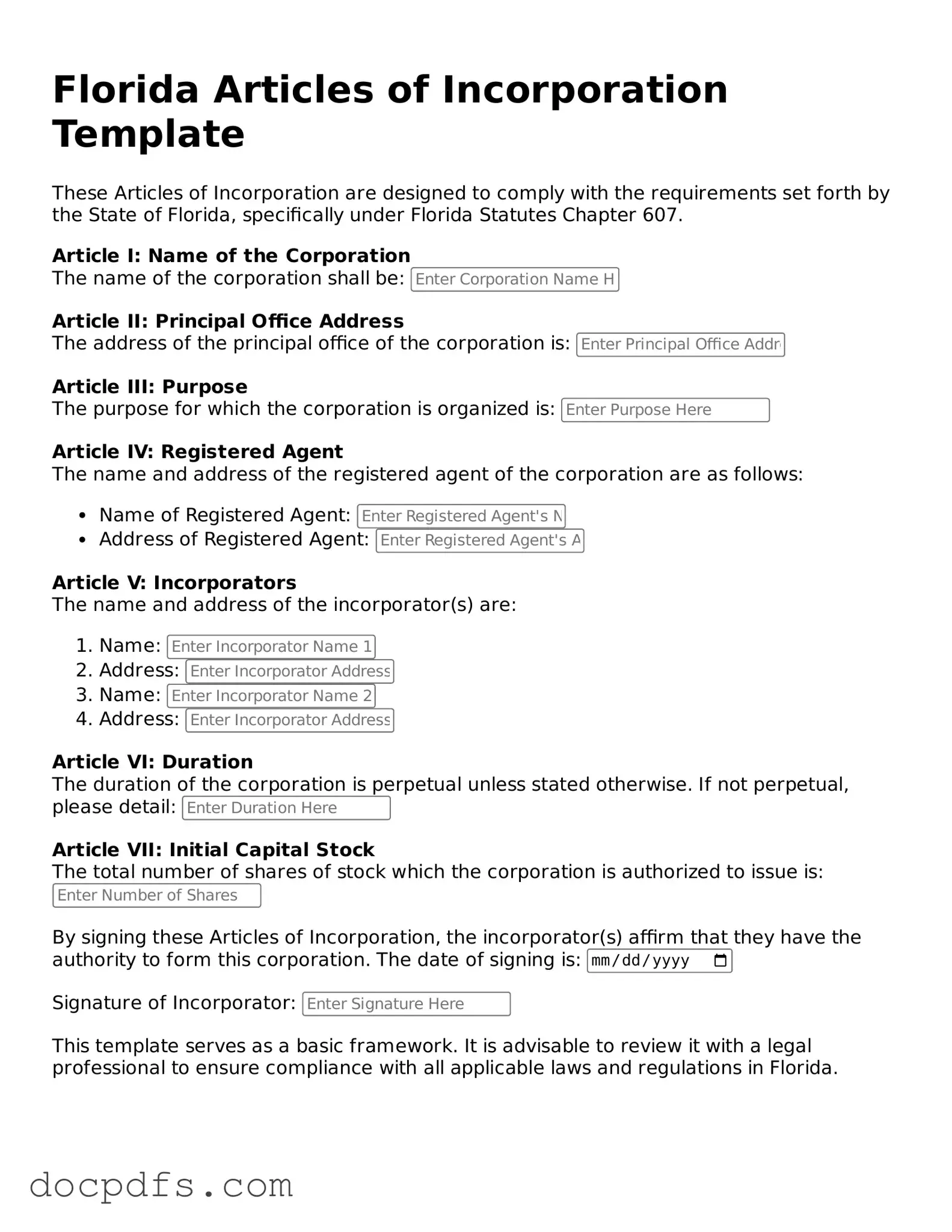

The Florida Articles of Incorporation form is a crucial document for anyone looking to establish a corporation in the state. This form officially creates a corporation and outlines its basic structure, including its name, purpose, and registered agent. Completing this form accurately is essential for legal recognition and protection of your business.

Open Articles of Incorporation Editor Now

Free Florida Articles of Incorporation Form

Open Articles of Incorporation Editor Now

Open Articles of Incorporation Editor Now

or

⇓ Articles of Incorporation

Finish this form the fast way

Complete Articles of Incorporation online with a smooth editing experience.