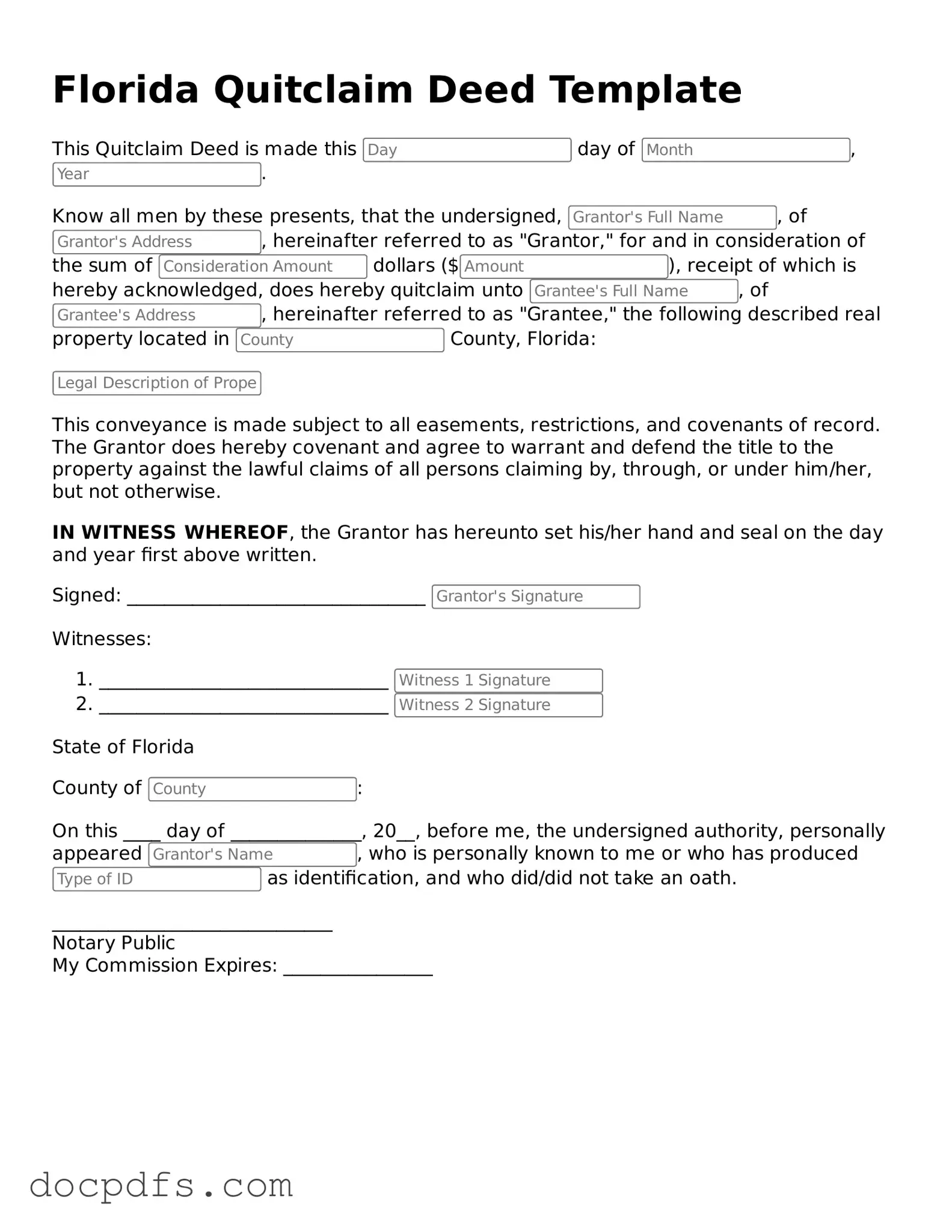

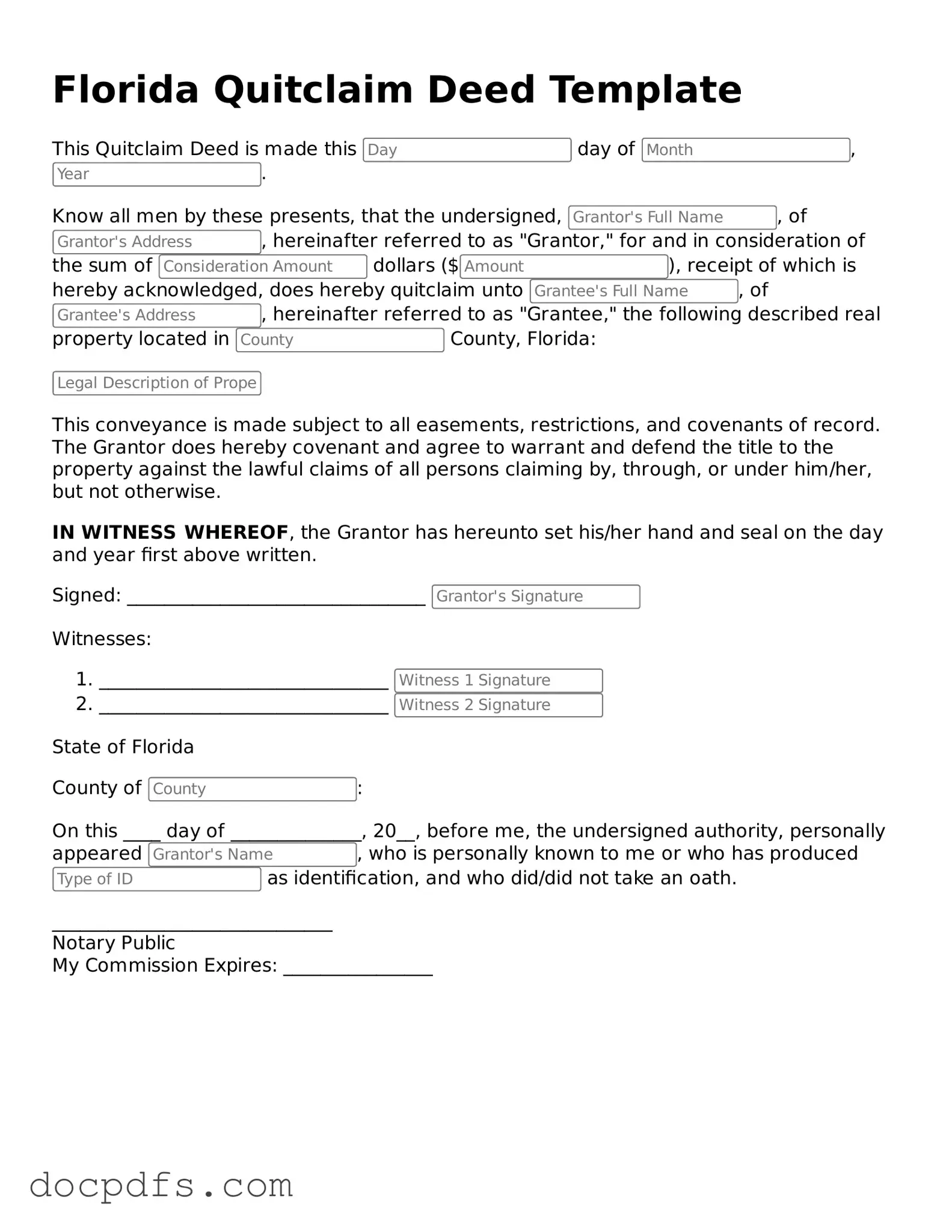

Free Florida Quitclaim Deed Form

A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing the title's validity. This form is often utilized in situations such as transferring property between family members or clearing up title issues. Understanding its purpose and implications is essential for anyone involved in property transactions in Florida.

Open Quitclaim Deed Editor Now

Free Florida Quitclaim Deed Form

Open Quitclaim Deed Editor Now

Open Quitclaim Deed Editor Now

or

⇓ Quitclaim Deed

Finish this form the fast way

Complete Quitclaim Deed online with a smooth editing experience.