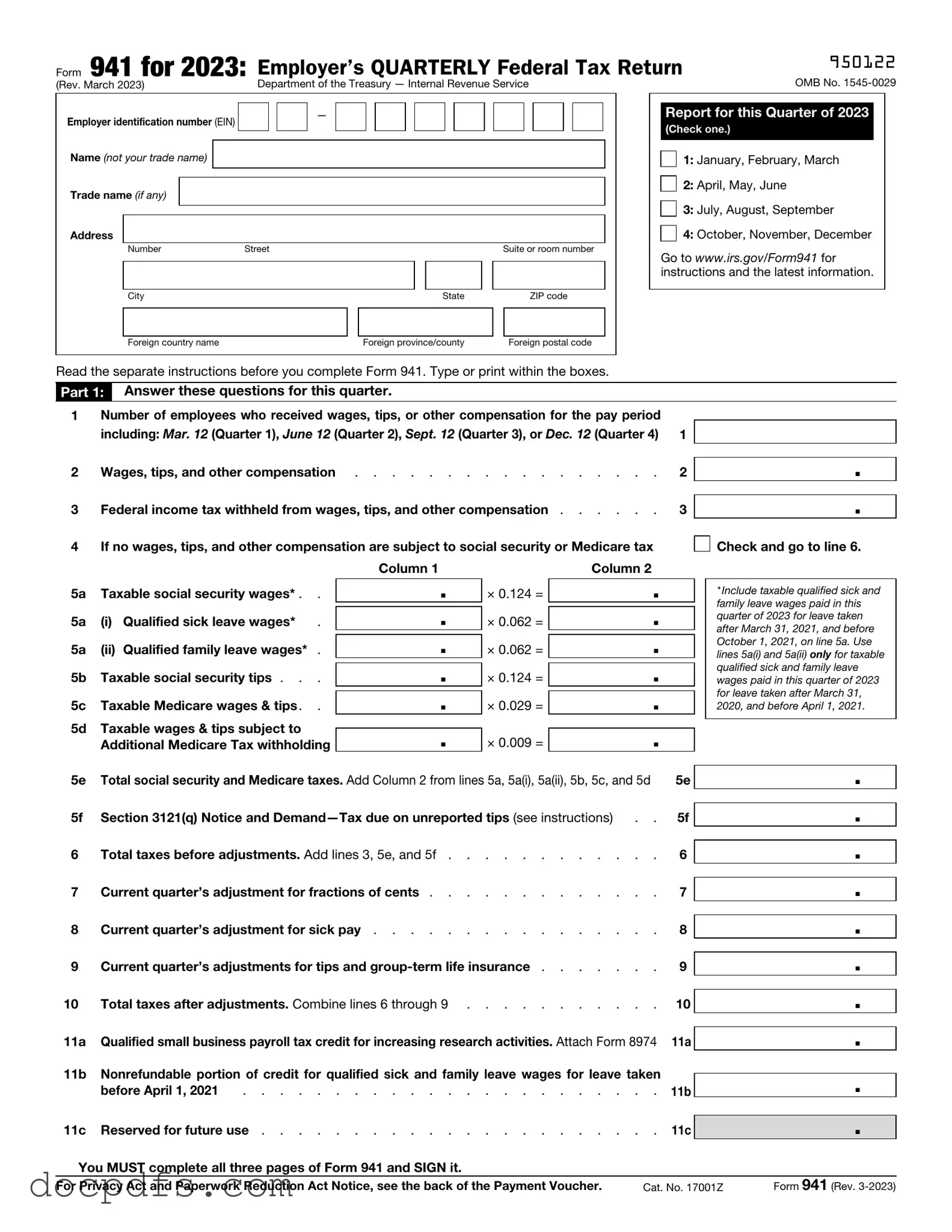

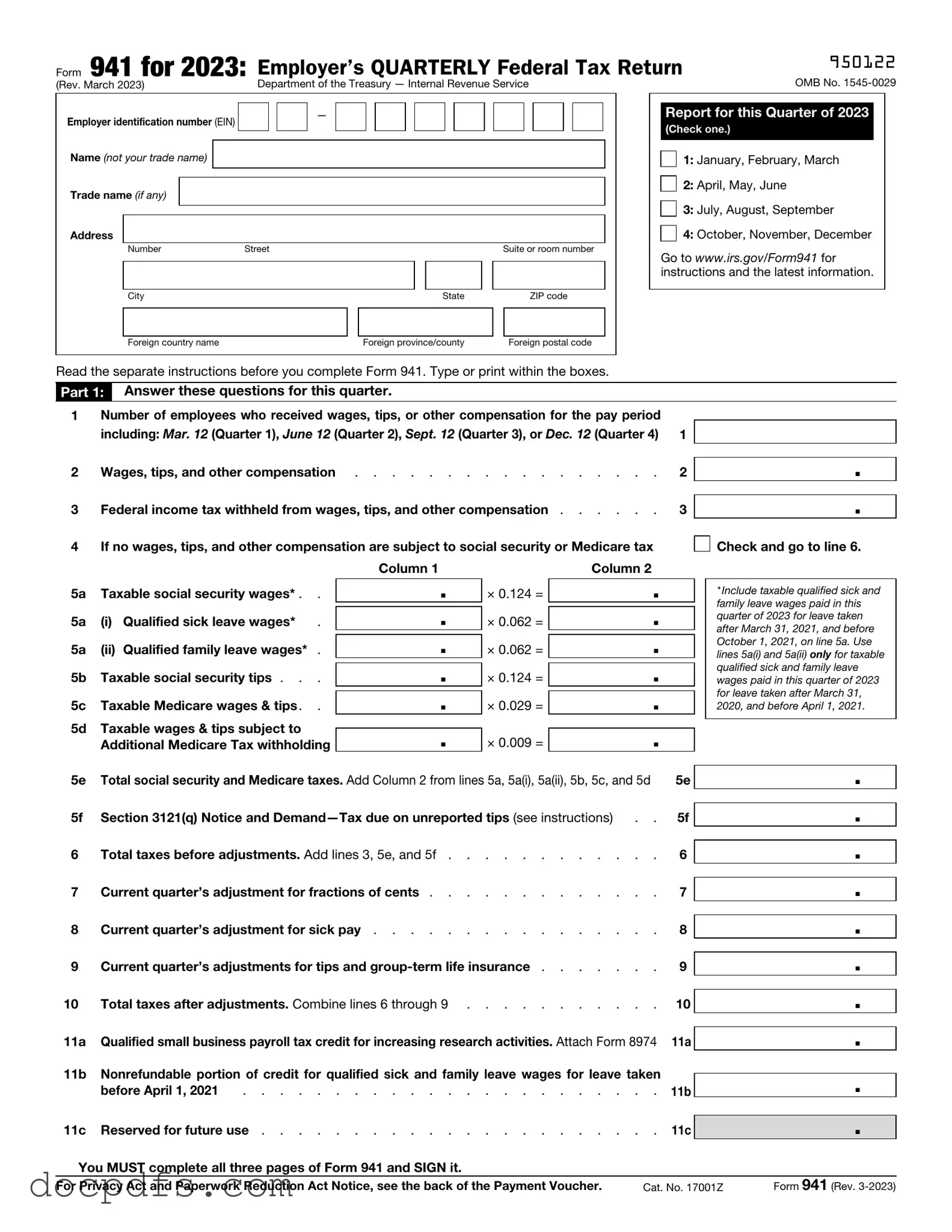

IRS 941 Template in PDF

The IRS Form 941 is a crucial document that employers must file quarterly to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form not only helps the IRS track tax obligations but also ensures that businesses remain compliant with federal tax laws. Understanding its requirements is essential for maintaining proper payroll practices and avoiding potential penalties.

Open IRS 941 Editor Now

IRS 941 Template in PDF

Open IRS 941 Editor Now

Open IRS 941 Editor Now

or

⇓ IRS 941

Finish this form the fast way

Complete IRS 941 online with a smooth editing experience.