What is a Florida Lady Bird Deed?

A Florida Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer their property to beneficiaries while retaining the right to live in and control the property during their lifetime. This type of deed can help avoid probate and provides flexibility in estate planning.

Who can use a Lady Bird Deed?

Any property owner in Florida can use a Lady Bird Deed. It is particularly beneficial for individuals who want to ensure their property passes directly to their heirs without going through probate. It's also suitable for those who wish to maintain control over their property during their lifetime.

What are the benefits of a Lady Bird Deed?

-

Avoids Probate:

The property transfers directly to beneficiaries upon the owner's death, bypassing the probate process.

-

Retains Control:

The property owner retains the right to sell, mortgage, or change the beneficiaries at any time.

-

Tax Benefits:

The property receives a step-up in basis for tax purposes, which can reduce capital gains taxes for heirs.

-

Medicaid Protection:

It can protect the property from being counted as an asset for Medicaid eligibility purposes.

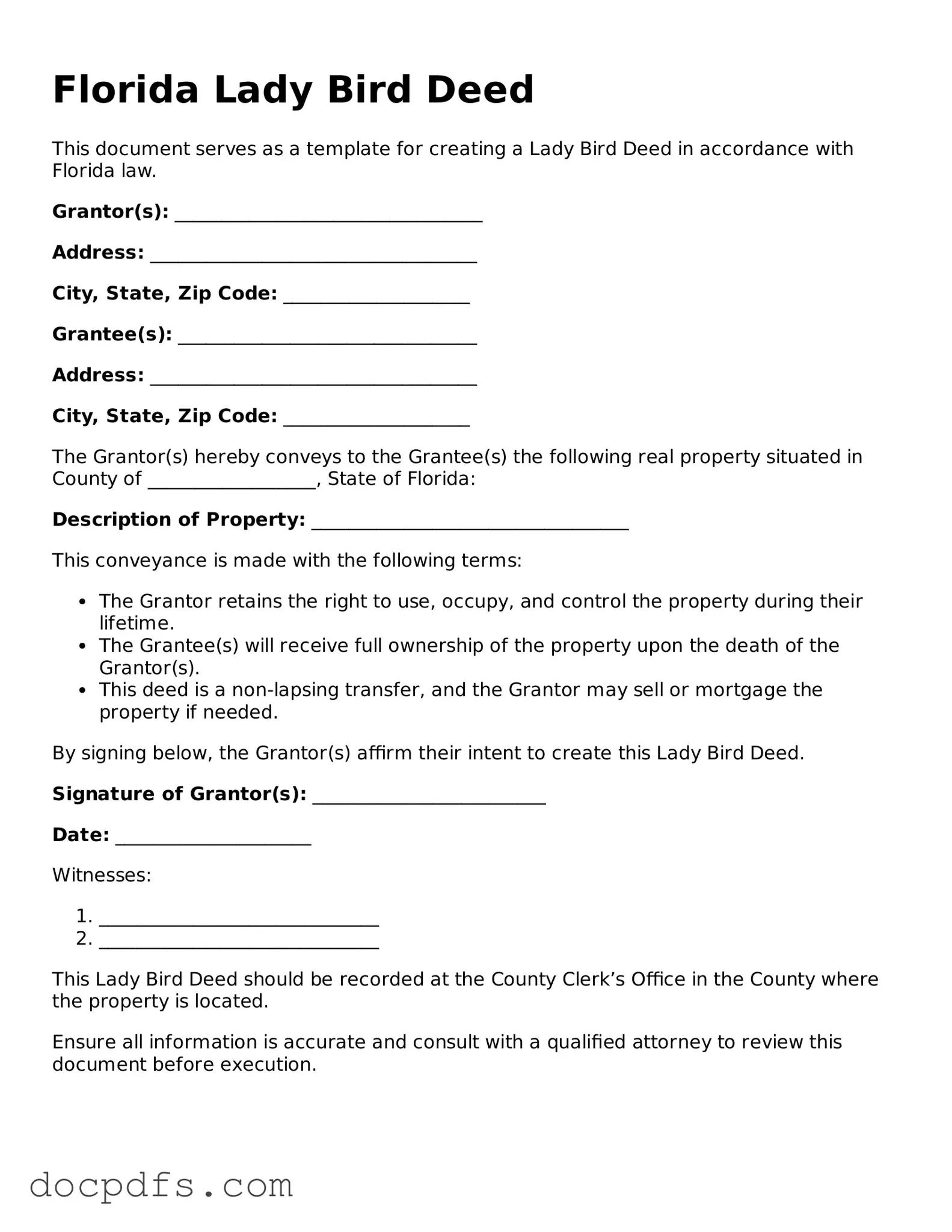

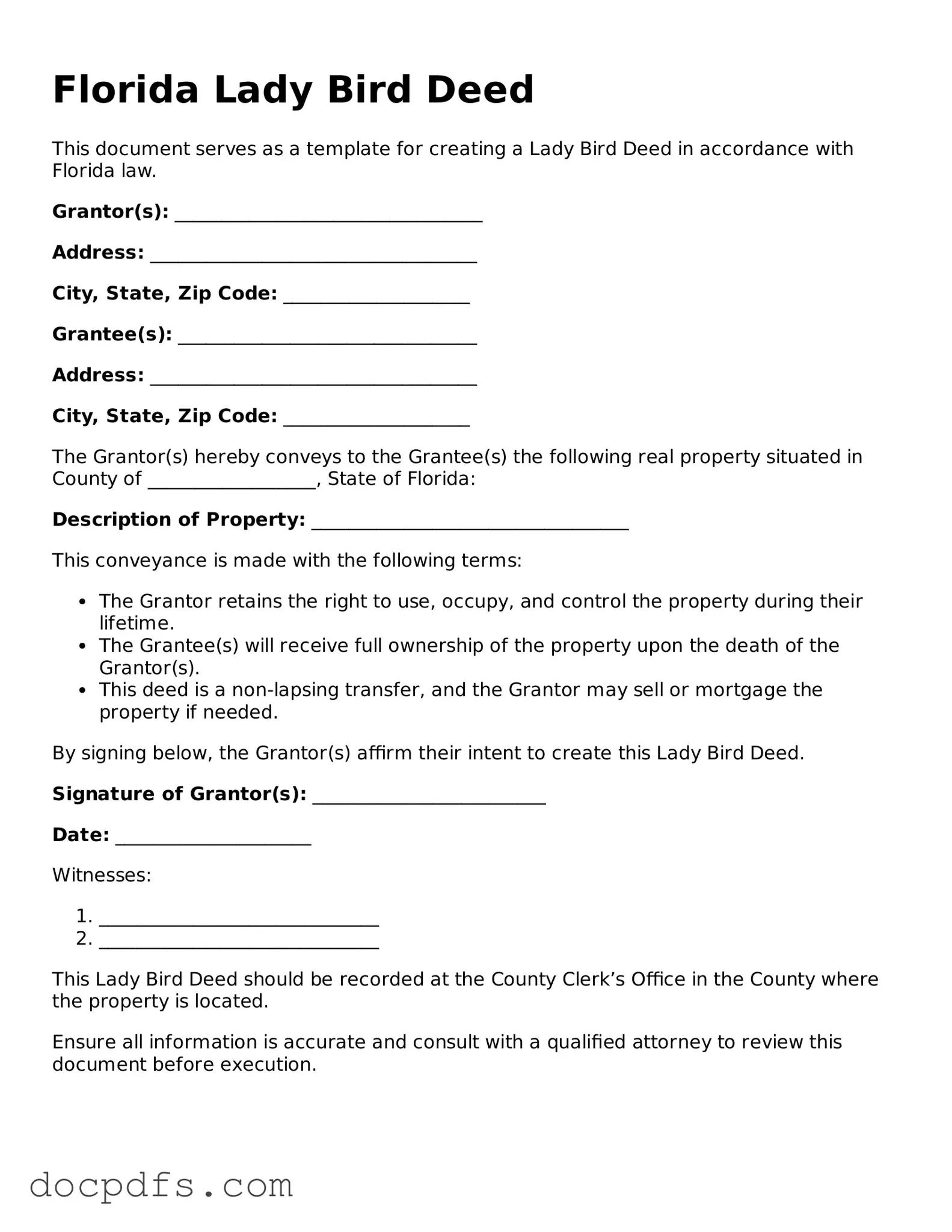

How do I create a Lady Bird Deed?

To create a Lady Bird Deed, you typically need to follow these steps:

-

Obtain a blank Lady Bird Deed form, which can be found online or through legal offices.

-

Fill out the form with the required information, including the property description and the names of the beneficiaries.

-

Sign the deed in the presence of a notary public.

-

Record the deed with the county clerk’s office where the property is located.

Can I revoke a Lady Bird Deed?

