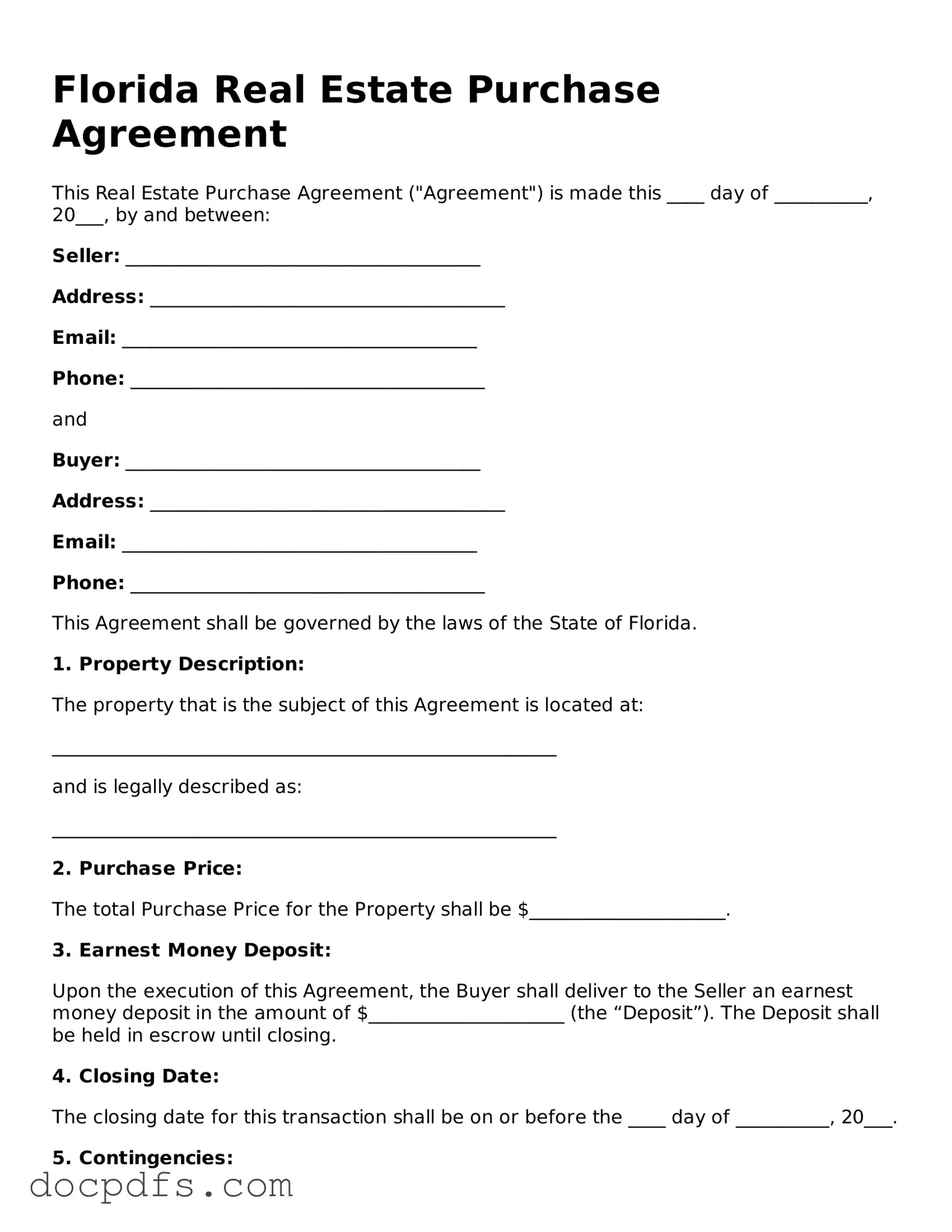

What is a Florida Real Estate Purchase Agreement?

A Florida Real Estate Purchase Agreement is a legally binding document that outlines the terms and conditions under which a buyer agrees to purchase property from a seller. This agreement typically includes details such as the purchase price, property description, closing date, and any contingencies that must be met before the sale can be finalized.

What are the essential components of the agreement?

The essential components of a Florida Real Estate Purchase Agreement typically include:

-

Parties Involved:

Identification of the buyer and seller.

-

Property Description:

A detailed description of the property being sold.

-

Purchase Price:

The agreed-upon price for the property.

-

Earnest Money Deposit:

The amount of money the buyer will put down to show commitment.

-

Contingencies:

Conditions that must be met for the sale to proceed, such as financing or inspections.

-

Closing Details:

The date and location where the sale will be finalized.

Are there any contingencies that can be included?

Yes, contingencies are common in Florida Real Estate Purchase Agreements. They protect the buyer and can include:

-

Financing Contingency:

The sale is contingent upon the buyer securing a mortgage.

-

Inspection Contingency:

The buyer must be satisfied with the results of a property inspection.

-

Appraisal Contingency:

The property must appraise for at least the purchase price.

These contingencies allow the buyer to back out of the agreement without penalty if certain conditions are not met.

How is the earnest money handled?

The earnest money is typically held in escrow by a neutral third party, such as a title company or real estate broker. This deposit demonstrates the buyer's serious intent to purchase the property. If the sale goes through, the earnest money is usually applied to the buyer's down payment or closing costs. If the buyer backs out without a valid reason, the seller may be entitled to keep the earnest money.

What happens if either party wants to back out of the agreement?

If either party wishes to back out of the agreement, they must refer to the specific terms outlined in the contract. If contingencies are included and are not satisfied, the buyer can typically withdraw without penalty. However, if a party backs out without a valid reason, they may face legal consequences, including the potential loss of earnest money or other damages.

Is it necessary to have a real estate attorney review the agreement?

While it is not legally required to have a real estate attorney review the Florida Real Estate Purchase Agreement, it is highly recommended. An attorney can provide valuable insights, ensure that the agreement complies with state laws, and help protect the interests of both the buyer and seller. This step can prevent misunderstandings and potential legal issues down the line.