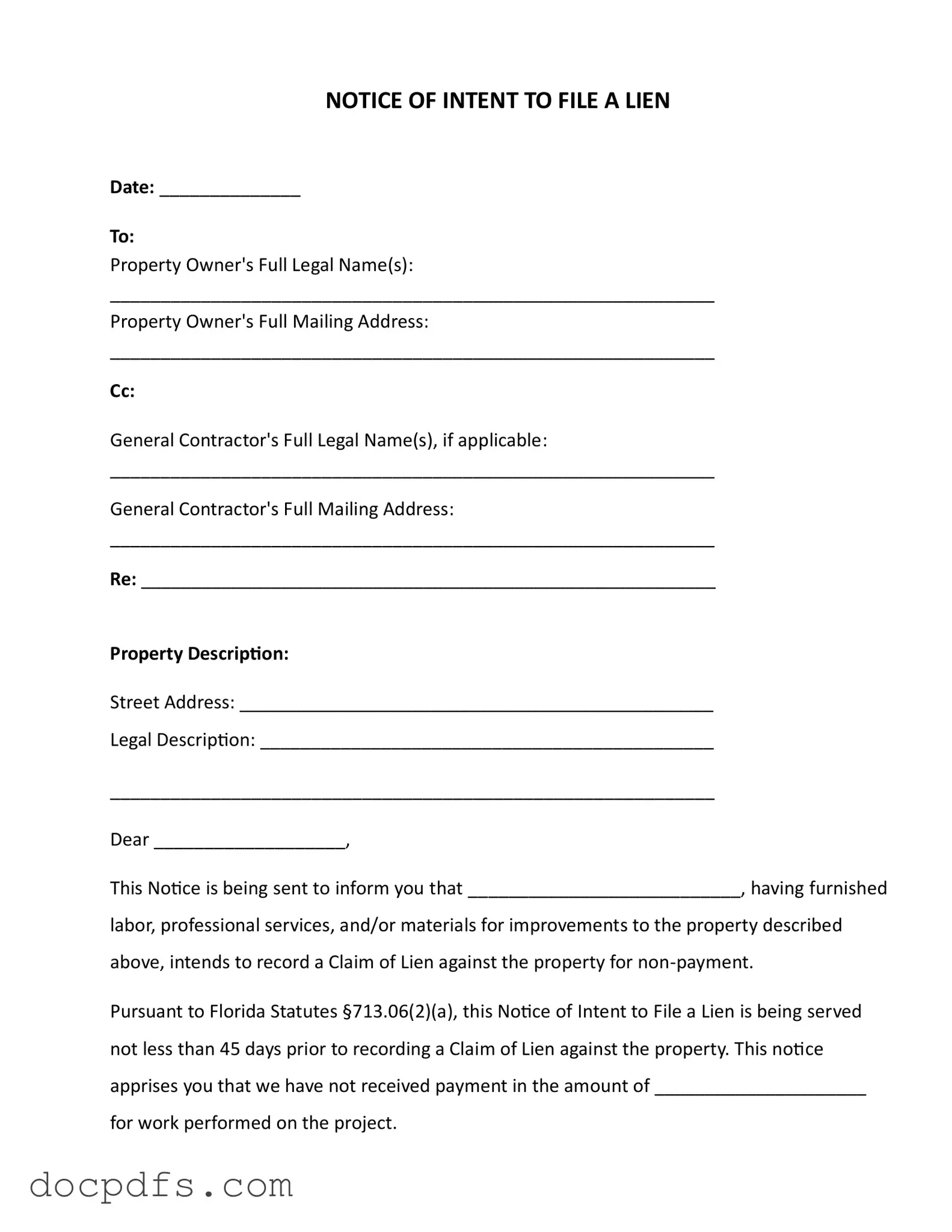

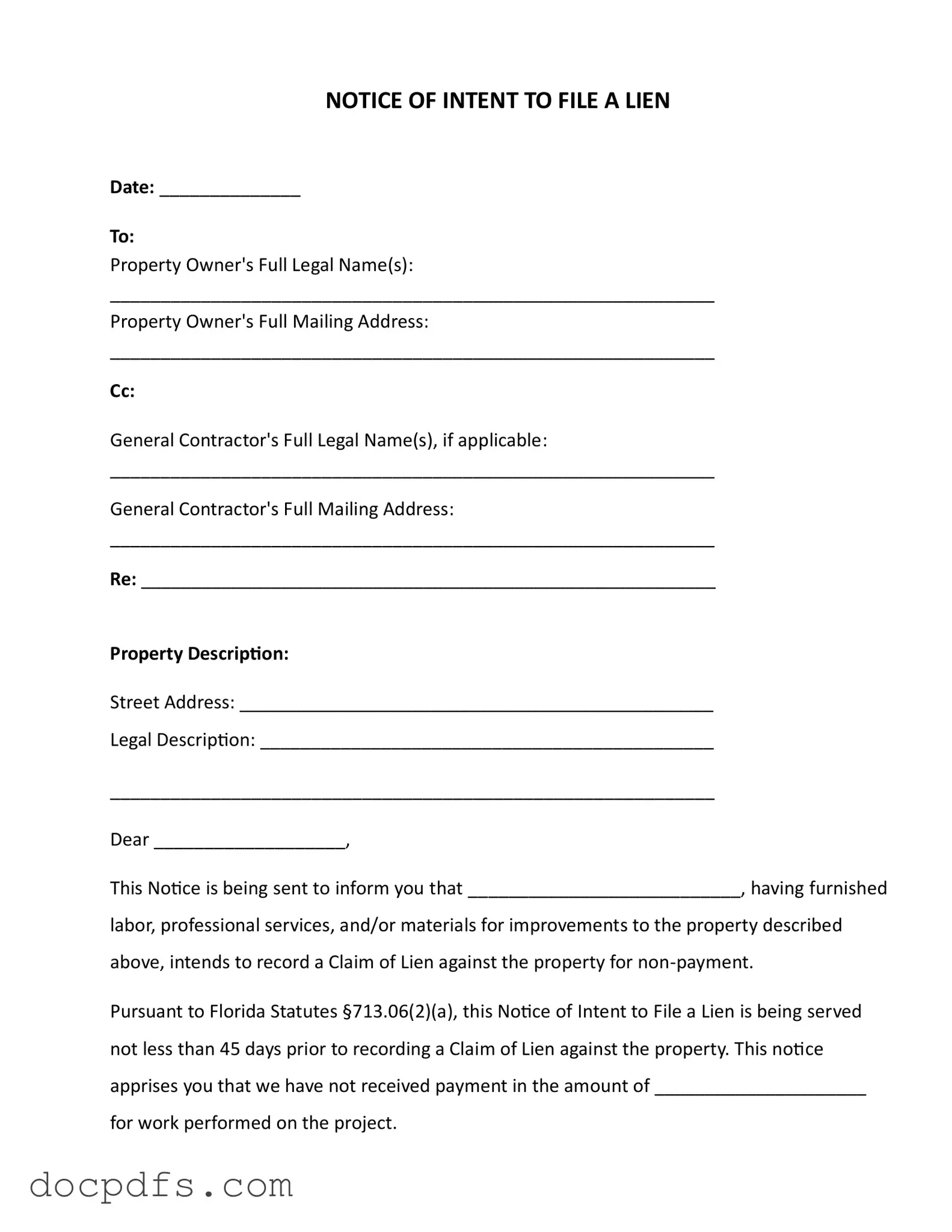

Intent To Lien Florida Template in PDF

The Intent to Lien Florida form serves as a formal notice indicating a party's intention to file a lien against a property due to non-payment for services or materials provided. This document is crucial for property owners to understand, as it outlines the potential consequences of failing to address outstanding payments. By adhering to the guidelines set forth in Florida law, this form helps protect the rights of those who have contributed to property improvements.

Open Intent To Lien Florida Editor Now

Intent To Lien Florida Template in PDF

Open Intent To Lien Florida Editor Now

Open Intent To Lien Florida Editor Now

or

⇓ Intent To Lien Florida

Finish this form the fast way

Complete Intent To Lien Florida online with a smooth editing experience.