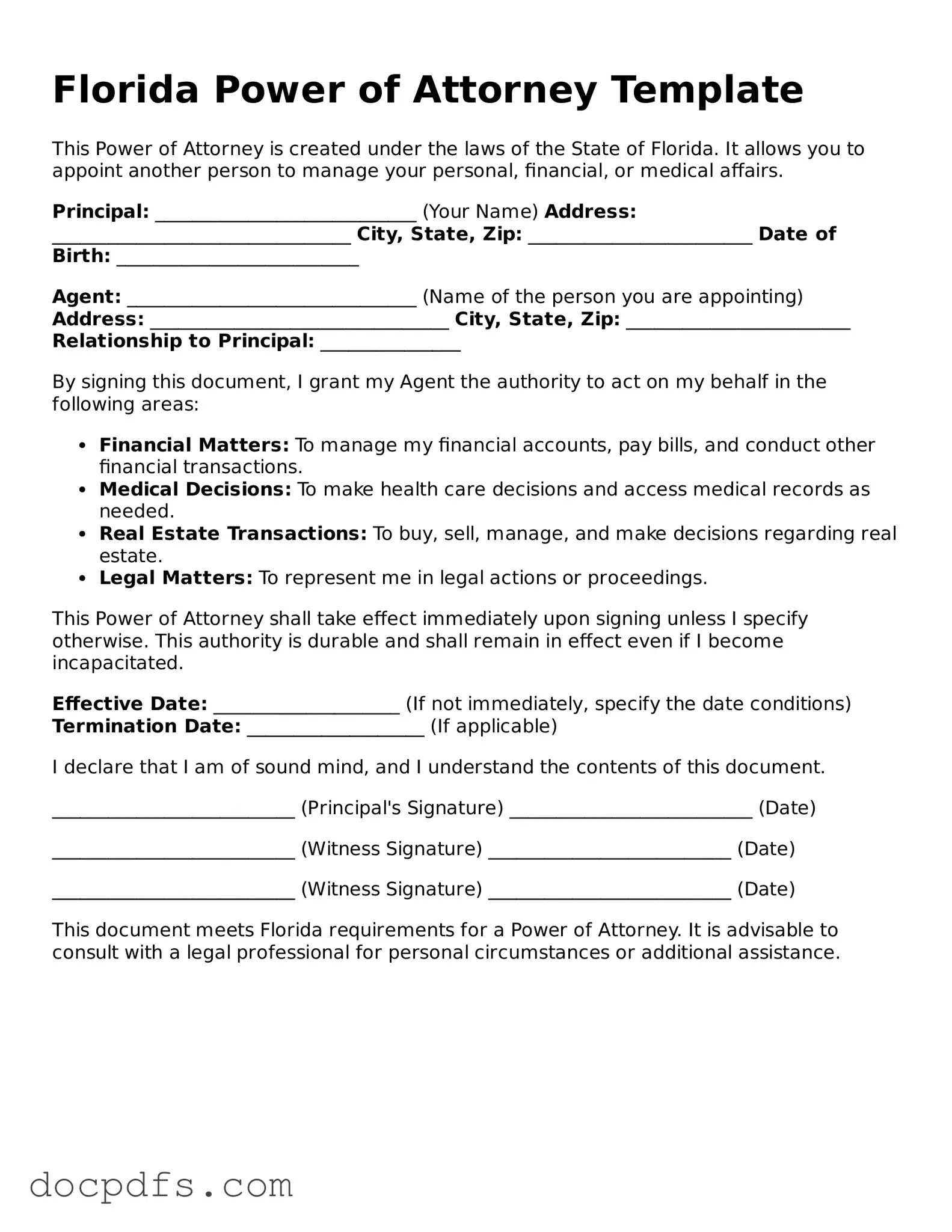

What is a Florida Power of Attorney?

A Florida Power of Attorney is a legal document that allows one person to act on behalf of another in legal or financial matters. This can include handling bank transactions, signing documents, or making healthcare decisions. The person granting this authority is called the principal, while the person receiving it is known as the agent or attorney-in-fact.

Do I need a lawyer to create a Power of Attorney in Florida?

No, you do not need a lawyer to create a Power of Attorney in Florida. However, consulting with a lawyer can help ensure that the document meets your specific needs and complies with Florida law. A lawyer can also clarify any complex issues related to your situation.

What are the different types of Power of Attorney in Florida?

Florida recognizes several types of Power of Attorney, including:

-

Durable Power of Attorney:

Remains effective even if the principal becomes incapacitated.

-

Limited Power of Attorney:

Grants authority for specific tasks or a limited time period.

-

Healthcare Power of Attorney:

Allows the agent to make medical decisions on behalf of the principal.

How do I revoke a Power of Attorney in Florida?

To revoke a Power of Attorney in Florida, you must create a written document stating your intention to revoke. This document should be signed and dated. It's also a good idea to notify your agent and any institutions or individuals that were relying on the original Power of Attorney.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated, a Durable Power of Attorney remains in effect. This means the agent can continue to act on the principal's behalf. If the Power of Attorney is not durable, it will become invalid upon the principal's incapacity.

Can I appoint more than one agent in a Florida Power of Attorney?

Yes, you can appoint multiple agents in a Florida Power of Attorney. You can specify whether they must act together or if they can act independently. Be clear about your intentions to avoid confusion later.

Is a Power of Attorney valid in other states?

A Florida Power of Attorney may be recognized in other states, but this can vary. Some states have different requirements. It’s advisable to check the specific laws in the state where the Power of Attorney will be used to ensure its validity.

What should I consider when choosing an agent?

Choosing an agent is a significant decision. Consider the following:

-

Trustworthiness: Your agent should be someone you trust completely.

-

Availability: Make sure they are willing and able to take on the responsibilities.

-

Understanding: They should understand your wishes and values.