What is a Florida Tractor Bill of Sale?

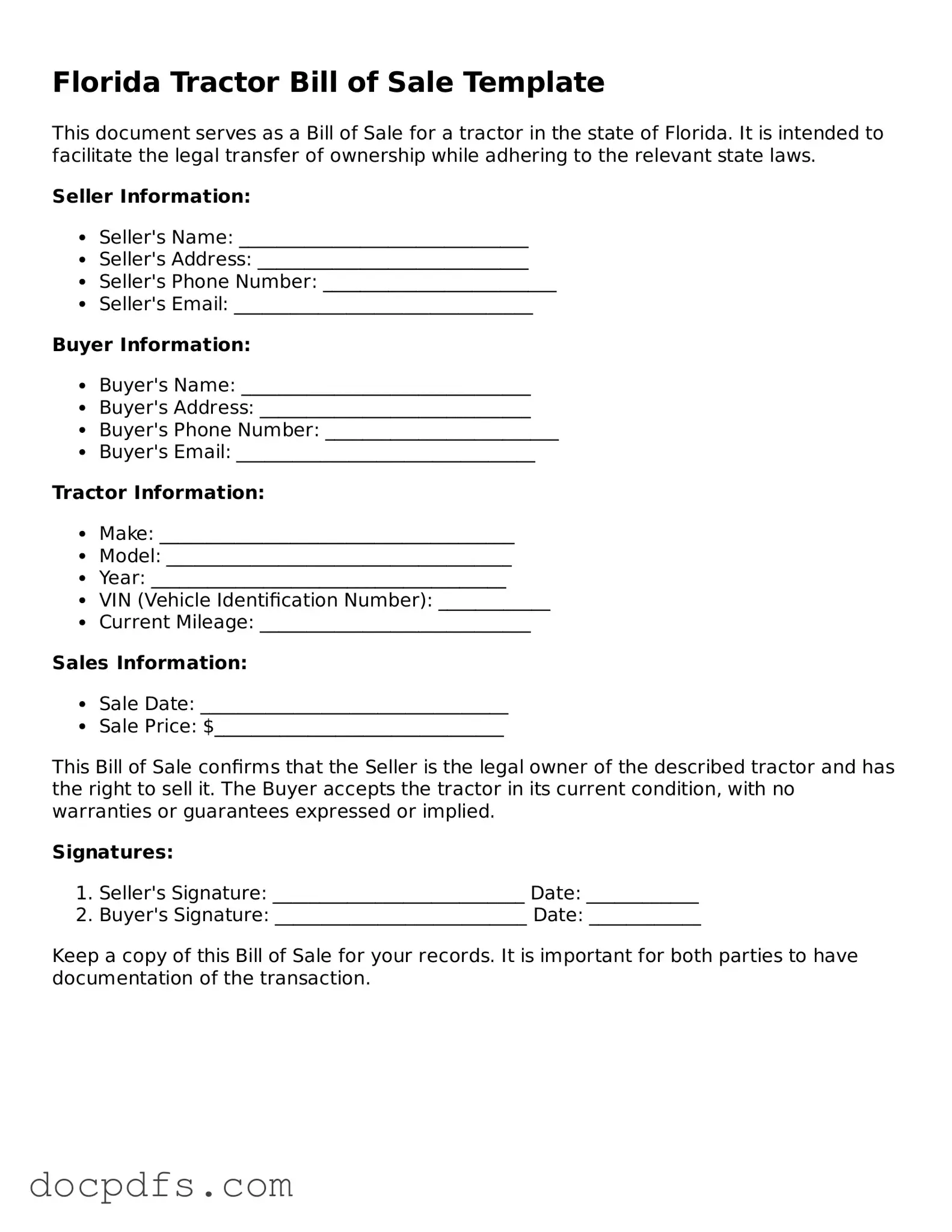

A Florida Tractor Bill of Sale is a legal document that records the sale and transfer of ownership of a tractor in the state of Florida. This document serves as proof of the transaction between the buyer and seller, detailing the specifics of the sale, including the tractor's make, model, year, and identification number.

Why is a Bill of Sale important?

A Bill of Sale is crucial for several reasons:

-

It provides legal protection for both the buyer and seller.

-

It helps establish ownership and can be required for registration purposes.

-

It documents the terms of the sale, including the purchase price and any warranties or conditions.

To complete the Bill of Sale, the following information is typically required:

-

The full names and addresses of both the buyer and seller.

-

The tractor's make, model, year, and Vehicle Identification Number (VIN).

-

The purchase price and payment method.

-

The date of the sale.

Is a Bill of Sale required in Florida for tractor sales?

While a Bill of Sale is not legally required for all transactions in Florida, it is highly recommended. Having this document can help avoid disputes and provides a clear record of the sale for both parties. Additionally, it may be necessary for registering the tractor with the Florida Department of Highway Safety and Motor Vehicles.

Can I use a generic Bill of Sale template for my tractor sale?

Yes, you can use a generic Bill of Sale template, but it is advisable to ensure that it includes all necessary details specific to the tractor sale. Customizing the template to reflect the particulars of your transaction will help protect both parties involved.

What if the tractor has a lien on it?

If there is a lien on the tractor, it is essential to disclose this information in the Bill of Sale. The seller should work with the lienholder to clear the lien before completing the sale. The buyer should also verify that the lien has been satisfied to avoid future complications.

Do I need to notarize the Bill of Sale?

Notarization is not a requirement for a Bill of Sale in Florida, but having the document notarized can add an extra layer of authenticity. It may also be beneficial if either party needs to prove the legitimacy of the sale in the future.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should retain a copy for their records. The buyer should take the document to the local Department of Highway Safety and Motor Vehicles to register the tractor in their name. This step is crucial for legal ownership and may be necessary for insurance purposes.

Can I cancel a Bill of Sale?

Once a Bill of Sale is signed and the transaction is completed, it is generally considered a binding agreement. However, if both parties agree to cancel the sale, they can create a cancellation agreement. This document should outline the terms of the cancellation and be signed by both parties.

You can obtain a Florida Tractor Bill of Sale form from various sources, including online legal document providers, local government offices, or by creating your own using templates available on reputable websites. Ensure that the form you choose meets all state requirements.