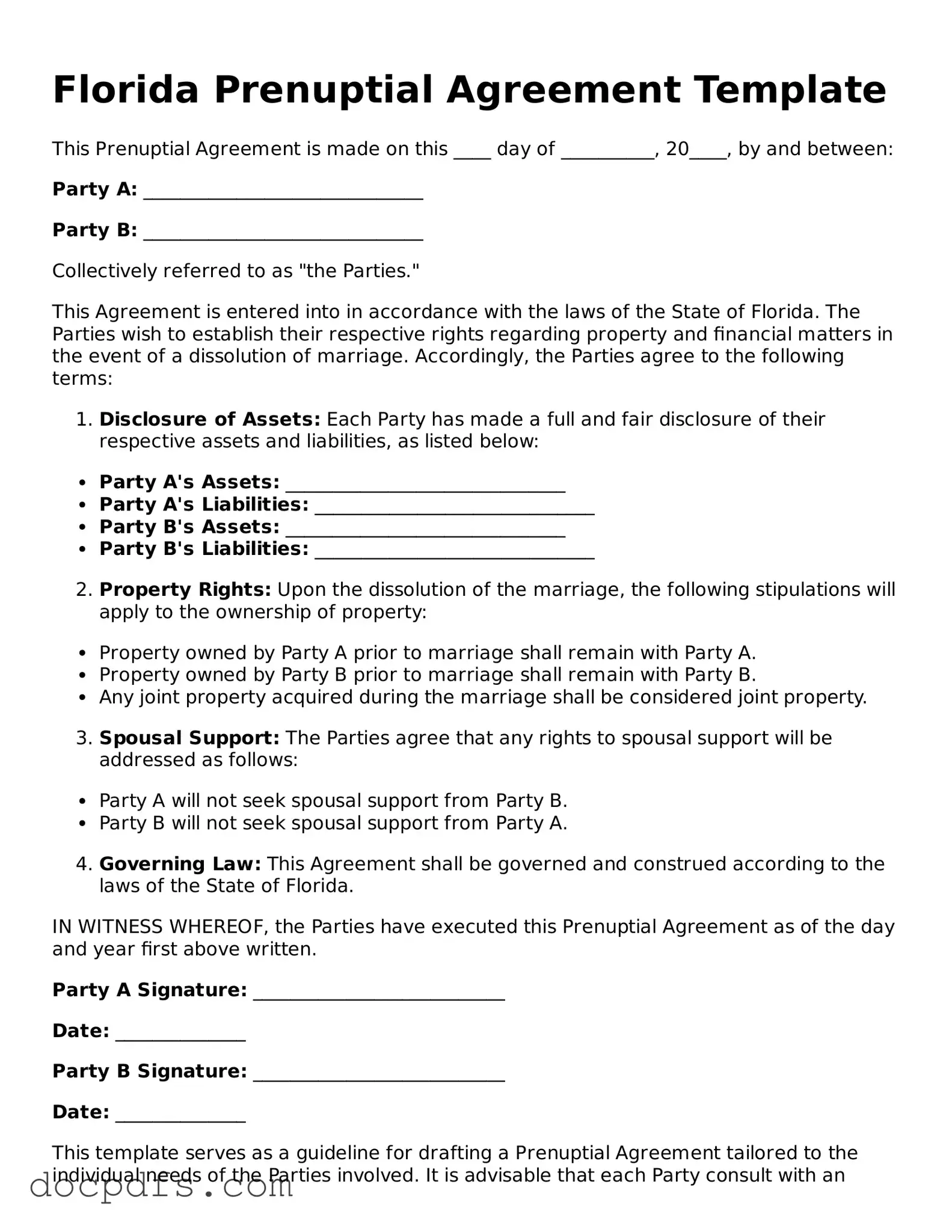

Free Florida Prenuptial Agreement Form

A Florida Prenuptial Agreement form is a legal document that outlines the financial and property rights of each partner before entering into marriage. This agreement serves to protect individual assets and clarify obligations, ensuring both parties have a clear understanding of their financial landscape. By establishing these terms upfront, couples can foster a sense of security and transparency as they embark on their marital journey.

Open Prenuptial Agreement Editor Now

Free Florida Prenuptial Agreement Form

Open Prenuptial Agreement Editor Now

Open Prenuptial Agreement Editor Now

or

⇓ Prenuptial Agreement

Finish this form the fast way

Complete Prenuptial Agreement online with a smooth editing experience.