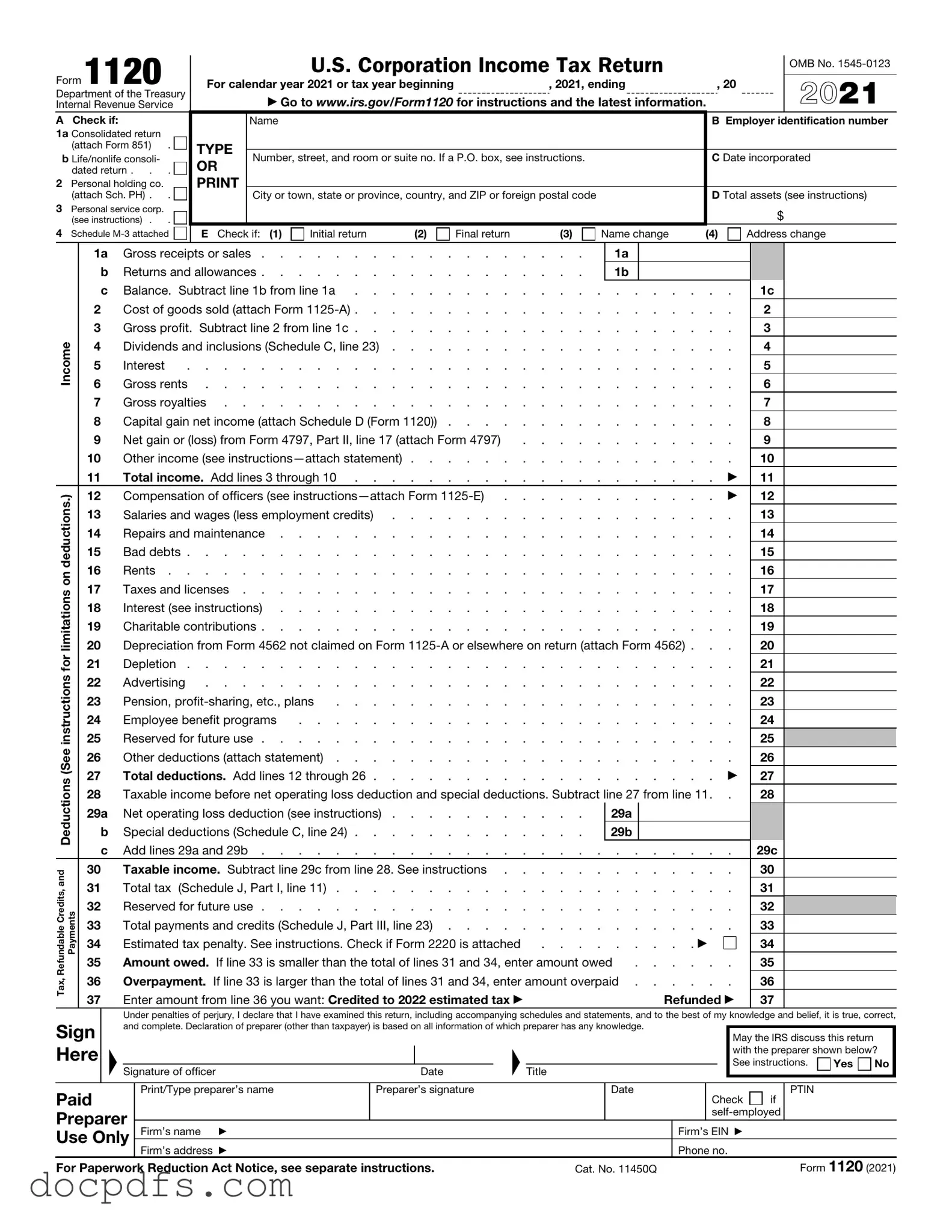

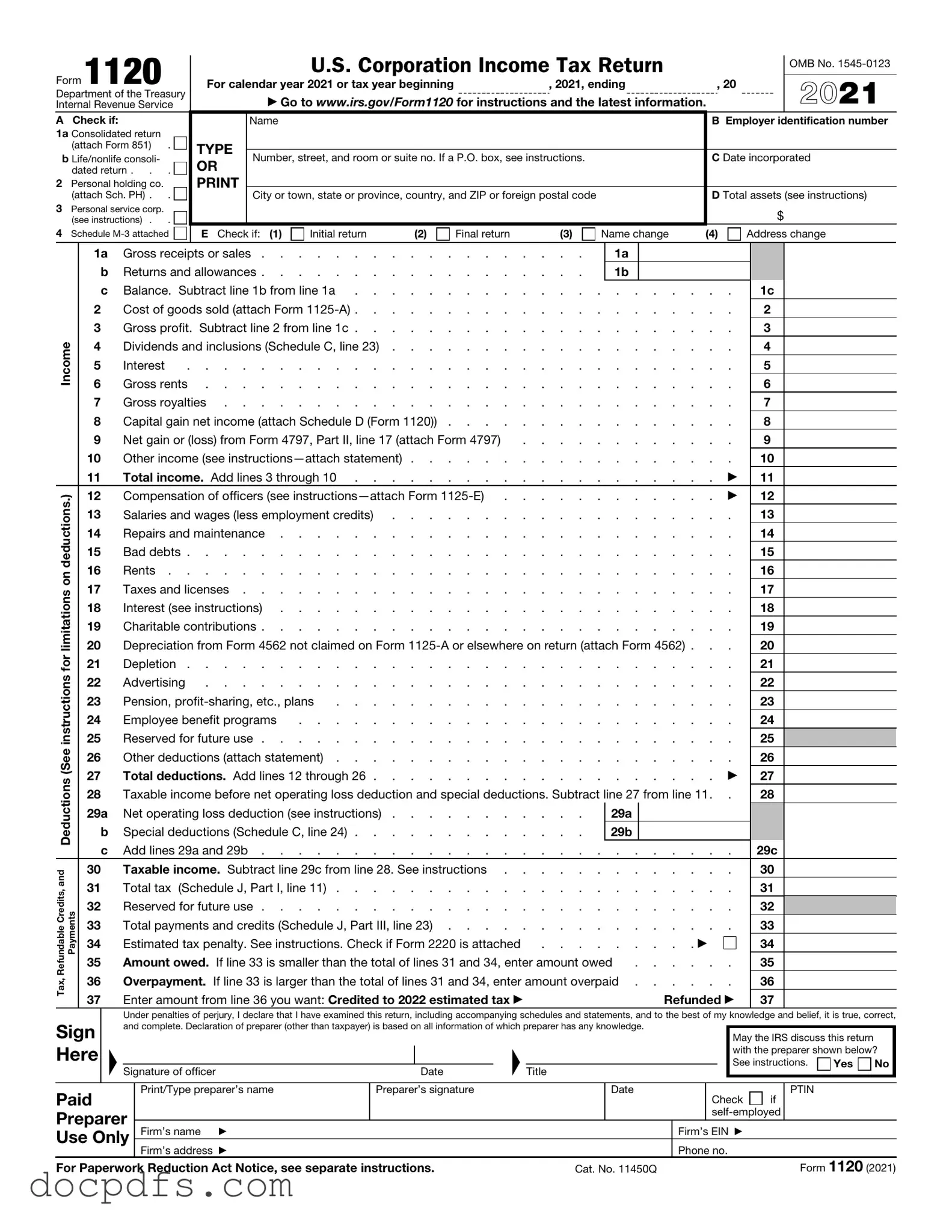

IRS 1120 Template in PDF

The IRS 1120 form is a tax return form used by corporations to report their income, gains, losses, deductions, and credits to the Internal Revenue Service. This form is essential for C corporations, as it determines their tax liability for the year. Understanding the requirements and details of the 1120 form is crucial for compliance and effective financial planning.

Open IRS 1120 Editor Now

IRS 1120 Template in PDF

Open IRS 1120 Editor Now

Open IRS 1120 Editor Now

or

⇓ IRS 1120

Finish this form the fast way

Complete IRS 1120 online with a smooth editing experience.