What is a Transfer-on-Death Deed in Georgia?

A Transfer-on-Death Deed (TOD) is a legal document that allows an individual to transfer real estate to a designated beneficiary upon the individual's death. This deed enables property owners to bypass the probate process, simplifying the transfer of property to heirs. It is important to note that the transfer occurs only after the owner's death, and the owner retains full control of the property during their lifetime.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Georgia can utilize a Transfer-on-Death Deed. This includes homeowners, landowners, and anyone with an interest in real property. However, it is essential to ensure that the property is not subject to any restrictions or liens that might complicate the transfer process.

How do I create a Transfer-on-Death Deed?

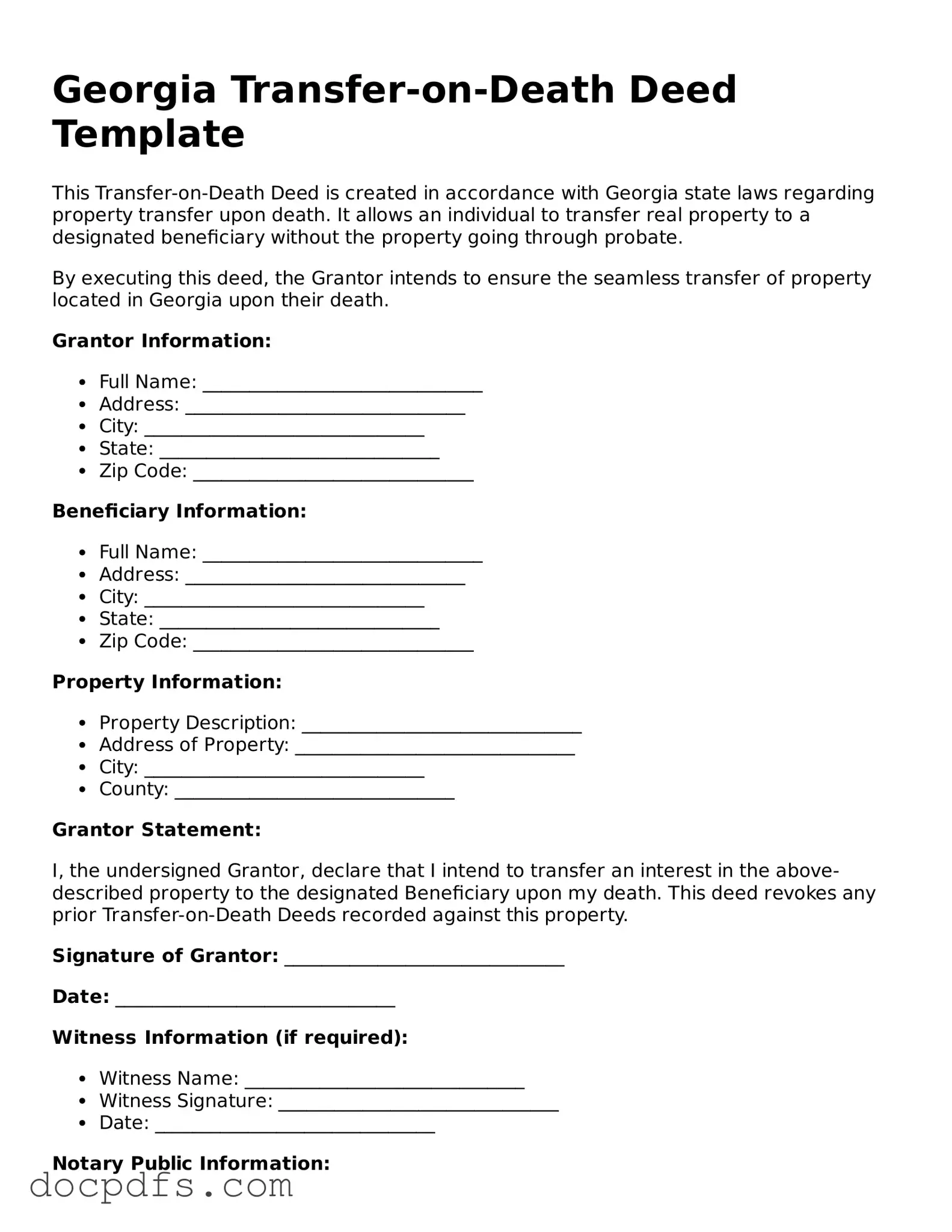

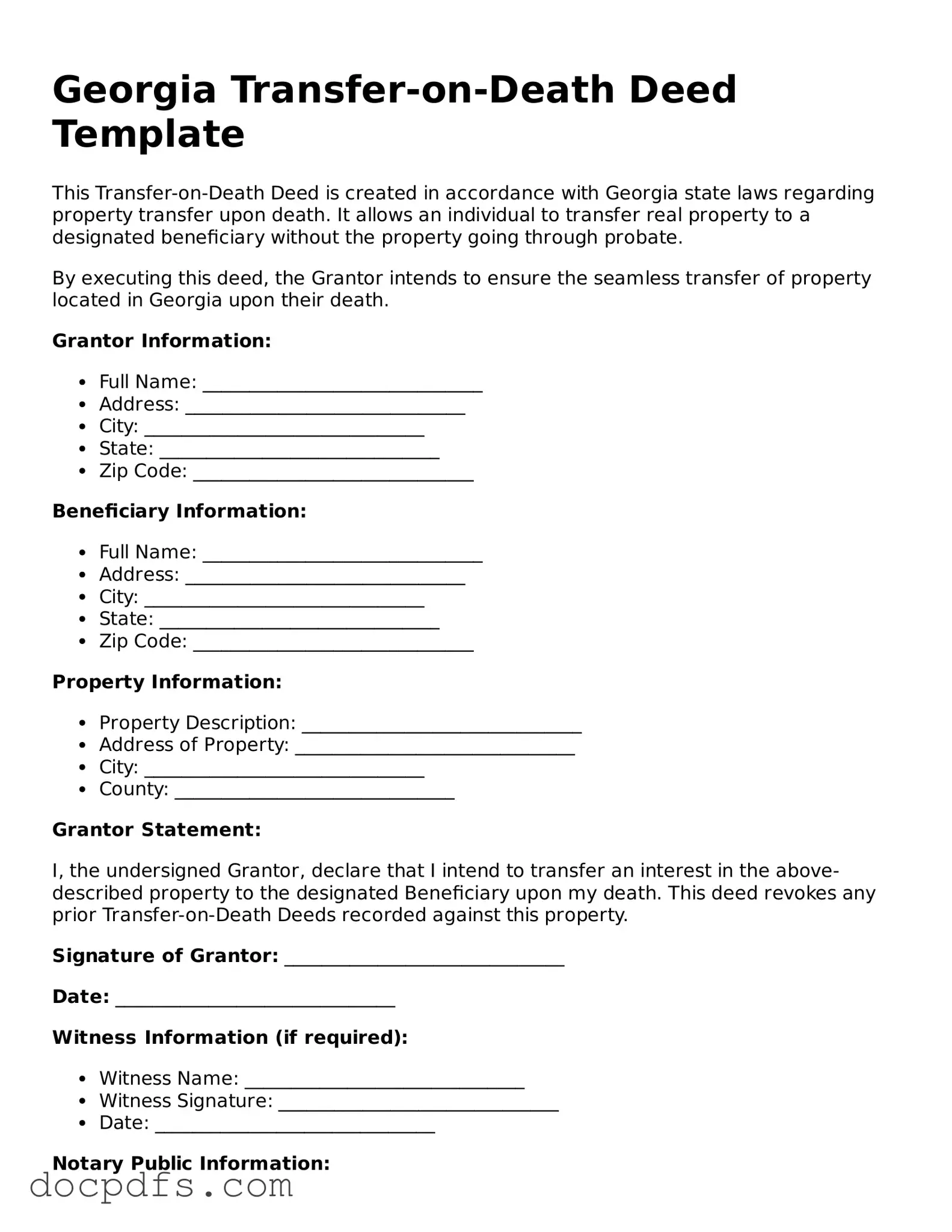

To create a Transfer-on-Death Deed in Georgia, follow these steps:

-

Obtain the appropriate form, which can often be found online or through legal resources.

-

Fill out the form, providing necessary details such as the property description and the beneficiary's information.

-

Sign the deed in the presence of a notary public.

-

Record the deed with the county clerk's office where the property is located.

Recording the deed is crucial, as it makes the transfer official and enforceable.

Can I change the beneficiary after creating a Transfer-on-Death Deed?

Yes, you can change the beneficiary at any time before your death. To do this, you must create a new Transfer-on-Death Deed that revokes the previous one. Be sure to record the new deed with the county clerk to ensure that your wishes are reflected in public records.

What happens if the beneficiary dies before the property owner?

