What is a Gift Letter?

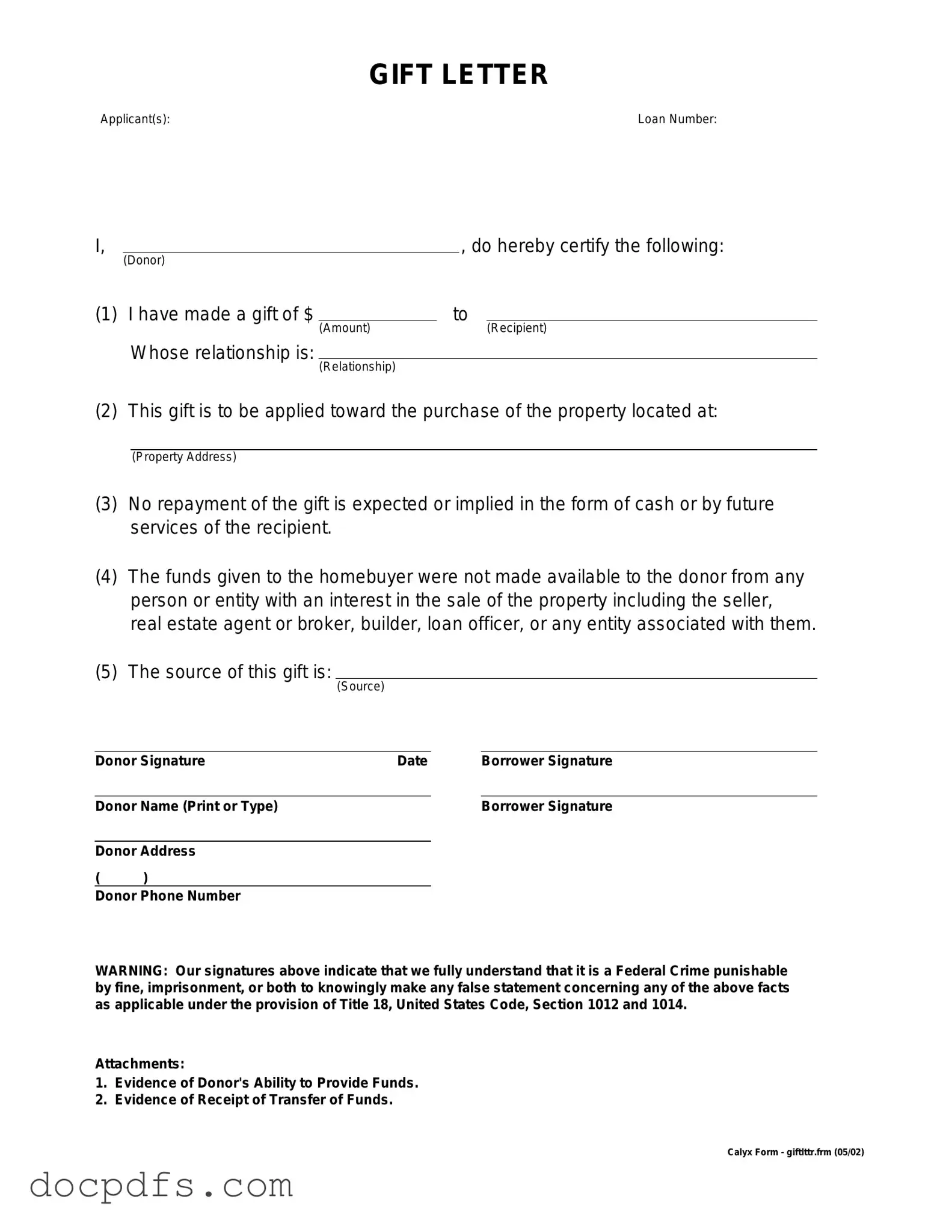

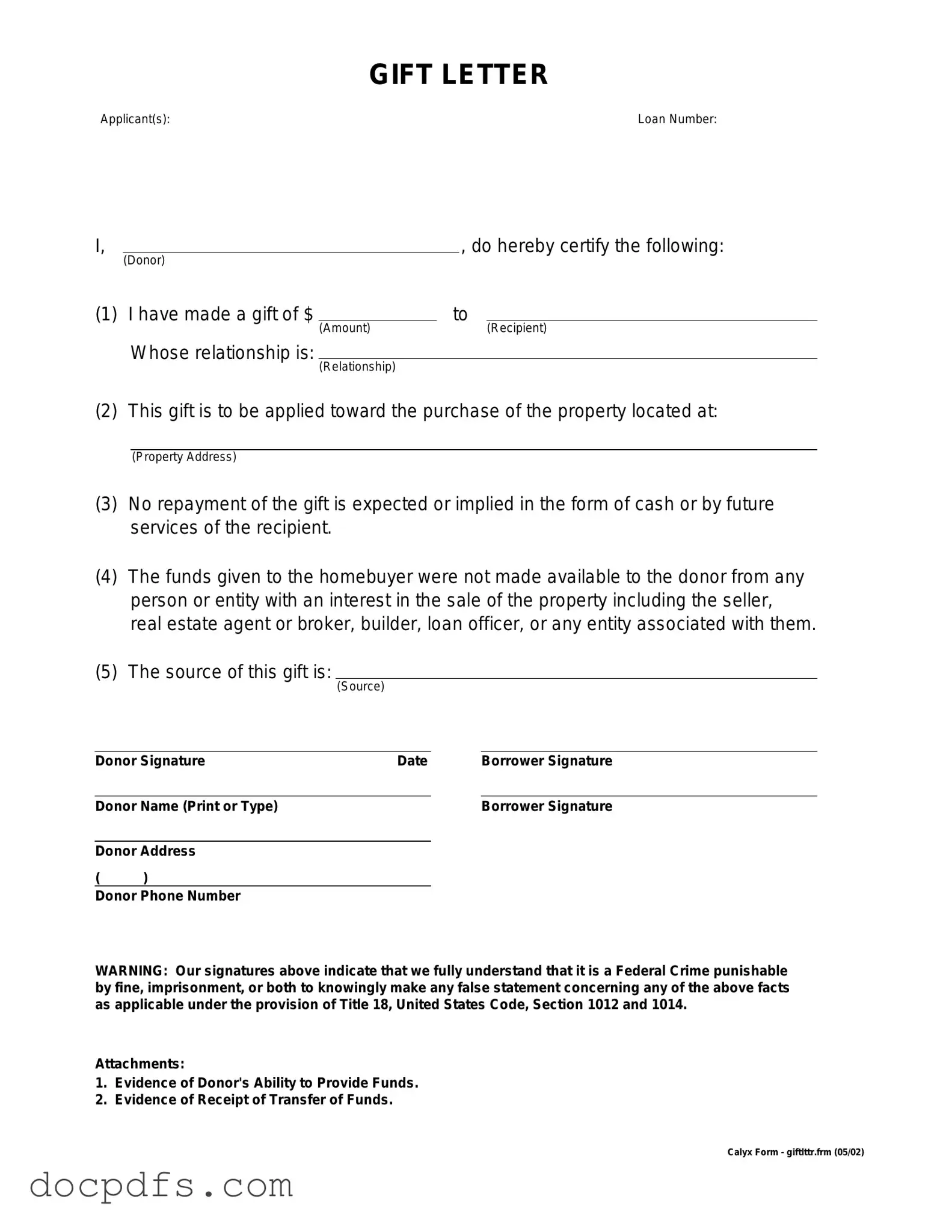

A Gift Letter is a document that confirms a financial gift given to a borrower, typically for the purpose of purchasing a home. It outlines the details of the gift, including the amount, the relationship between the giver and the recipient, and a statement that the funds do not need to be repaid. This letter is often required by lenders to ensure that the borrower has sufficient funds for a down payment without incurring additional debt.

Who can provide a Gift Letter?

Generally, anyone can provide a Gift Letter, but it is most commonly given by close family members such as parents, siblings, or grandparents. Some lenders may also accept gifts from friends or other relatives, but it’s essential to check with the specific lender for their requirements.

A well-prepared Gift Letter should include the following information:

-

The donor's name, address, and contact information

-

The recipient's name and relationship to the donor

-

The amount of the gift

-

A statement confirming that the gift is not a loan and does not need to be repaid

-

The date the gift was given

-

The donor's signature

Do I need to provide proof of the gift?

Yes, lenders often require proof of the gift in addition to the Gift Letter. This proof can include bank statements showing the transfer of funds from the donor to the recipient. It's a good idea to keep records of the transaction to ensure transparency and compliance with the lender's requirements.

Can a Gift Letter affect my mortgage application?

Yes, a Gift Letter can positively impact your mortgage application. It demonstrates to the lender that you have additional financial support for your down payment. However, if the letter is not properly completed or if the lender has concerns about the source of the funds, it could delay or complicate the approval process.

Is there a limit to how much I can receive as a gift?

While there is no specific limit to how much you can receive as a gift, lenders may have their own guidelines regarding acceptable gift amounts. Additionally, the IRS allows individuals to gift up to a certain amount each year without incurring gift tax. As of 2023, this amount is $17,000 per recipient. It’s important to consult with a financial advisor or tax professional for personalized advice.