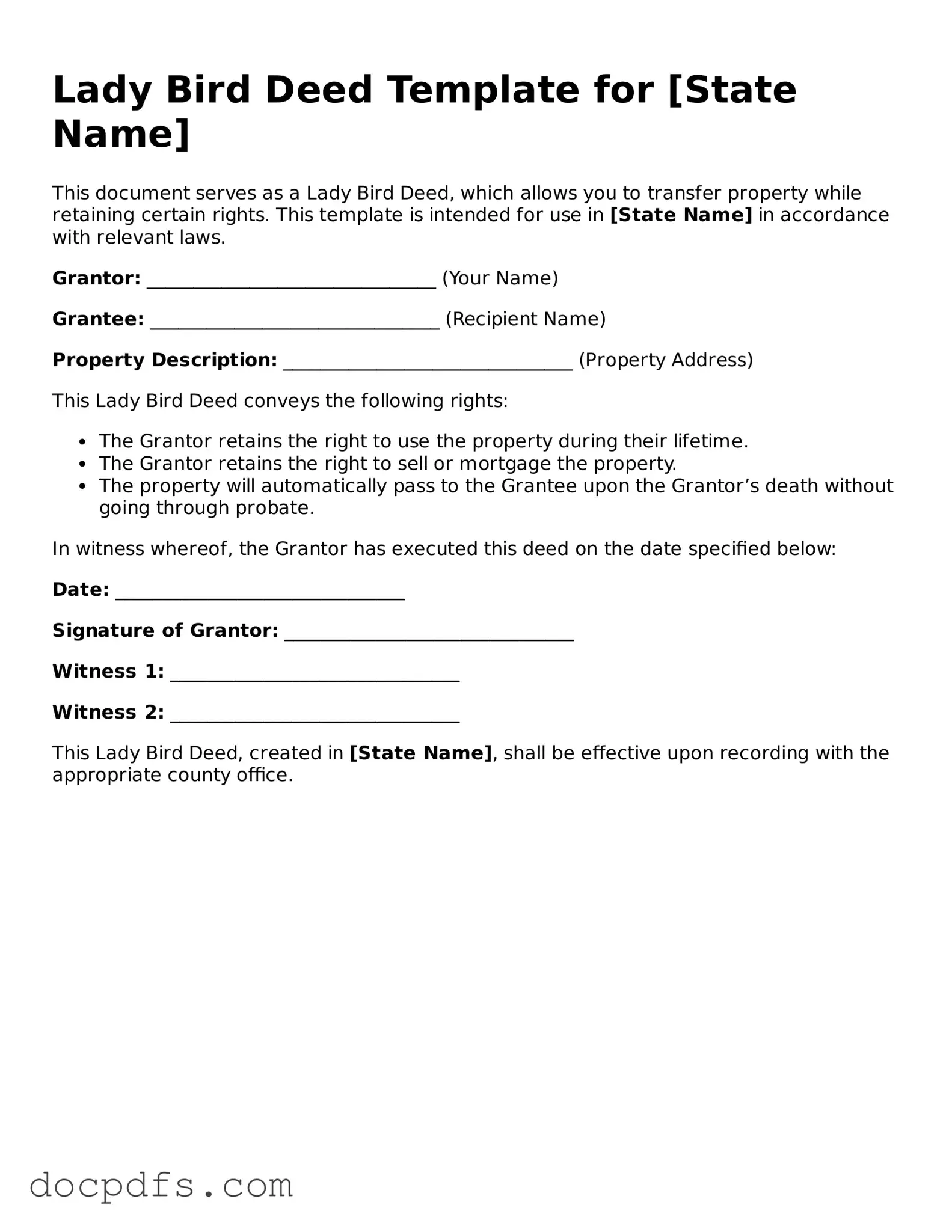

Legal Lady Bird Deed Document

The Lady Bird Deed, also known as an enhanced life estate deed, is a legal document that allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime. This unique form of deed provides significant benefits, including the ability to avoid probate and protect the property from creditors. Understanding the intricacies of the Lady Bird Deed can help individuals make informed decisions about their estate planning needs.

Open Lady Bird Deed Editor Now

Legal Lady Bird Deed Document

Open Lady Bird Deed Editor Now

Open Lady Bird Deed Editor Now

or

⇓ Lady Bird Deed

Finish this form the fast way

Complete Lady Bird Deed online with a smooth editing experience.