A Florida Deed form is a legal document used to transfer ownership of real estate in the state of Florida. It serves as proof of the transfer and outlines the rights and responsibilities of the parties involved. Different types of deeds exist, including warranty deeds, quitclaim deeds, and special warranty deeds, each serving specific purposes in property transactions.

Anyone involved in the transfer of real estate in Florida will need a Florida Deed form. This includes:

-

Sellers who are transferring property to buyers.

-

Individuals gifting property to family members or friends.

-

Heirs receiving property through an estate.

It is essential for all parties to ensure the deed is properly executed to avoid future disputes.

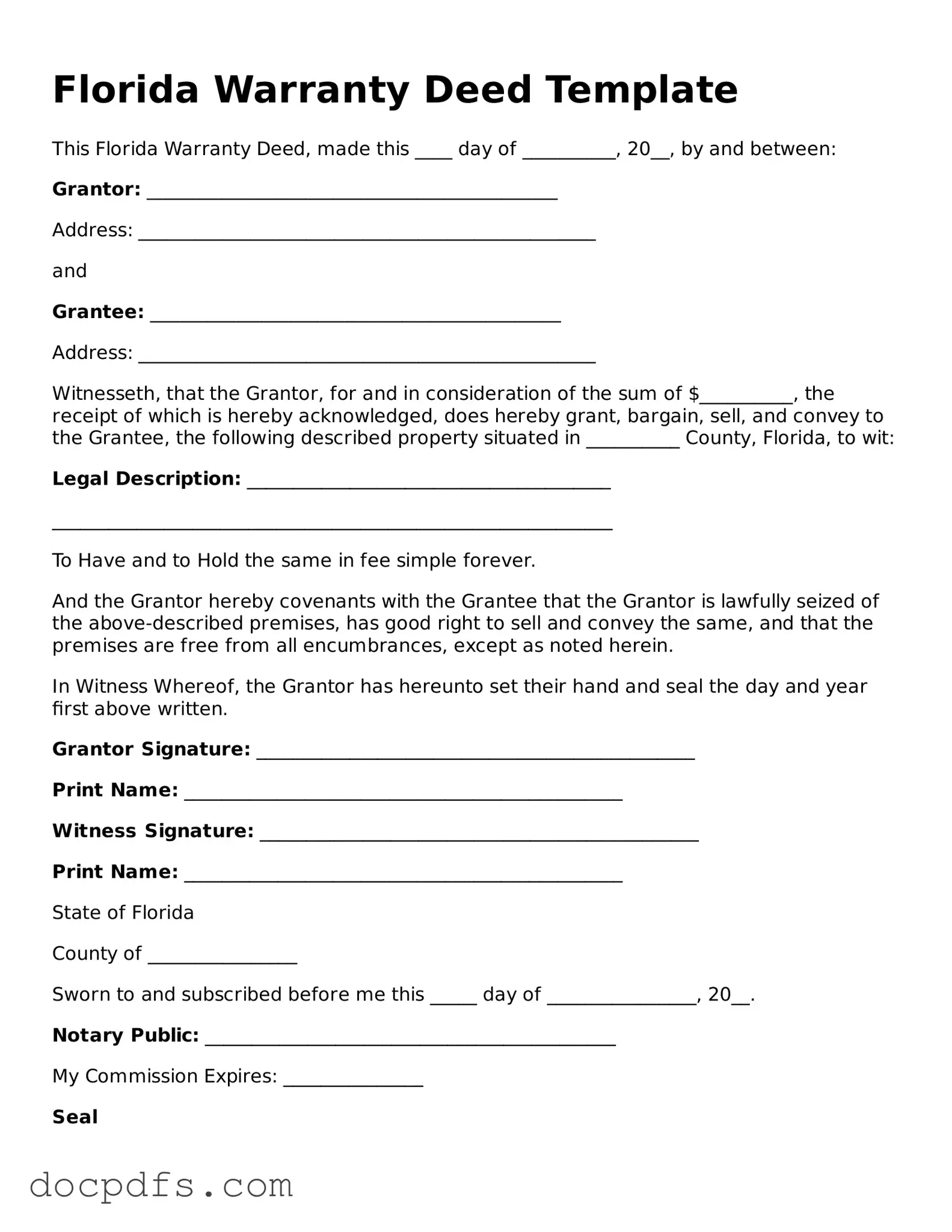

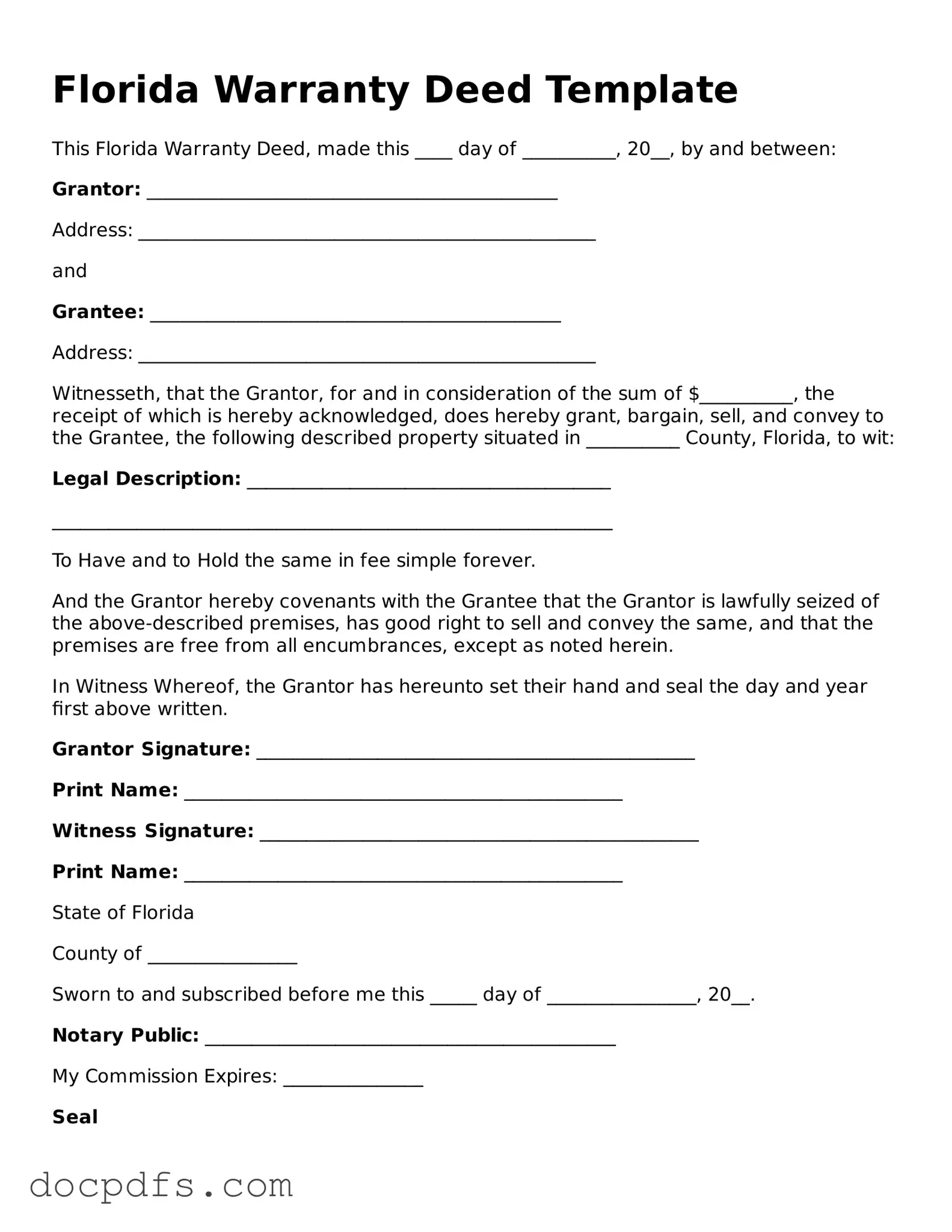

Completing a Florida Deed form involves several steps:

-

Identify the parties involved: Include the full names of the grantor (seller) and grantee (buyer).

-

Provide a legal description of the property: This can usually be found on the property tax record or previous deed.

-

Specify the type of deed: Choose the appropriate deed type based on your needs.

-

Sign the document: The grantor must sign the deed in the presence of a notary public.

-

Record the deed: Submit the completed deed to the local county clerk's office for recording.

What is the difference between a warranty deed and a quitclaim deed?

A warranty deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. It also protects the grantee against any claims or disputes regarding the title. In contrast, a quitclaim deed transfers whatever interest the grantor has in the property without any guarantees. This means the grantee assumes the risk of any title issues.

Yes, there are typically fees associated with filing a Florida Deed form. These may include:

-

Recording fees charged by the county clerk's office.

-

Documentary stamp taxes, which are based on the sale price of the property.

-

Notary fees if you require notarization of the document.

It is advisable to check with your local county clerk for specific fee amounts.

While it is not legally required to have an attorney prepare a Florida Deed form, it is often recommended. An attorney can ensure that the deed is properly drafted, executed, and recorded, reducing the risk of errors or disputes in the future. If you are unsure about the process, consulting with a legal professional can provide peace of mind.

Florida Deed forms can be obtained from various sources, including:

-

Local county clerk's office, where official forms may be available.

-

Online legal document services that provide customizable deed templates.

-

Real estate attorneys who can draft a deed tailored to your specific situation.

Make sure to use a form that complies with Florida laws to ensure validity.