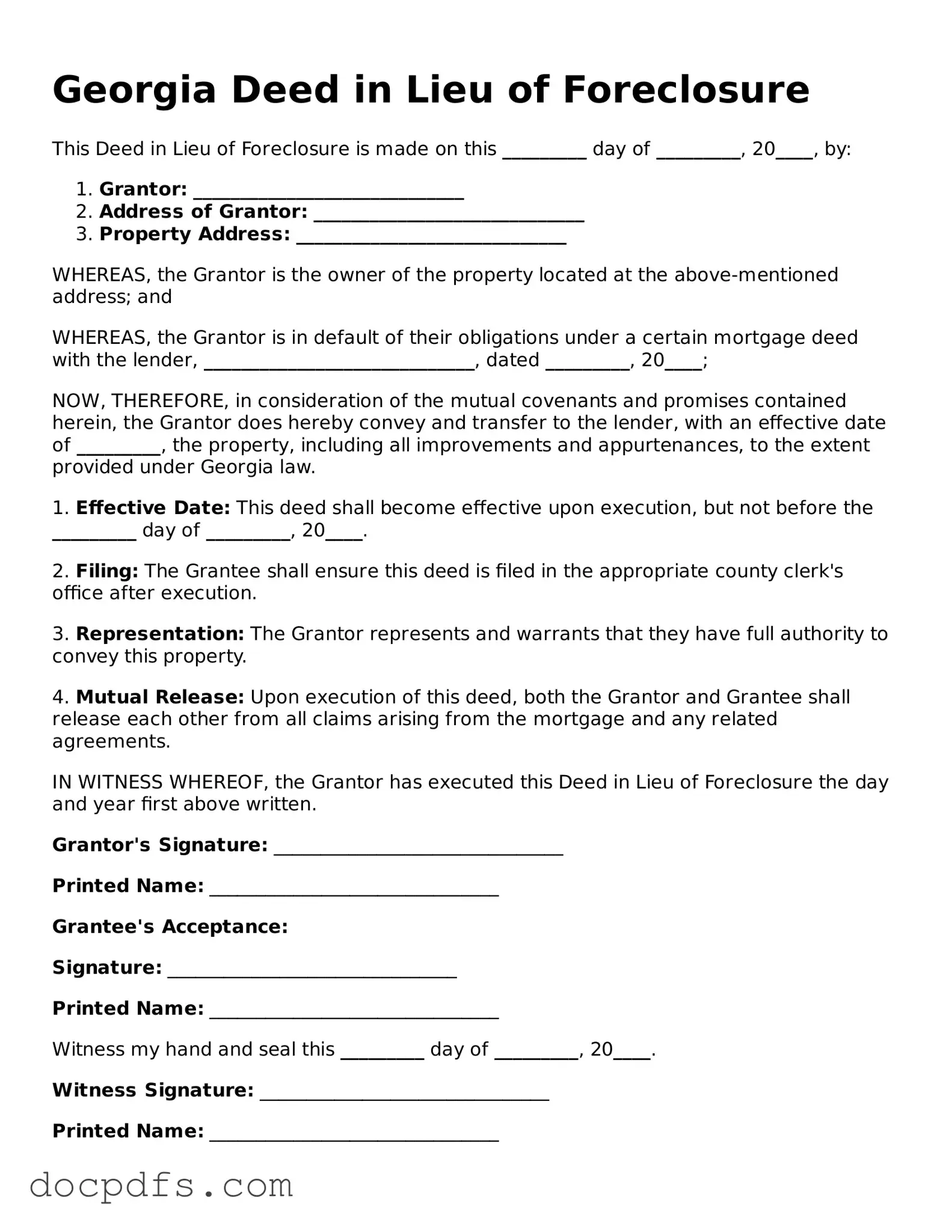

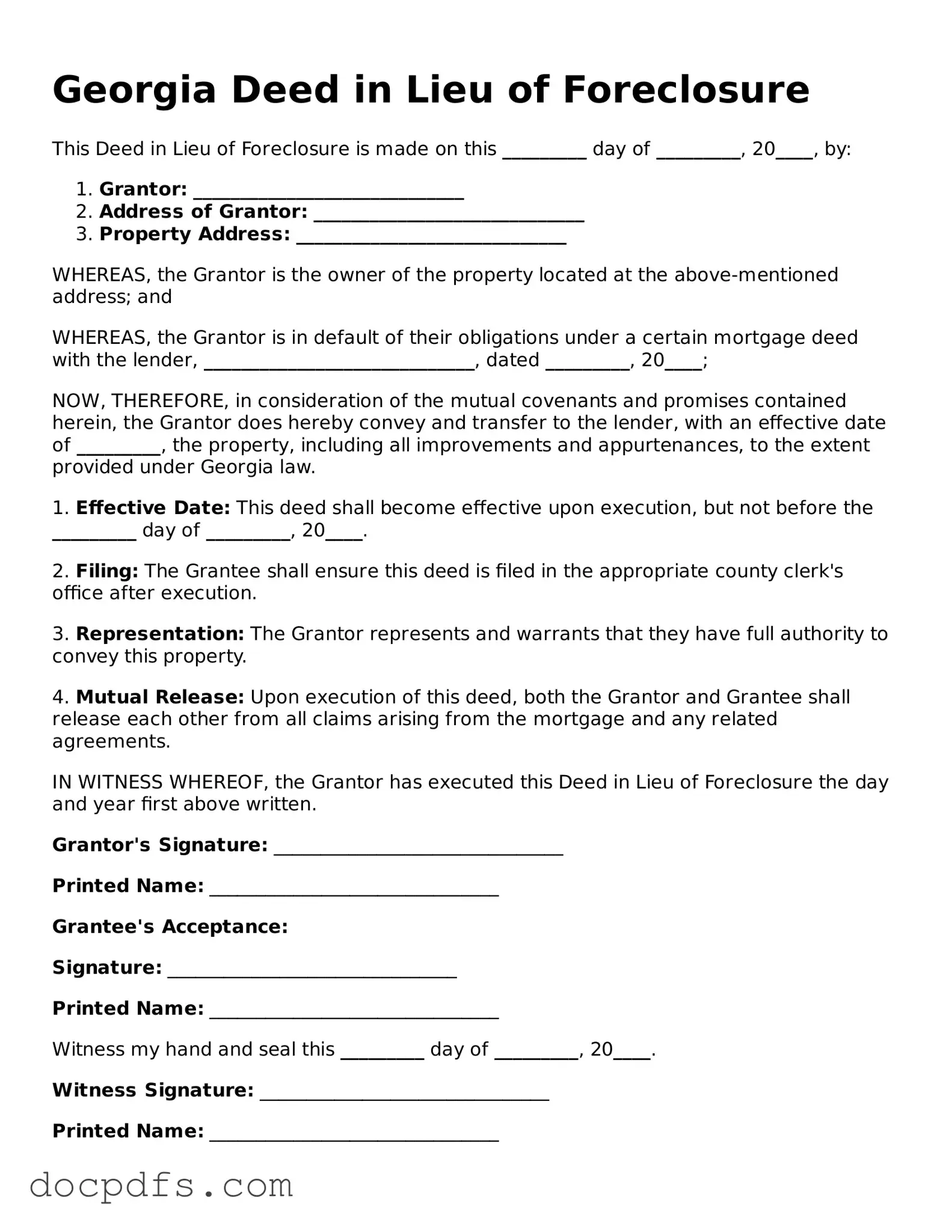

Free Georgia Deed in Lieu of Foreclosure Form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer the title of their property to the lender in order to avoid the foreclosure process. This option can provide a smoother transition for both parties and help the homeowner mitigate financial losses. Understanding the implications and requirements of this form is crucial for anyone facing financial difficulties with their mortgage.

Open Deed in Lieu of Foreclosure Editor Now

Free Georgia Deed in Lieu of Foreclosure Form

Open Deed in Lieu of Foreclosure Editor Now

Open Deed in Lieu of Foreclosure Editor Now

or

⇓ Deed in Lieu of Foreclosure

Finish this form the fast way

Complete Deed in Lieu of Foreclosure online with a smooth editing experience.