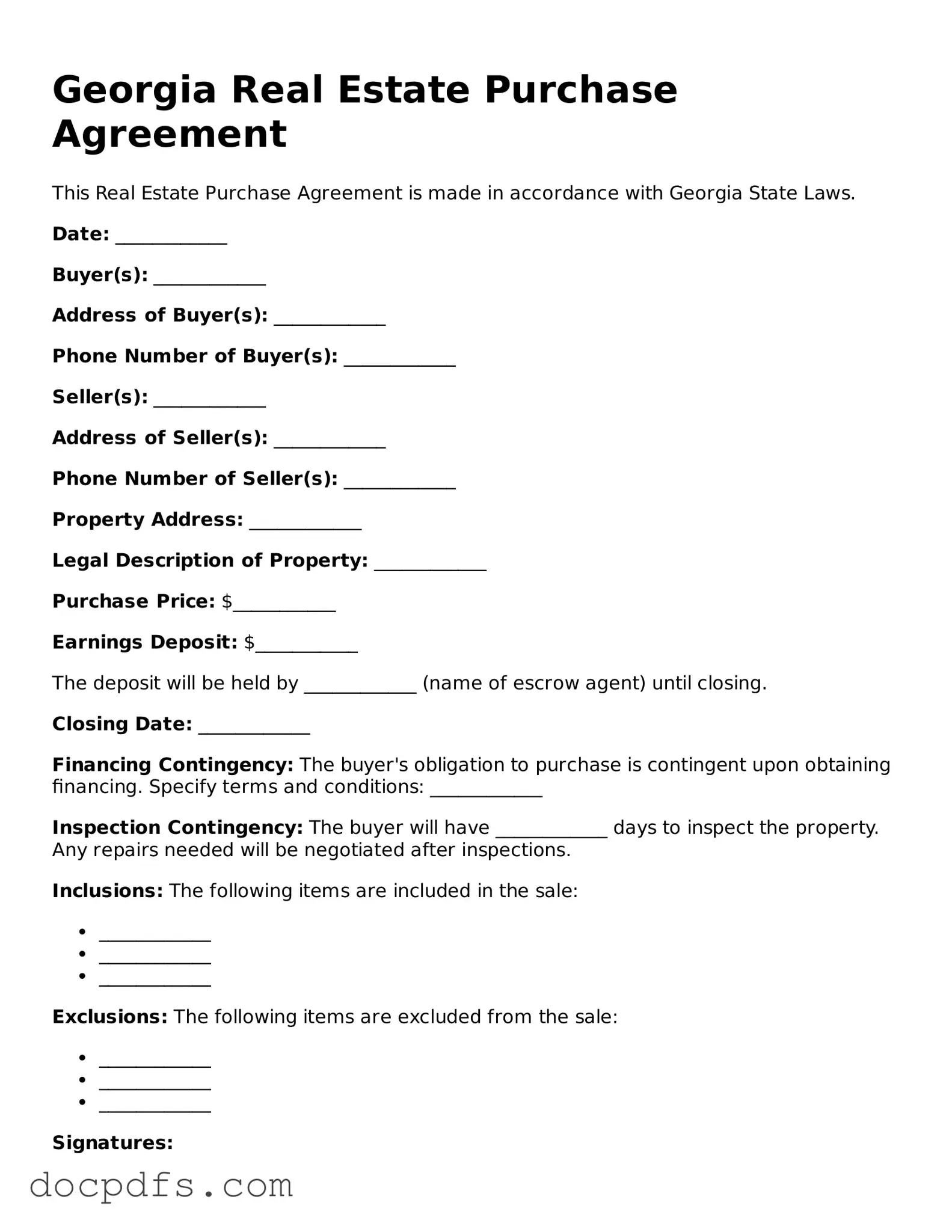

What is a Georgia Real Estate Purchase Agreement?

The Georgia Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of a real estate transaction between a buyer and a seller. It serves as a binding contract that details the property being sold, the purchase price, and the responsibilities of both parties throughout the transaction process.

What key components are included in the agreement?

The agreement typically includes the following components:

-

Property Description: A detailed description of the property being sold.

-

Purchase Price: The agreed-upon price for the property.

-

Earnest Money: A deposit made by the buyer to show commitment.

-

Closing Date: The date when the sale will be finalized.

-

Contingencies: Conditions that must be met for the sale to proceed, such as financing or inspections.

-

Disclosures: Any known issues with the property that the seller must disclose.

Who needs to sign the agreement?

Both the buyer and the seller must sign the agreement for it to be valid. If there are multiple buyers or sellers, all parties involved in the transaction should provide their signatures. Additionally, any agents representing the parties may also sign the document to acknowledge their role in the transaction.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and avoid disputes.

What happens if one party does not fulfill their obligations?

If one party fails to meet their obligations as outlined in the agreement, the other party may have legal recourse. This could include seeking damages or specific performance, which means asking the court to enforce the terms of the contract. It's advisable to consult with a legal professional to understand the options available.

Is the Georgia Real Estate Purchase Agreement standardized?

The agreement is often standardized, but it can be customized to fit the specific needs of the transaction. Real estate agents and attorneys may use templates that comply with Georgia law, but they can also modify terms to suit individual circumstances.

How does earnest money work in this agreement?

Earnest money is a deposit made by the buyer to demonstrate their serious intent to purchase the property. This amount is typically held in escrow until closing. If the transaction proceeds, the earnest money is applied to the purchase price. If the buyer backs out without a valid reason as defined in the agreement, the seller may keep the earnest money as compensation.

A Georgia Real Estate Purchase Agreement form can be obtained through various sources, including real estate agents, attorneys, or online legal document services. It is important to ensure that the form used complies with Georgia state laws and regulations.