If the designated beneficiary passes away before the property owner, the Transfer-on-Death Deed becomes void for that beneficiary. The property will not transfer to the deceased beneficiary's heirs unless a new beneficiary is named in a revised deed. It is wise to consider naming alternate beneficiaries to avoid complications.

Is a Transfer-on-Death Deed revocable?

Yes, a Transfer-on-Death Deed is revocable. The property owner can revoke the deed at any time during their lifetime. This can be done by creating a new deed that explicitly states the revocation or by executing a formal revocation document. Always ensure that any changes are recorded to maintain clarity regarding the property's ownership.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when creating a Transfer-on-Death Deed. The property is not considered a gift until the transfer occurs at death. However, beneficiaries may be subject to estate taxes depending on the overall value of the estate. It is advisable to consult with a tax professional to understand potential tax obligations.

Can a Transfer-on-Death Deed be contested?

Yes, a Transfer-on-Death Deed can be contested, much like any other legal document. Disputes may arise if there are claims of undue influence, lack of capacity, or if the deed was not executed properly. If a contest occurs, it may lead to a legal battle, which can complicate the intended transfer of property.

Is legal assistance recommended when creating a Transfer-on-Death Deed?

While it is possible to create a Transfer-on-Death Deed without legal assistance, consulting with an attorney is highly recommended. An experienced lawyer can ensure that the deed complies with Georgia law and that your intentions are clearly articulated. This can prevent future disputes and ensure a smoother transfer process.

The Transfer-on-Death Deed form can typically be found on the official website of the Georgia Secretary of State or through local county clerk offices. Additionally, legal aid organizations and online legal resources may provide templates or guidance for creating the deed.