What is a Georgia Quitclaim Deed?

A Georgia Quitclaim Deed is a legal document used to transfer ownership of real property from one person to another without making any guarantees about the title. It conveys whatever interest the grantor has in the property, if any, and is often used between family members or in situations where the parties know each other well.

When should I use a Quitclaim Deed?

This type of deed is commonly used in various situations, including:

-

Transferring property between family members.

-

Clearing up title issues.

-

Transferring property into or out of a trust.

-

Divorces or separations where property is divided.

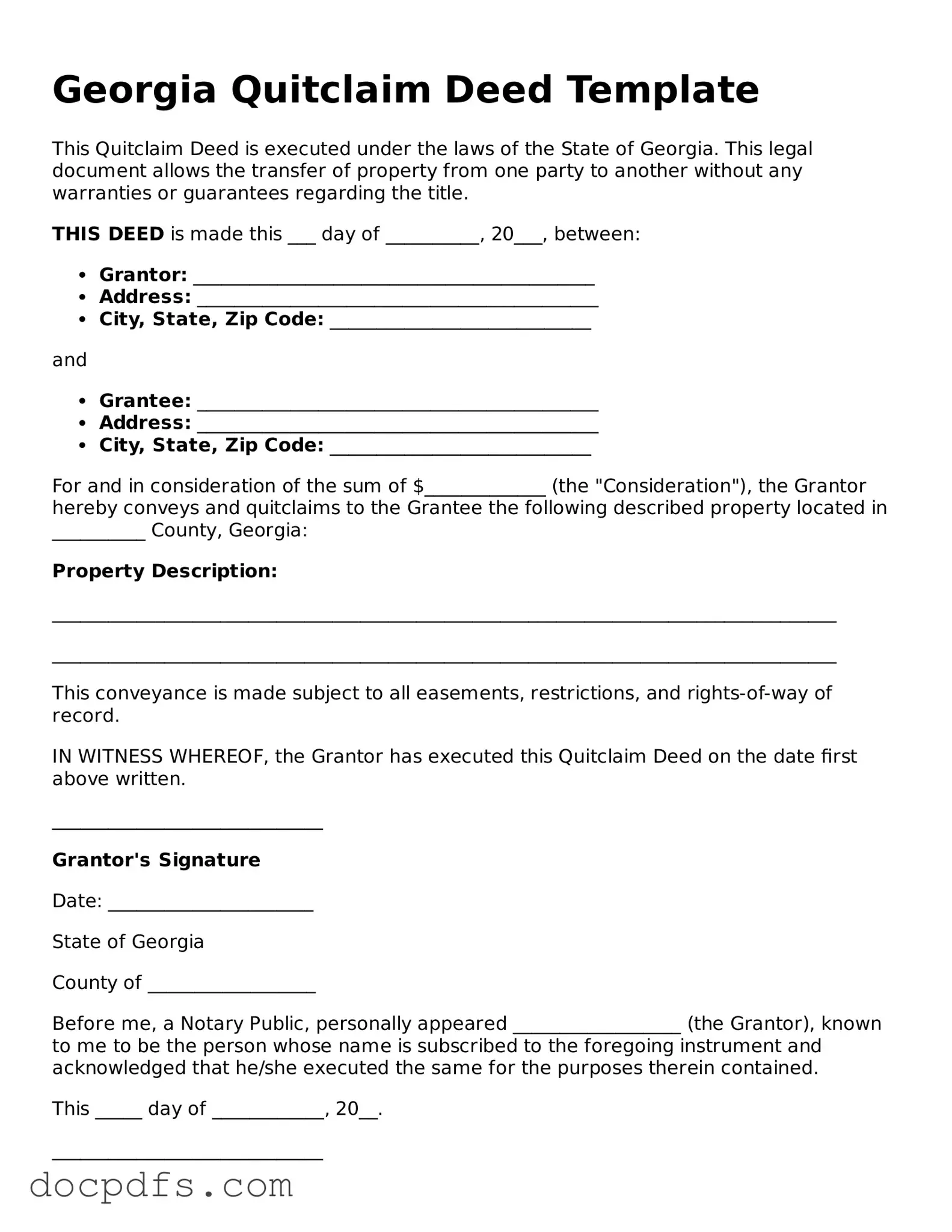

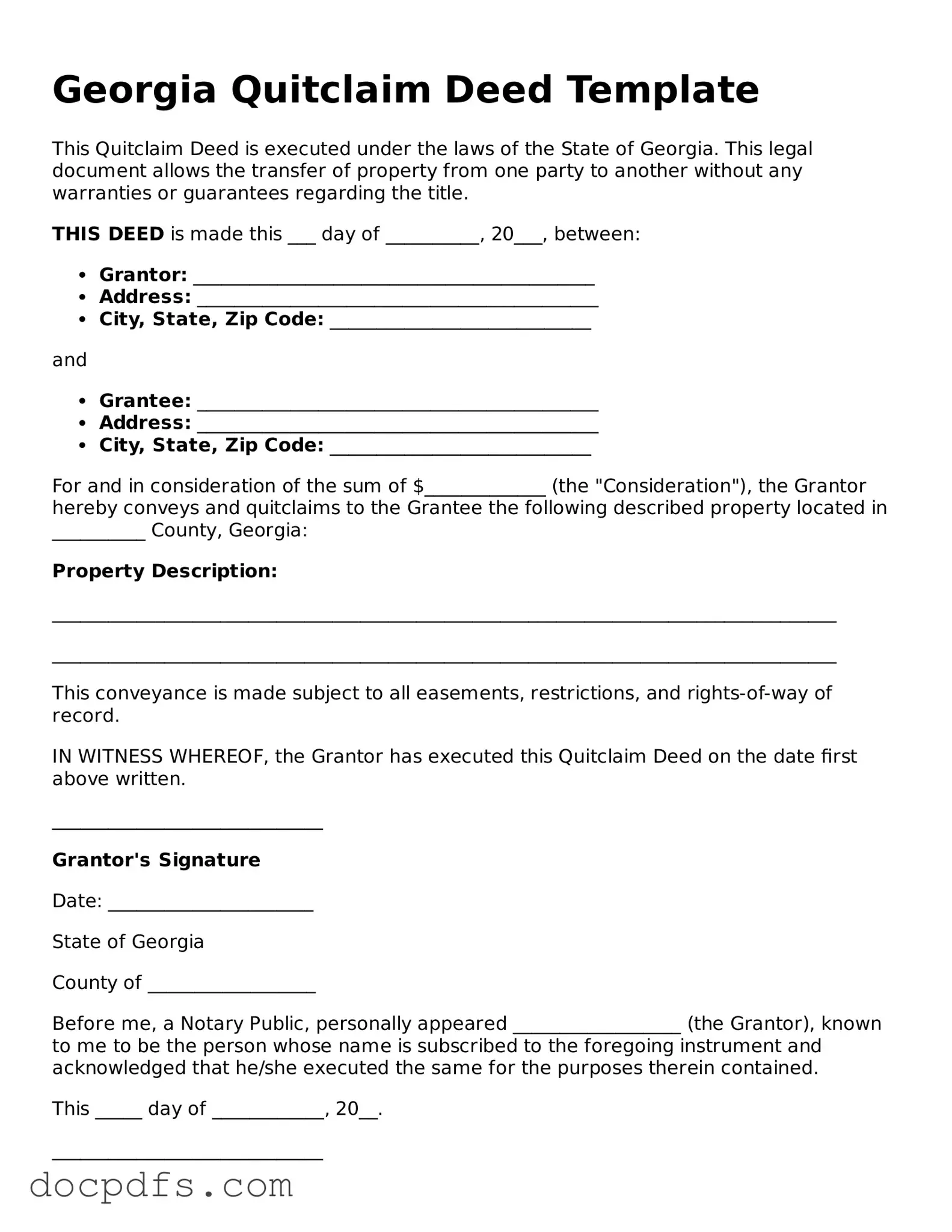

The Quitclaim Deed must include the following information:

-

The names and addresses of the grantor (the person transferring the property) and the grantee (the person receiving the property).

-

A legal description of the property being transferred.

-

The date of the transfer.

-

The signature of the grantor, which must be notarized.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides guarantees about the title and protects the grantee against any claims. In contrast, a Quitclaim Deed offers no such protections, as it simply transfers whatever interest the grantor has.

Do I need to have the Quitclaim Deed notarized?

Yes, the Quitclaim Deed must be signed in the presence of a notary public. This notarization helps verify the identity of the grantor and ensures that the deed is legally binding.

How do I record a Quitclaim Deed in Georgia?

To record a Quitclaim Deed in Georgia, follow these steps:

-

Complete the Quitclaim Deed form with all required information.

-

Have the grantor sign the document in front of a notary public.

-

Submit the notarized deed to the county clerk's office in the county where the property is located.

-

Pay any applicable recording fees.

Are there any taxes associated with a Quitclaim Deed?

Yes, there may be transfer taxes associated with the Quitclaim Deed. In Georgia, the transfer tax is typically based on the value of the property being transferred. It's important to check with the local county tax office for specific rates and requirements.

Can I revoke a Quitclaim Deed after it is recorded?

Once a Quitclaim Deed is recorded, it cannot be revoked unilaterally. However, the grantor can create a new deed to transfer the property back, or the parties can agree to reverse the transaction through another legal process.

What happens if the grantor has no ownership interest in the property?

If the grantor has no ownership interest in the property, the Quitclaim Deed will not transfer any rights to the grantee. The grantee receives no legal claim to the property, and the deed may not be useful in resolving any title issues.

Quitclaim Deed forms for Georgia can be found online through legal document preparation services, county clerk's offices, or legal stationery stores. Ensure that the form you use complies with Georgia state laws.