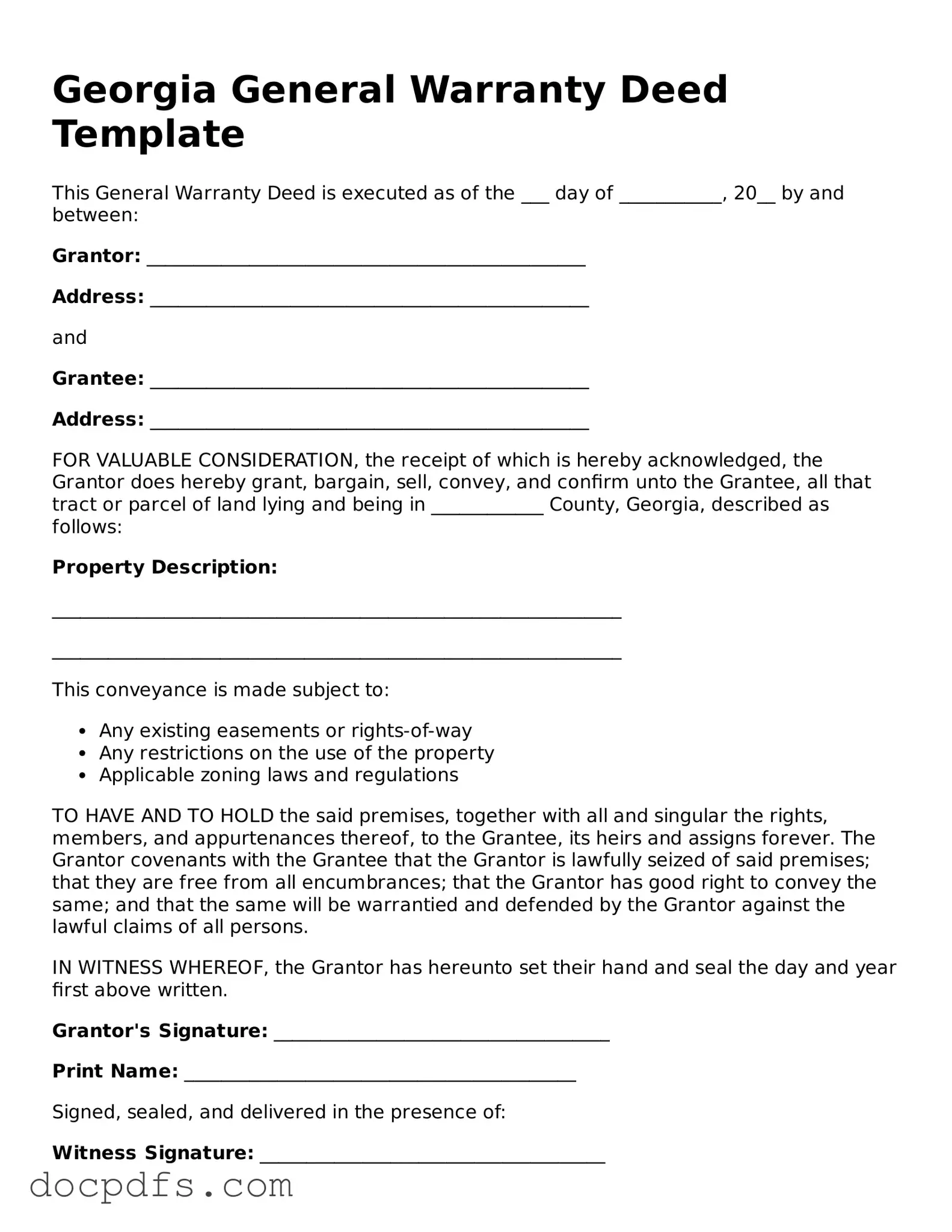

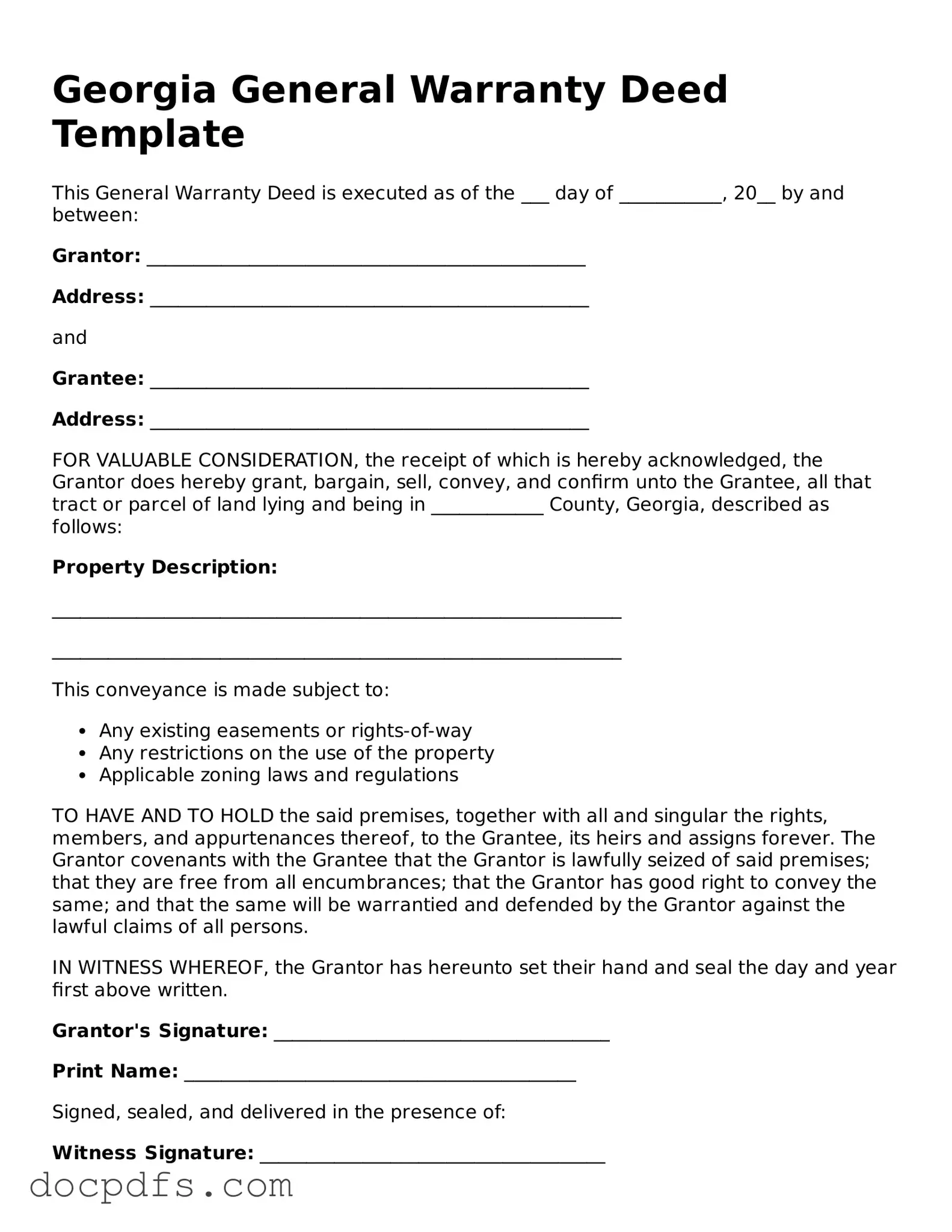

A Georgia Deed form is a legal document used to transfer ownership of real property in the state of Georgia. This form outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions or warranties related to the transfer.

What types of Deeds are available in Georgia?

In Georgia, several types of deeds can be used, including:

-

Warranty Deed:

Provides the highest level of protection to the buyer, guaranteeing that the seller has clear title to the property.

-

Quitclaim Deed:

Transfers whatever interest the seller has in the property without any guarantees about the title.

-

Special Warranty Deed:

Offers some protections to the buyer, stating that the seller has not encumbered the property during their ownership.

Do I need to have the Deed notarized?

Yes, in Georgia, a Deed must be notarized to be legally effective. The signature of the grantor (the person transferring the property) must be witnessed by a notary public. This step helps to prevent fraud and ensures the authenticity of the document.

To complete a Georgia Deed form, follow these steps:

-

Identify the parties involved: Include the full names of the grantor and grantee.

-

Describe the property: Provide a legal description of the property being transferred.

-

State the consideration: Indicate the amount of money or other value exchanged for the property.

-

Sign and notarize the document: The grantor must sign in the presence of a notary public.

Where do I file the Deed after it is completed?

After completing and notarizing the Deed, it should be filed with the Clerk of Superior Court in the county where the property is located. This filing makes the transfer of ownership a matter of public record.

Is there a fee to file a Georgia Deed?

Yes, there is typically a fee associated with filing a Deed in Georgia. The amount may vary by county, so it is advisable to check with the local Clerk of Superior Court for the exact fee schedule.

A Georgia Deed form can generally be used for residential, commercial, and vacant land properties. However, specific regulations may apply depending on the type of property and its zoning. It is important to ensure that the Deed complies with any local laws or restrictions.

What happens if I do not file the Deed?

If the Deed is not filed, the transfer of ownership may not be recognized legally. This can lead to disputes over property rights and may complicate future transactions involving the property. Filing the Deed is crucial to establish clear title and protect the interests of both the buyer and seller.

Can I amend a Georgia Deed after it has been filed?

Yes, a Georgia Deed can be amended or corrected after it has been filed. This typically involves preparing a new document that outlines the changes and filing it with the Clerk of Superior Court. It is advisable to consult with a legal professional to ensure that the amendments are made correctly.