What is an Investment Letter of Intent?

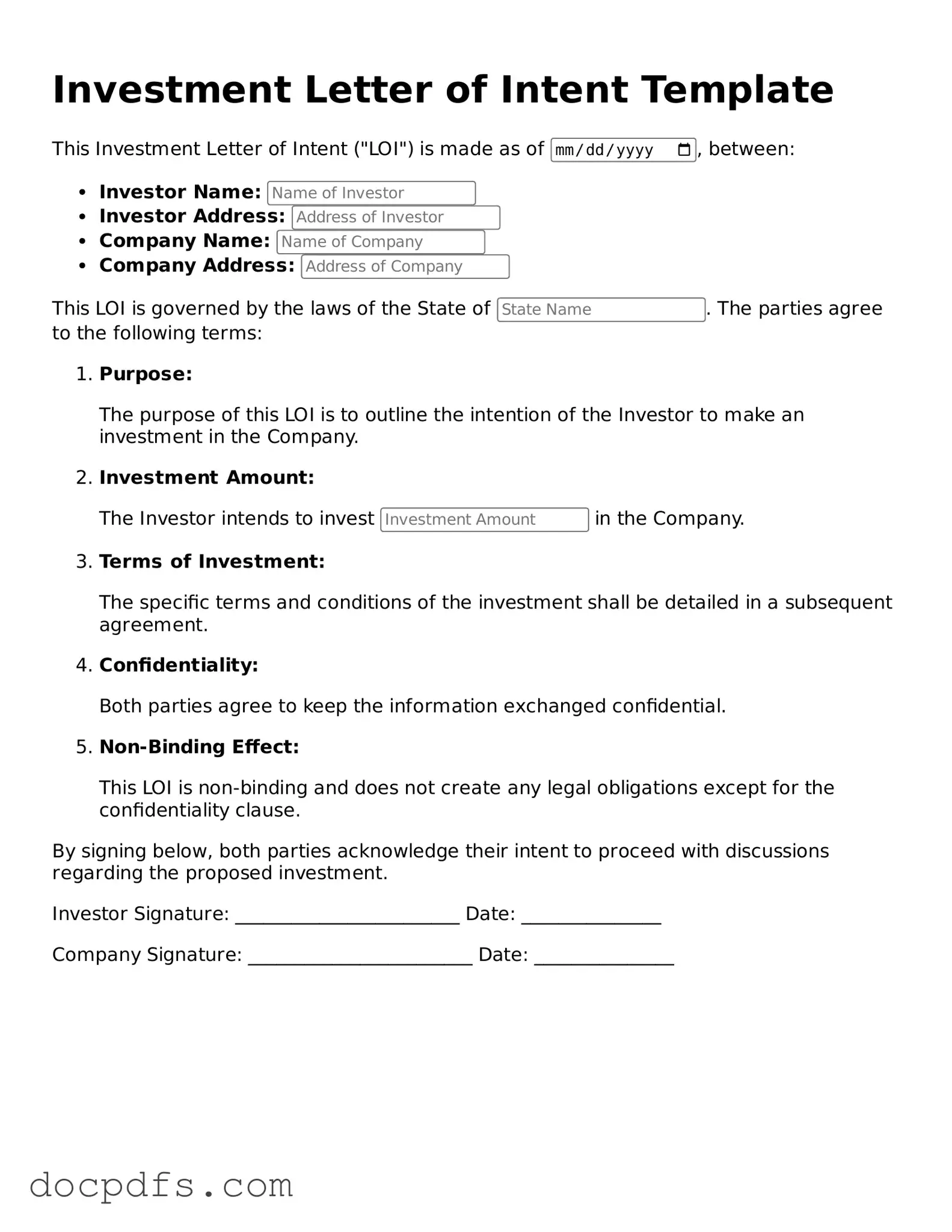

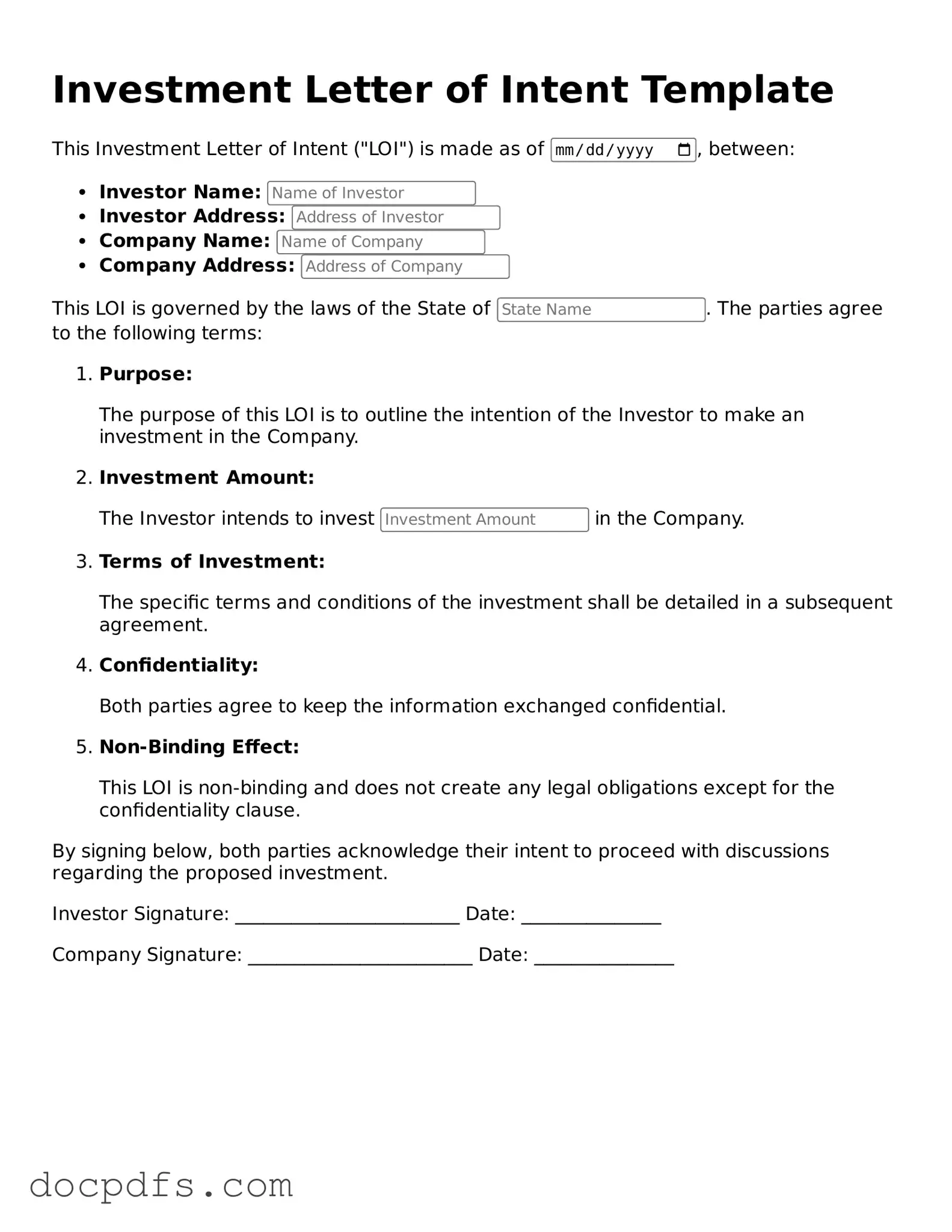

An Investment Letter of Intent (LOI) is a document that outlines the preliminary understanding between two parties who intend to enter into a formal investment agreement. It serves as a non-binding agreement that expresses the interest of one party to invest in a business or project, while also detailing the key terms and conditions that will be negotiated in the future.

Why is an Investment Letter of Intent important?

The LOI is important because it sets the groundwork for the investment process. It helps both parties clarify their intentions and expectations before committing to a formal agreement. Additionally, it can:

-

Establish a timeline for negotiations.

-

Outline the main terms of the investment.

-

Identify any conditions that must be met before the investment is finalized.

Is the Investment Letter of Intent legally binding?

Typically, an Investment Letter of Intent is not legally binding, except for certain provisions that may be included, such as confidentiality or exclusivity clauses. The primary purpose of the LOI is to express mutual interest and outline the key terms for further negotiation. However, it’s essential to review the document carefully, as some sections may carry legal obligations.

What should be included in an Investment Letter of Intent?

A well-crafted Investment Letter of Intent should include several key components, such as:

-

Parties Involved:

Clearly identify the investors and the business or project.

-

Investment Amount:

Specify the proposed amount of investment.

-

Terms of Investment:

Outline the terms, including equity stakes or other compensation.

-

Timeline:

Provide a timeline for negotiations and closing the deal.

-

Conditions:

List any conditions that must be met before the investment is finalized.

-

Confidentiality:

Include any confidentiality agreements to protect sensitive information.

The Investment Letter of Intent is a preliminary document that outlines the intent to invest, while a formal investment agreement is a legally binding contract that details the final terms of the investment. The LOI is typically less detailed and serves as a starting point for negotiations, whereas the formal agreement will include comprehensive terms, conditions, and legal obligations.

Can an Investment Letter of Intent be amended?

Yes, an Investment Letter of Intent can be amended if both parties agree to the changes. As negotiations progress, it is common for the terms outlined in the LOI to evolve. Any amendments should be documented in writing and signed by both parties to ensure clarity and mutual understanding.

What happens after signing the Investment Letter of Intent?

Once the Investment Letter of Intent is signed, both parties will typically move forward with due diligence and negotiations. This phase may involve:

-

Reviewing financial statements and business plans.

-

Conducting background checks.

-

Finalizing the terms of the investment agreement.

At the end of this process, a formal investment agreement will be drafted and signed, solidifying the investment terms.