What is an Independent Contractor Pay Stub?

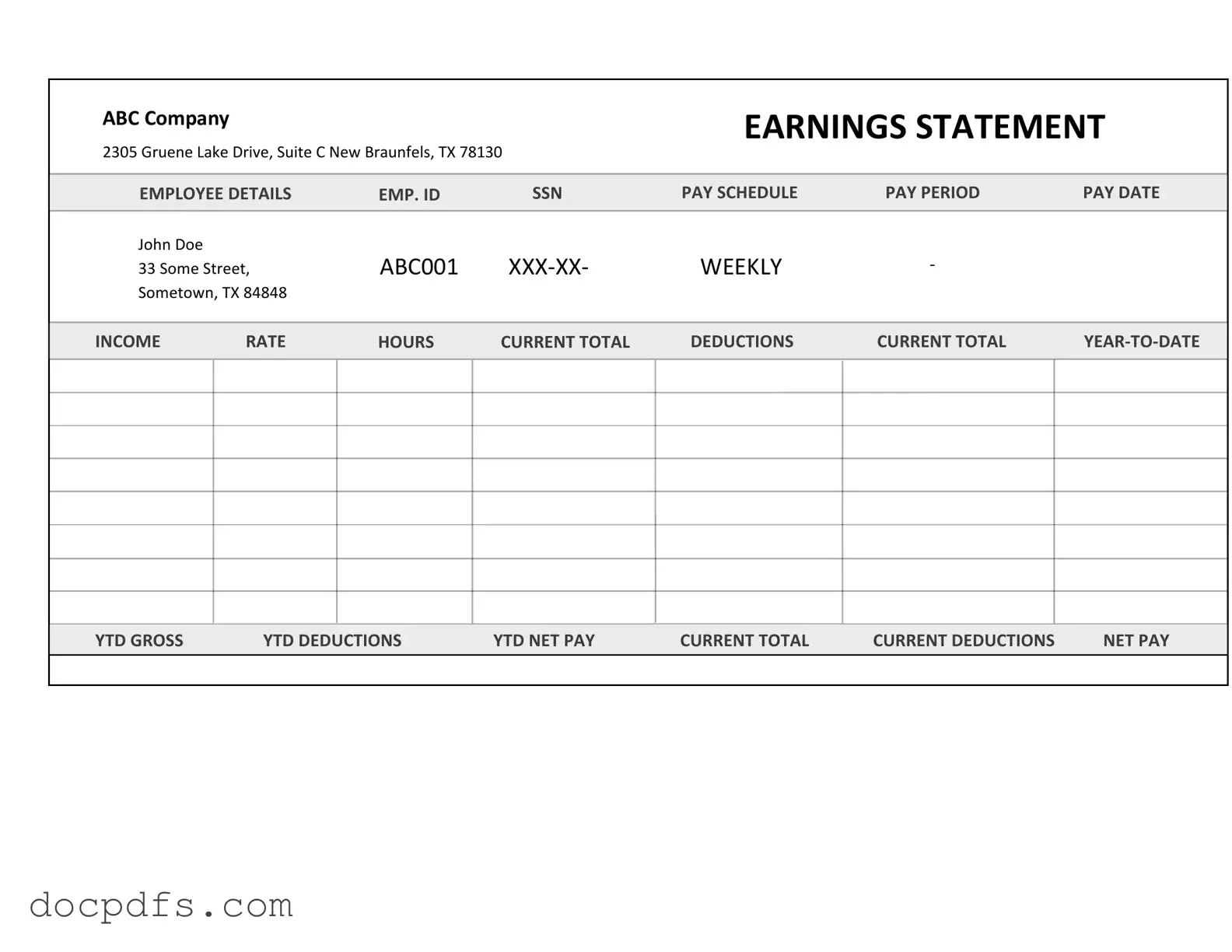

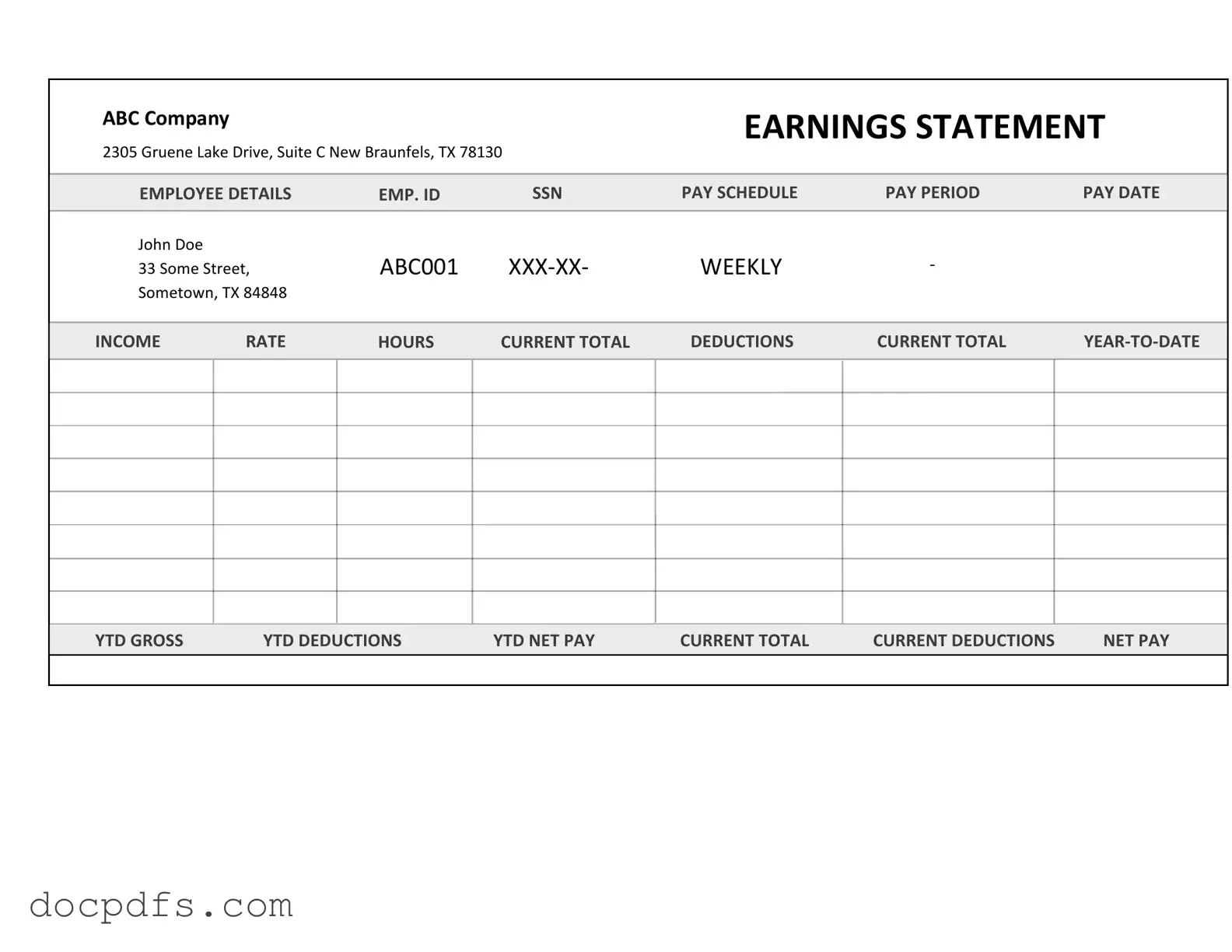

An Independent Contractor Pay Stub is a document that provides a detailed breakdown of payments made to an independent contractor for their services. It typically includes information such as the contractor’s name, payment amount, date of service, and any deductions that may apply. This form serves as a record for both the contractor and the hiring entity.

Why do I need a Pay Stub as an Independent Contractor?

Having a pay stub is important for several reasons:

-

It provides proof of income, which can be useful when applying for loans or mortgages.

-

It helps you keep track of your earnings and any deductions for tax purposes.

-

It can serve as a record in case of disputes regarding payment or services rendered.

The Pay Stub generally includes the following details:

-

Contractor's name and contact information

-

Pay period dates

-

Total amount earned

-

Any deductions (taxes, fees, etc.)

-

Net payment amount

How do I create a Pay Stub?

Creating a Pay Stub can be straightforward. You can use templates available online or software designed for this purpose. Make sure to fill in all necessary details accurately. If you are unsure, consulting with a financial professional can help ensure everything is correct.

Do I need to provide a Pay Stub to my clients?

While it’s not legally required to provide a Pay Stub to clients, it is a good practice. It promotes transparency and professionalism in your business dealings. Additionally, clients may appreciate having a detailed record of the payment for their own accounting purposes.

How often should I issue Pay Stubs?

The frequency of issuing Pay Stubs can vary based on your agreement with clients. Some contractors provide them after each project, while others may do so on a monthly basis. Establishing a clear schedule with your clients can help manage expectations.

What if I find an error on my Pay Stub?

If you notice an error on your Pay Stub, address it promptly. Contact the client or the entity that issued the Pay Stub to discuss the discrepancy. It’s important to resolve these issues quickly to ensure accurate records for tax purposes.

Are Pay Stubs required for tax purposes?

While Pay Stubs are not required to file taxes, they can be very helpful. They provide a clear record of your income and any deductions, making it easier to report your earnings accurately. It’s advisable to keep all Pay Stubs organized for your records.

Can I use a Pay Stub for proof of income?

Yes, a Pay Stub can be used as proof of income. Many lenders and financial institutions accept them as valid documentation when assessing your financial situation. Make sure the Pay Stub is detailed and accurately reflects your earnings.