Yes, a Lady Bird Deed can be revoked or changed at any time during the property owner's lifetime. The property owner simply needs to create a new deed that revokes the previous one or alters the beneficiaries as desired.

What happens if the beneficiary predeceases the property owner?

If a beneficiary listed on a Lady Bird Deed passes away before the property owner, the deed typically allows for the property to pass to the remaining beneficiaries. If no alternate beneficiaries are named, the property may revert to the owner's estate.

Is a Lady Bird Deed the same as a regular deed?

No, a Lady Bird Deed differs from a regular deed in that it includes specific provisions allowing the property owner to retain certain rights during their lifetime. Regular deeds do not offer the same level of control or benefits related to estate planning.

Do I need an attorney to create a Lady Bird Deed?

While it is not legally required to hire an attorney to create a Lady Bird Deed, consulting with one is highly recommended. An attorney can ensure that the deed is properly drafted and executed, and they can provide guidance on how it fits into your overall estate plan.

Are there any drawbacks to using a Lady Bird Deed?

While Lady Bird Deeds offer many advantages, there are some potential drawbacks to consider. These may include:

-

The possibility of disputes among beneficiaries.

-

Potential impacts on eligibility for certain government benefits.

-

Complexities in tax implications that may arise.

How does a Lady Bird Deed affect property taxes?

A Lady Bird Deed can provide a step-up in property tax basis for the beneficiaries upon the owner's death. This means that if the property appreciates in value, the beneficiaries may only pay capital gains tax on the value increase from the time of inheritance, rather than from the original purchase price. It's essential to consult a tax professional for specific advice related to your situation.