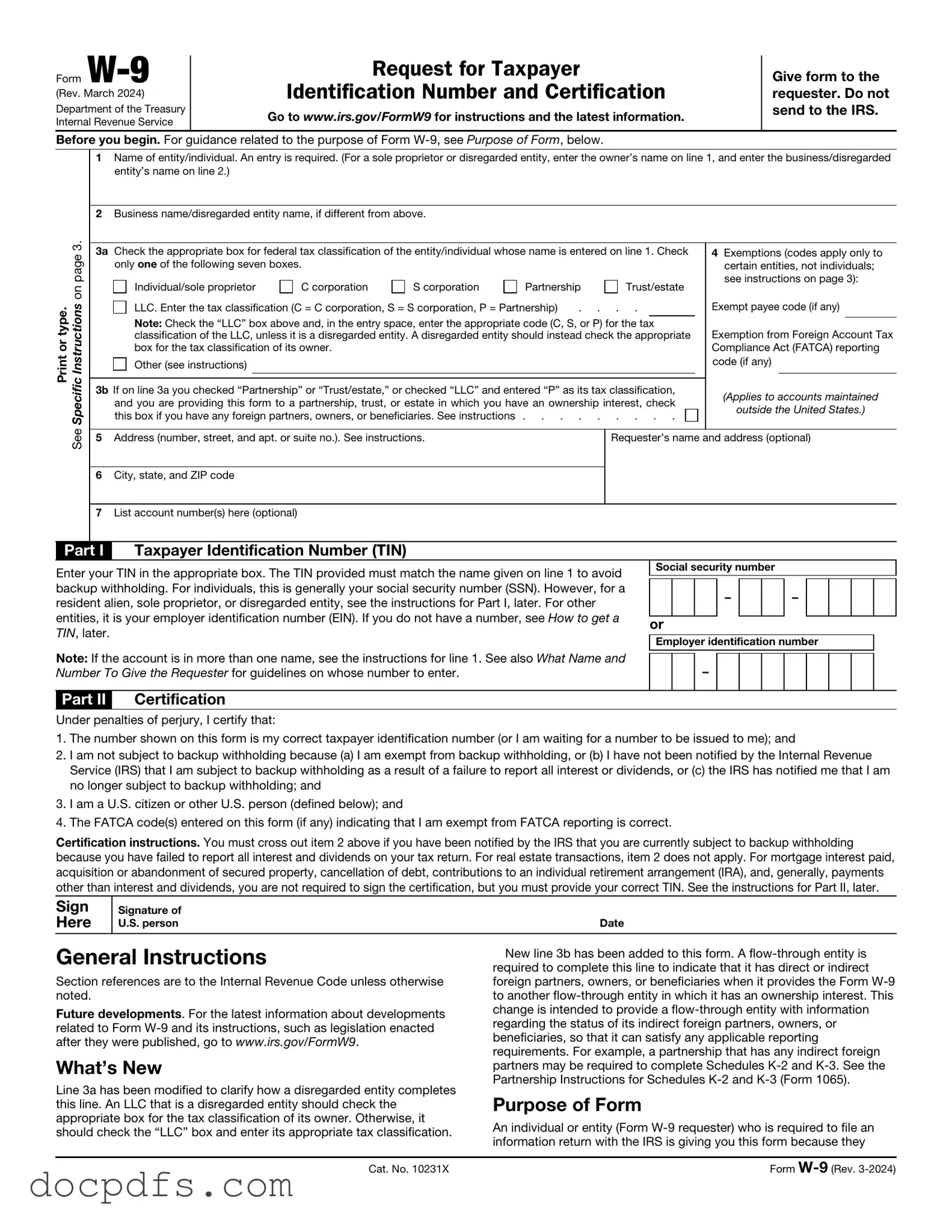

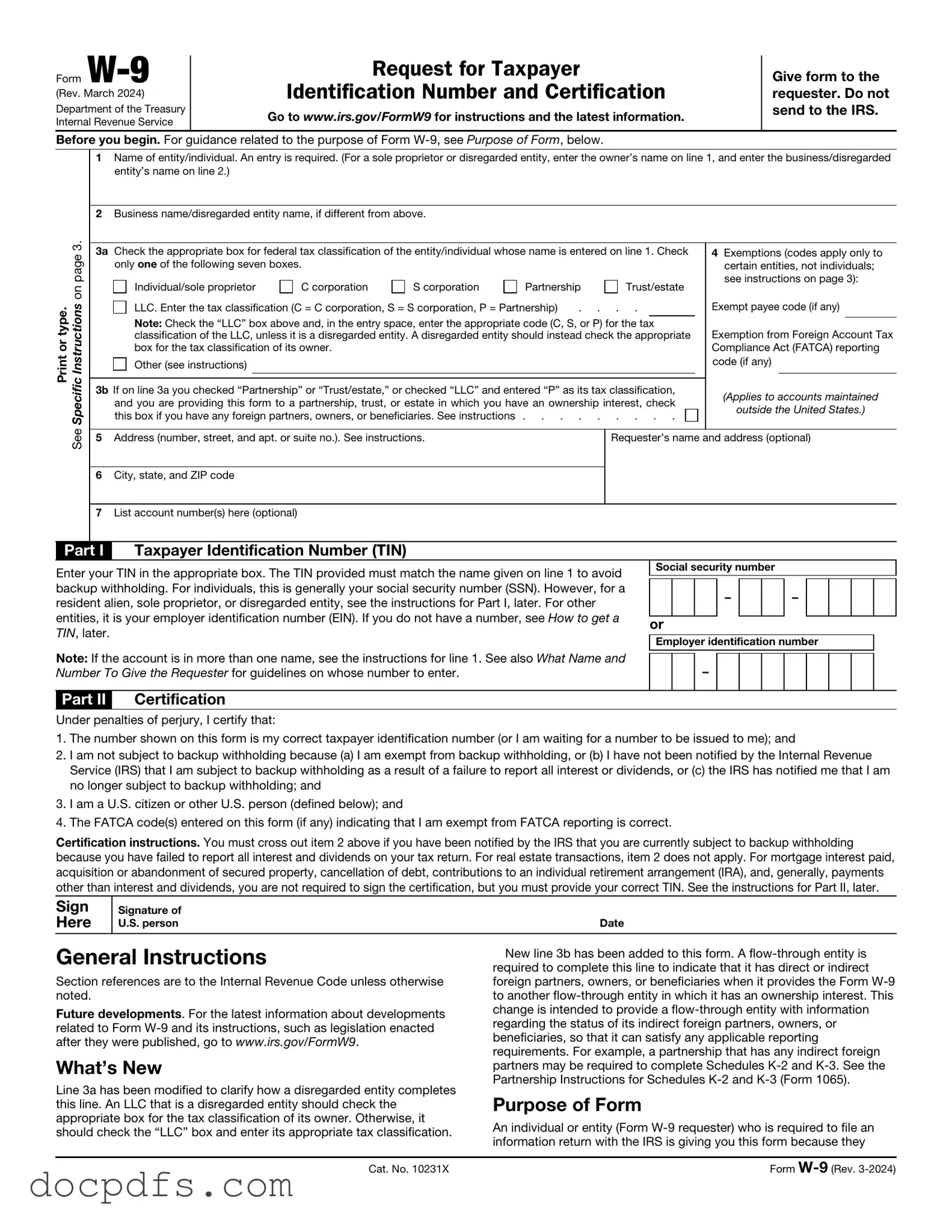

The IRS W-9 form is used to provide your taxpayer identification information to a person or entity that is required to file an information return with the IRS. This form is commonly used by freelancers, independent contractors, and other non-employees to report income received from businesses.

Individuals and businesses that receive income that is reportable to the IRS must complete a W-9 form. This includes:

-

Freelancers and independent contractors

-

Partnerships and corporations

-

Landlords receiving rental income

-

Individuals receiving interest or dividends

The W-9 form requires the following information:

-

Your name

-

Your business name (if applicable)

-

Your address

-

Your taxpayer identification number (Social Security Number or Employer Identification Number)

-

Your certification signature

The W-9 form is typically submitted directly to the requester, not to the IRS. You can send it via mail, email, or fax, depending on the requester's preference. Ensure that you keep a copy for your records.

Submit a W-9 form when you start a new job or business relationship that requires you to provide your taxpayer information. Additionally, if your information changes (like a name or address change), you should submit a new W-9.

If you do not submit a W-9 form when requested, the payer may be required to withhold a percentage of your payments for tax purposes. This is known as backup withholding and can be as high as 24%.

No, the W-9 form and W-2 form serve different purposes. The W-9 is used to provide taxpayer information for independent contractors and freelancers, while the W-2 form is issued by employers to report wages and taxes withheld for employees.

You can refuse to fill out a W-9 form, but doing so may result in the payer withholding taxes from your payments. It is often in your best interest to provide the requested information to avoid unnecessary tax withholding.

You typically only need to submit a W-9 form once per requester unless your information changes. If you change your name, address, or taxpayer identification number, a new W-9 should be submitted.

The W-9 form can be downloaded directly from the IRS website. It is available in PDF format and can be printed for completion. Ensure you are using the most current version of the form to avoid any issues.