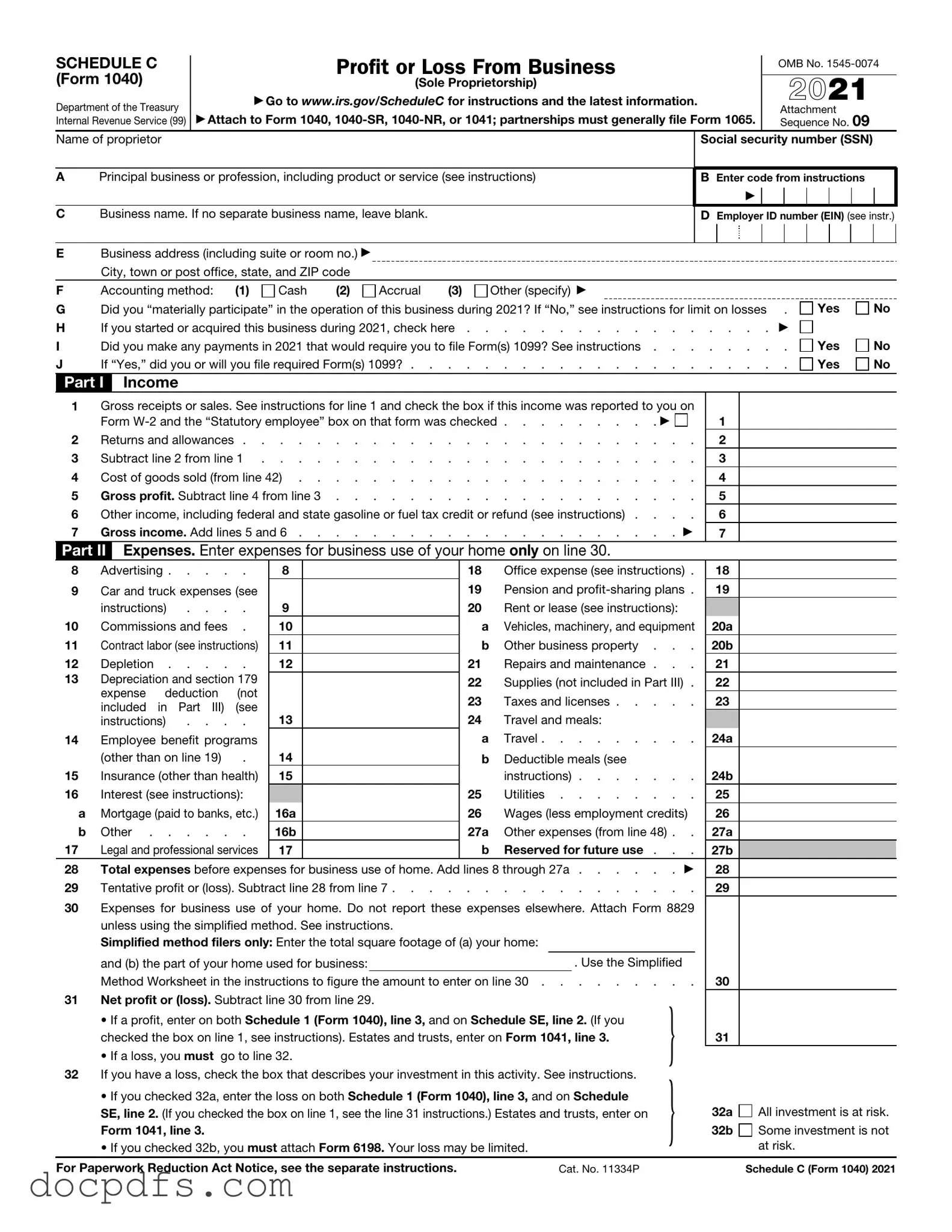

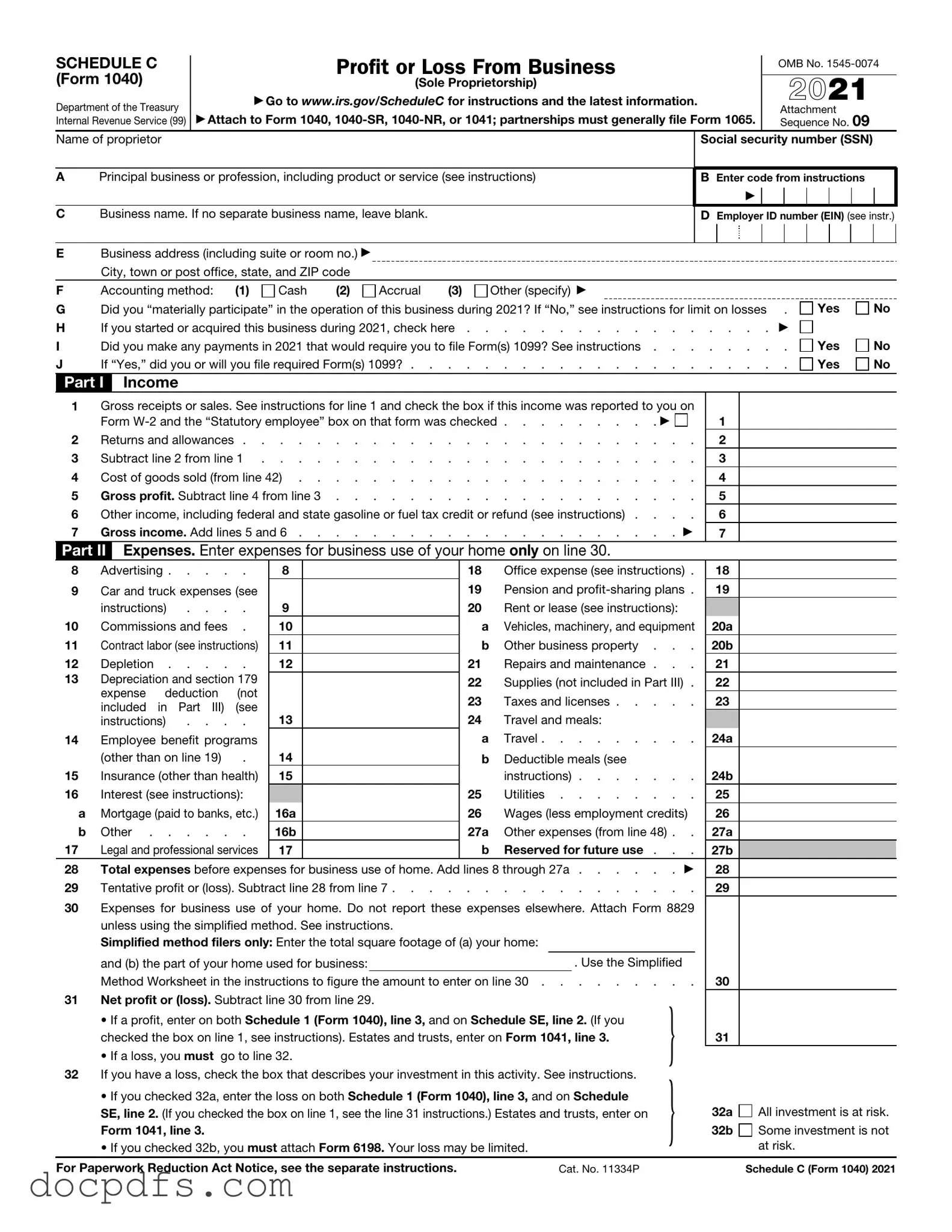

IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business. This form is essential for individuals who operate a business as a sole proprietorship, allowing them to detail their earnings and expenses. By filing Schedule C, taxpayers can calculate their net profit or loss, which is then reported on their individual tax return.

Who needs to file Schedule C?

Individuals who operate a business as a sole proprietor must file Schedule C. This includes those who:

-

Earn income from self-employment.

-

Provide services or sell goods as a business owner.

-

Have income from a profession, such as freelance work or consulting.

If you are a single-member LLC, you also report your business income on Schedule C, as it is treated as a sole proprietorship for tax purposes.

To fill out Schedule C, you will need various pieces of information, including:

-

Your business name and address.

-

Your business's principal activity and the product or service you provide.

-

Your income from sales or services.

-

Business expenses, which may include costs for supplies, rent, utilities, and other operating expenses.

Accurate records of all transactions throughout the year are crucial for completing this form effectively.

What types of expenses can be deducted on Schedule C?

Schedule C allows for a variety of business expenses to be deducted, which can significantly reduce your taxable income. Common deductible expenses include:

-

Cost of goods sold.

-

Advertising and marketing costs.

-

Utilities and rent for business premises.

-

Depreciation on business assets.

-

Office supplies and equipment.

-

Travel expenses related to business activities.

It's important to keep receipts and documentation for all expenses claimed to ensure compliance with IRS regulations.

How do I report income on Schedule C?

Income is reported on Schedule C by entering the total amount earned from your business during the tax year. This includes all revenue from sales, services, and any other business-related income. If you received any Form 1099-MISC or 1099-NEC for freelance work, that income should also be included. Be sure to report the gross income before any deductions are applied.

What is the difference between net profit and gross income?

Gross income refers to the total revenue generated by your business before any expenses are deducted. In contrast, net profit is calculated by subtracting total business expenses from gross income. This net profit figure is what ultimately affects your taxable income and is reported on your Form 1040.

Can I file Schedule C electronically?

Yes, you can file Schedule C electronically. Many tax preparation software programs allow for the electronic filing of this form, making the process more efficient. Additionally, e-filing can help reduce errors and expedite the processing of your tax return. Ensure that you follow all instructions provided by the software to accurately complete and submit your Schedule C.

What happens if I make a loss on Schedule C?

If your business incurs a loss, you can still file Schedule C. The loss can be used to offset other income on your tax return, potentially lowering your overall tax liability. This is often referred to as a net operating loss (NOL). However, specific rules apply to carry forward or carry back these losses, so consulting with a tax professional may be beneficial for understanding your options.