What is a Transfer-on-Death Deed in Florida?

A Transfer-on-Death Deed (TOD) allows an individual to transfer real estate to a designated beneficiary upon their death. This deed enables property owners to avoid probate, simplifying the transfer process for their heirs. The transfer occurs automatically, meaning the beneficiary gains ownership without needing to go through court proceedings.

Who can use a Transfer-on-Death Deed?

Any property owner in Florida can use a Transfer-on-Death Deed. This includes individuals who own residential or commercial real estate. However, the property must be located in Florida, and the owner must have the legal capacity to execute the deed. It is important to consider the implications for any co-owners or existing liens on the property.

How do I create a Transfer-on-Death Deed?

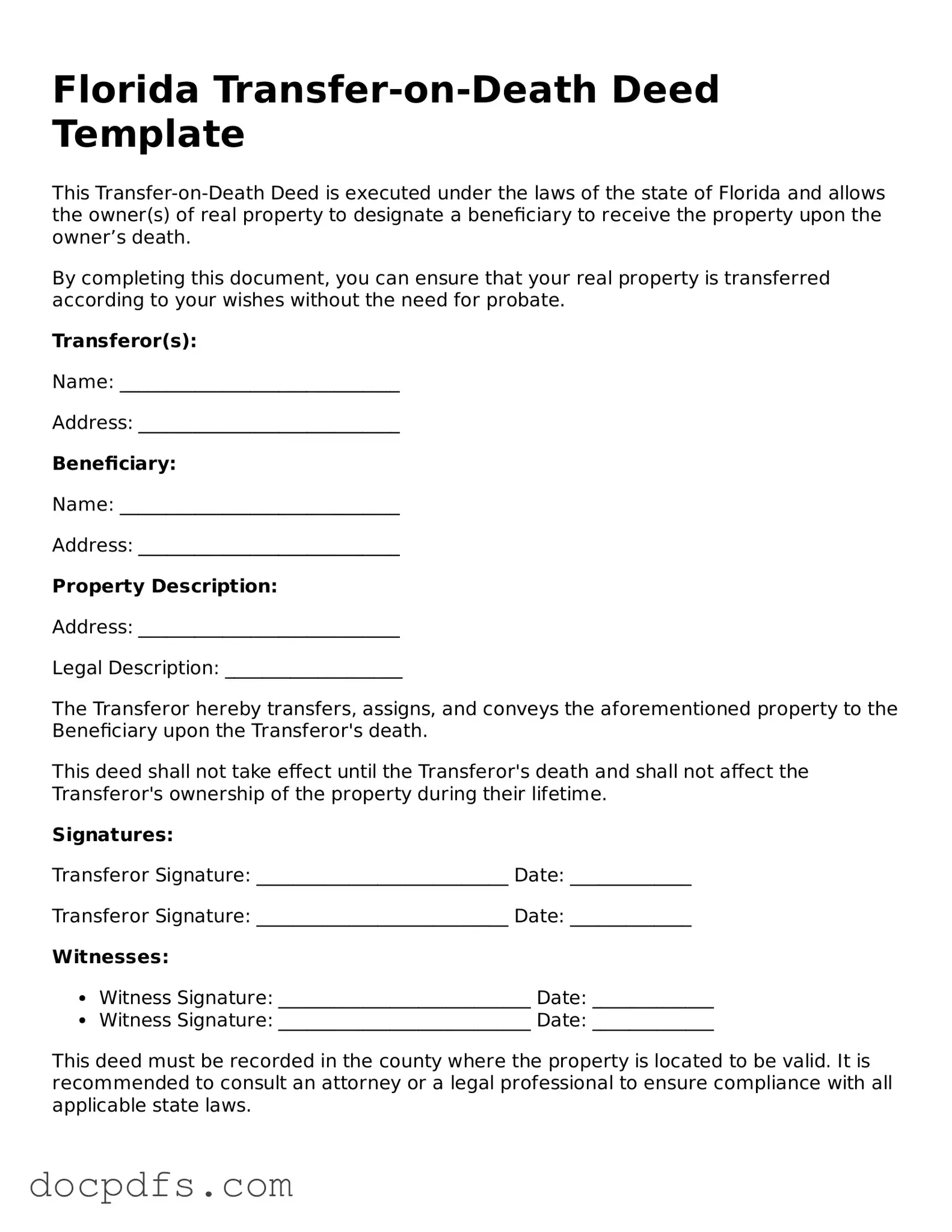

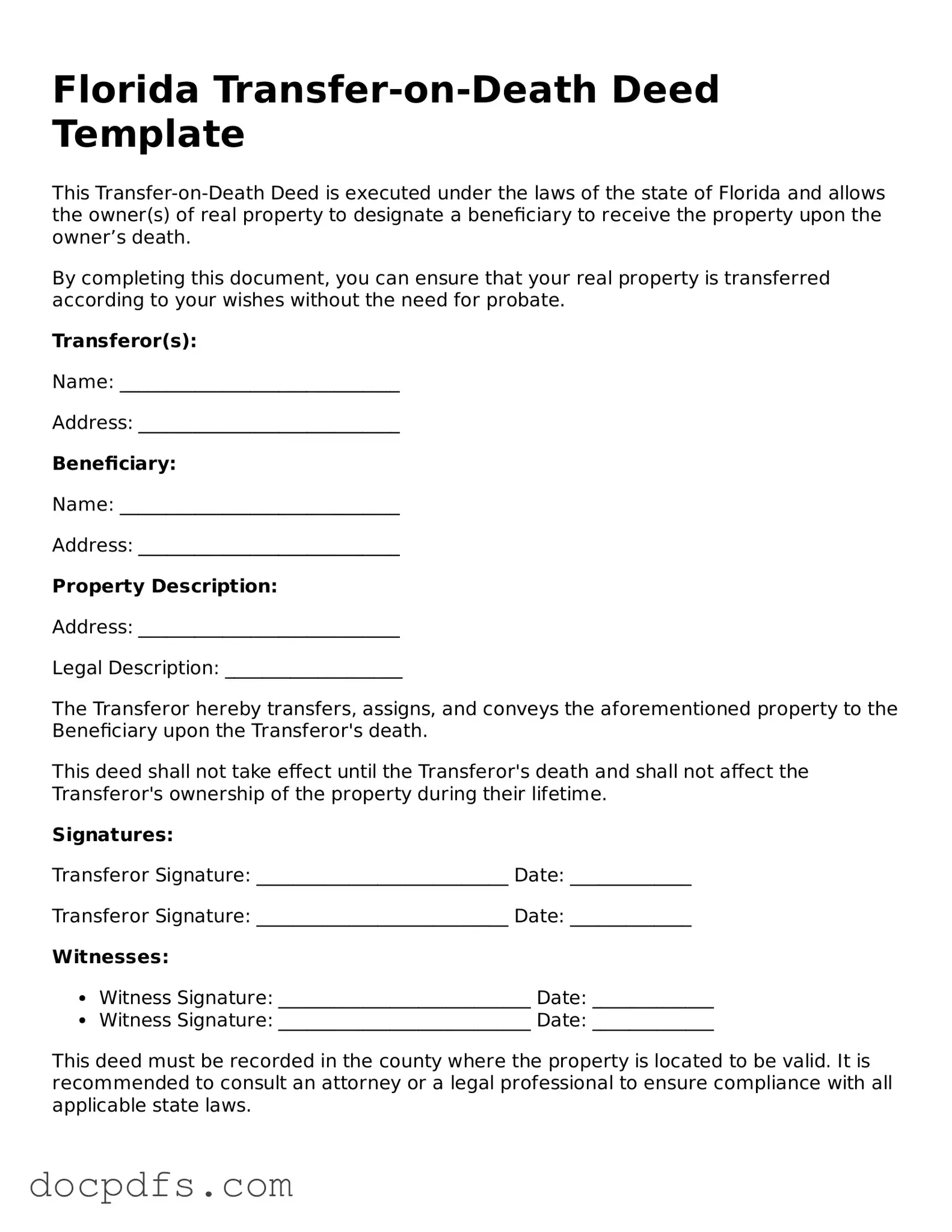

To create a Transfer-on-Death Deed, follow these steps:

-

Obtain the appropriate form, which is available online or through legal offices.

-

Complete the form with accurate information about the property and the beneficiary.

-

Sign the deed in the presence of a notary public.

-

Record the deed with the county clerk's office where the property is located.

It is advisable to consult with a legal professional to ensure the deed is executed correctly and meets all legal requirements.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time during your lifetime. To do so, you must execute a new deed that either names a different beneficiary or explicitly revokes the previous deed. This new deed must also be signed, notarized, and recorded with the county clerk's office to be effective.

What happens if the beneficiary dies before me?

If the designated beneficiary passes away before you, the Transfer-on-Death Deed will not automatically transfer the property to that individual. Instead, the property will become part of your estate. You may want to update the deed to name a new beneficiary to ensure your wishes are carried out.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences. The property may be subject to estate taxes, depending on the overall value of your estate at the time of your death. It is important to consult with a tax professional to understand any potential tax liabilities that may arise.

Is legal assistance necessary for a Transfer-on-Death Deed?

While it is possible to complete a Transfer-on-Death Deed without legal assistance, consulting with an attorney is highly recommended. Legal professionals can provide valuable guidance, ensuring that the deed is correctly executed and that your intentions are clearly expressed. This can help prevent potential disputes among heirs in the future.