What is a Gift Deed?

A Gift Deed is a legal document that allows a person (the donor) to transfer ownership of property or assets to another person (the recipient) without any exchange of money or consideration. This transfer is typically made voluntarily and without any conditions attached, making it a straightforward way to give property to someone else.

What types of property can be transferred using a Gift Deed?

Various types of property can be transferred through a Gift Deed, including:

-

Real estate, such as land or a house

-

Personal property, like vehicles, jewelry, or artwork

-

Financial assets, including stocks or bonds

It is essential that the property is clearly identified in the deed to avoid any confusion regarding what is being gifted.

Are there any tax implications associated with a Gift Deed?

Yes, there can be tax implications when executing a Gift Deed. The donor may be subject to gift taxes if the value of the property exceeds a certain threshold set by the IRS. As of 2023, the annual exclusion amount is $17,000 per recipient. Gifts above this amount may require the filing of a gift tax return. Recipients may also need to consider potential capital gains taxes if they decide to sell the property in the future.

Do I need to register a Gift Deed?

In most cases, it is advisable to register a Gift Deed with the appropriate government authority, especially for real estate transactions. Registration provides legal proof of the transfer and helps protect the recipient's ownership rights. The process may vary by state, so it is essential to check local laws regarding registration requirements.

Can a Gift Deed be revoked?

A Gift Deed is generally considered irrevocable once executed and delivered. However, there are some exceptions. If the deed includes conditions that have not been met or if there is evidence of fraud or undue influence, it may be possible to challenge the deed in court. It is crucial to understand the implications of gifting property before proceeding.

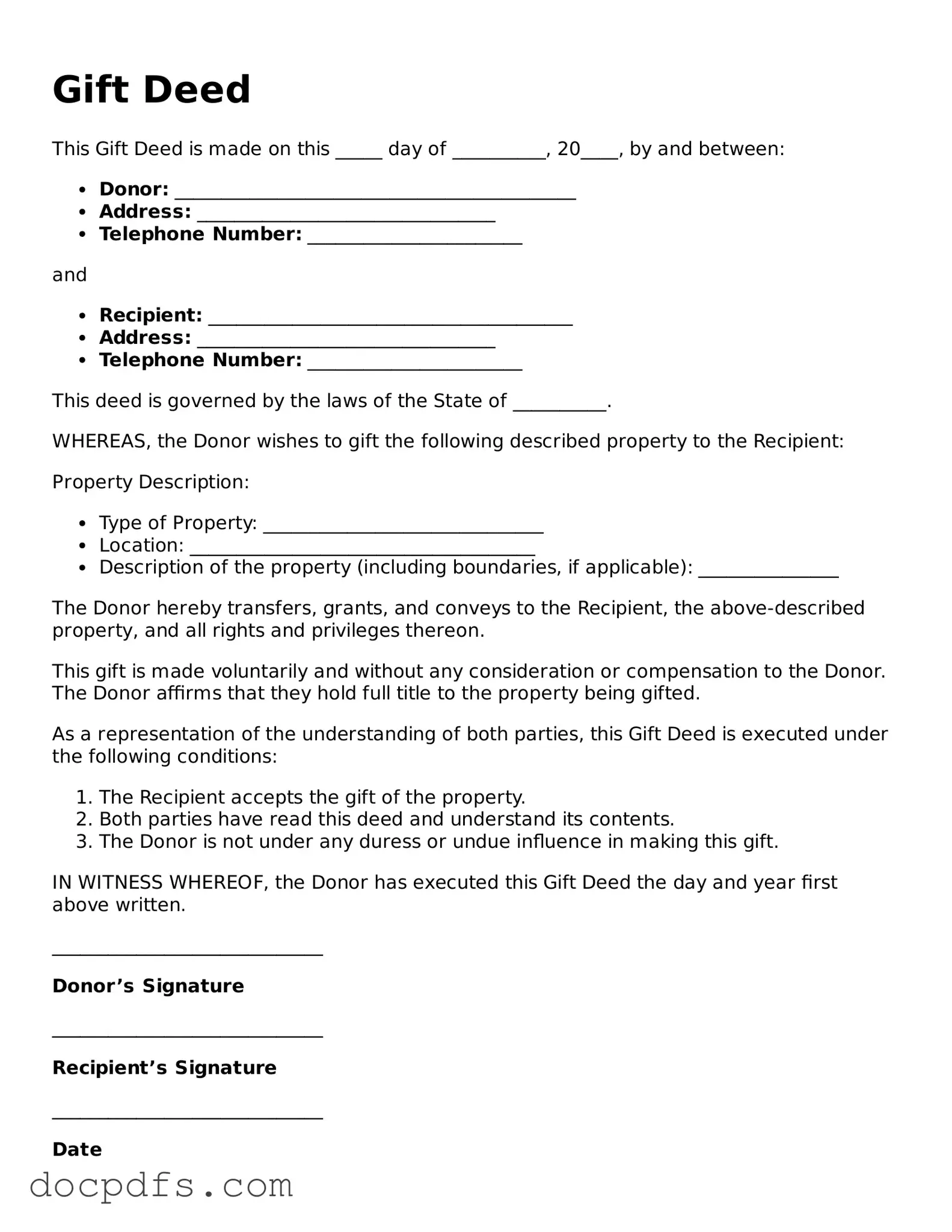

What should be included in a Gift Deed?

A well-drafted Gift Deed should include the following elements:

-

The names and addresses of both the donor and the recipient

-

A clear description of the property being gifted

-

The date of the gift

-

A statement indicating that the gift is made voluntarily and without any consideration

-

Signatures of the donor and, if required, witnesses

Including these elements ensures clarity and can help prevent disputes in the future.