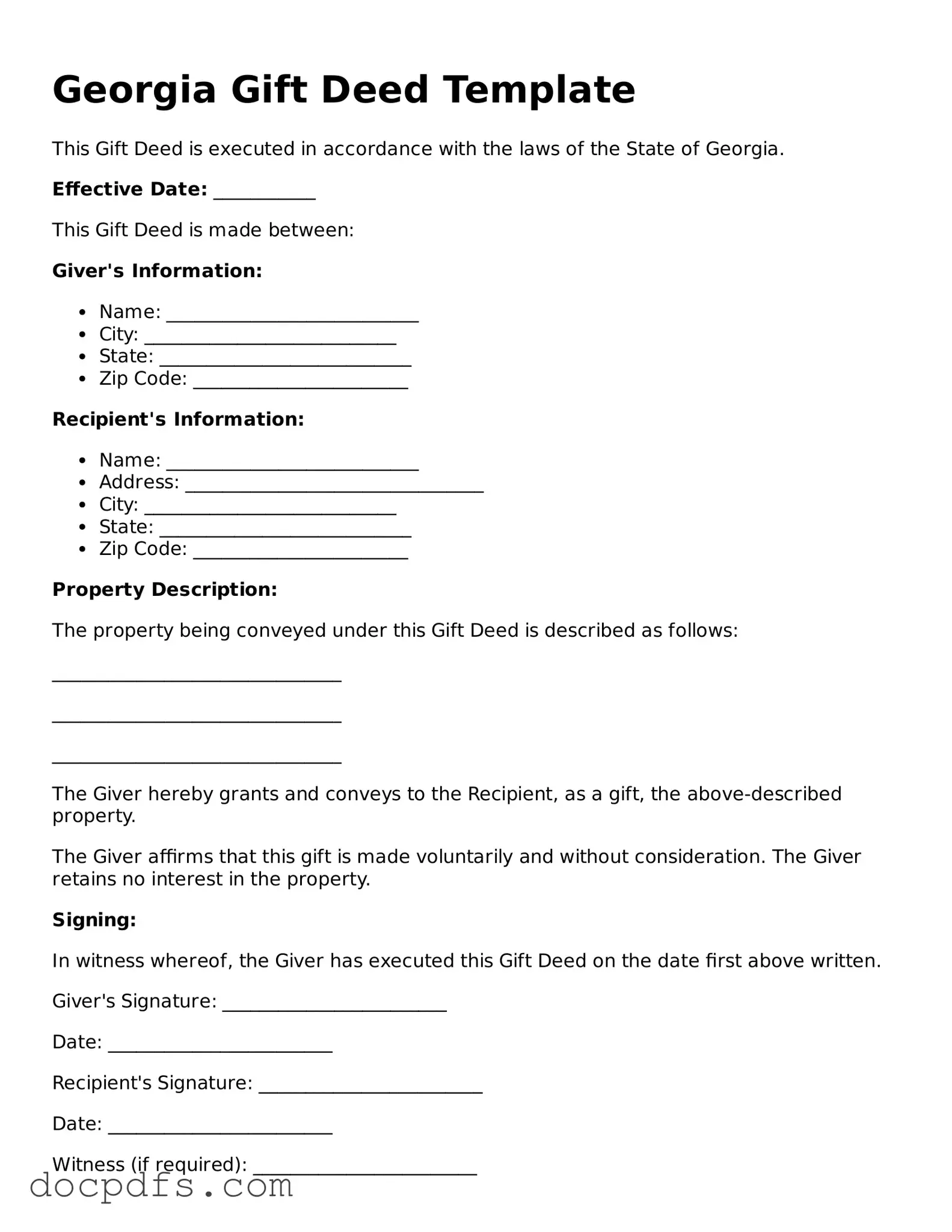

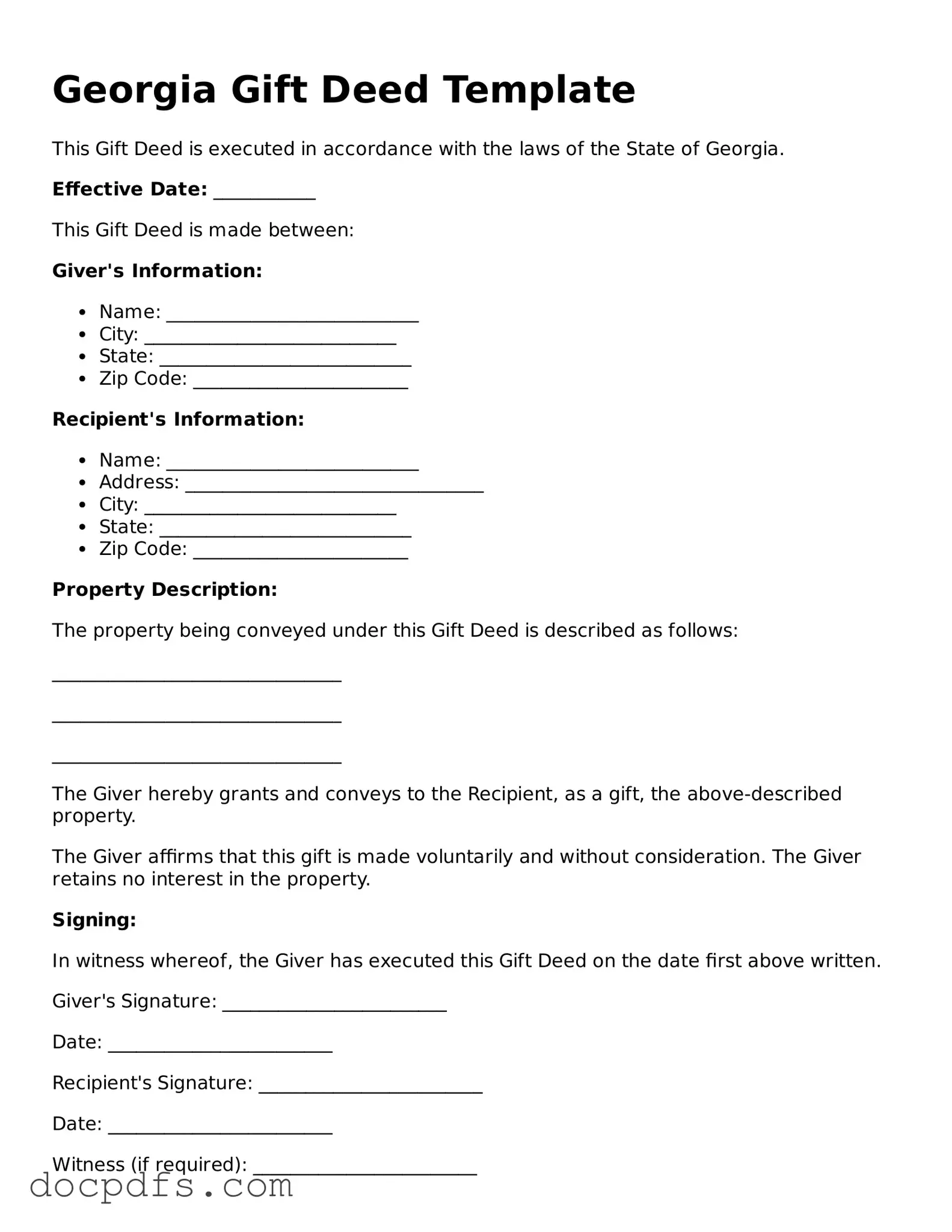

Free Georgia Gift Deed Form

A Georgia Gift Deed form is a legal document used to transfer property from one person to another without any exchange of money. This form allows individuals to give real estate as a gift while ensuring that the transaction is recorded properly. Understanding how to use this form can simplify the process of making a generous gift to a loved one.

Open Gift Deed Editor Now

Free Georgia Gift Deed Form

Open Gift Deed Editor Now

Open Gift Deed Editor Now

or

⇓ Gift Deed

Finish this form the fast way

Complete Gift Deed online with a smooth editing experience.