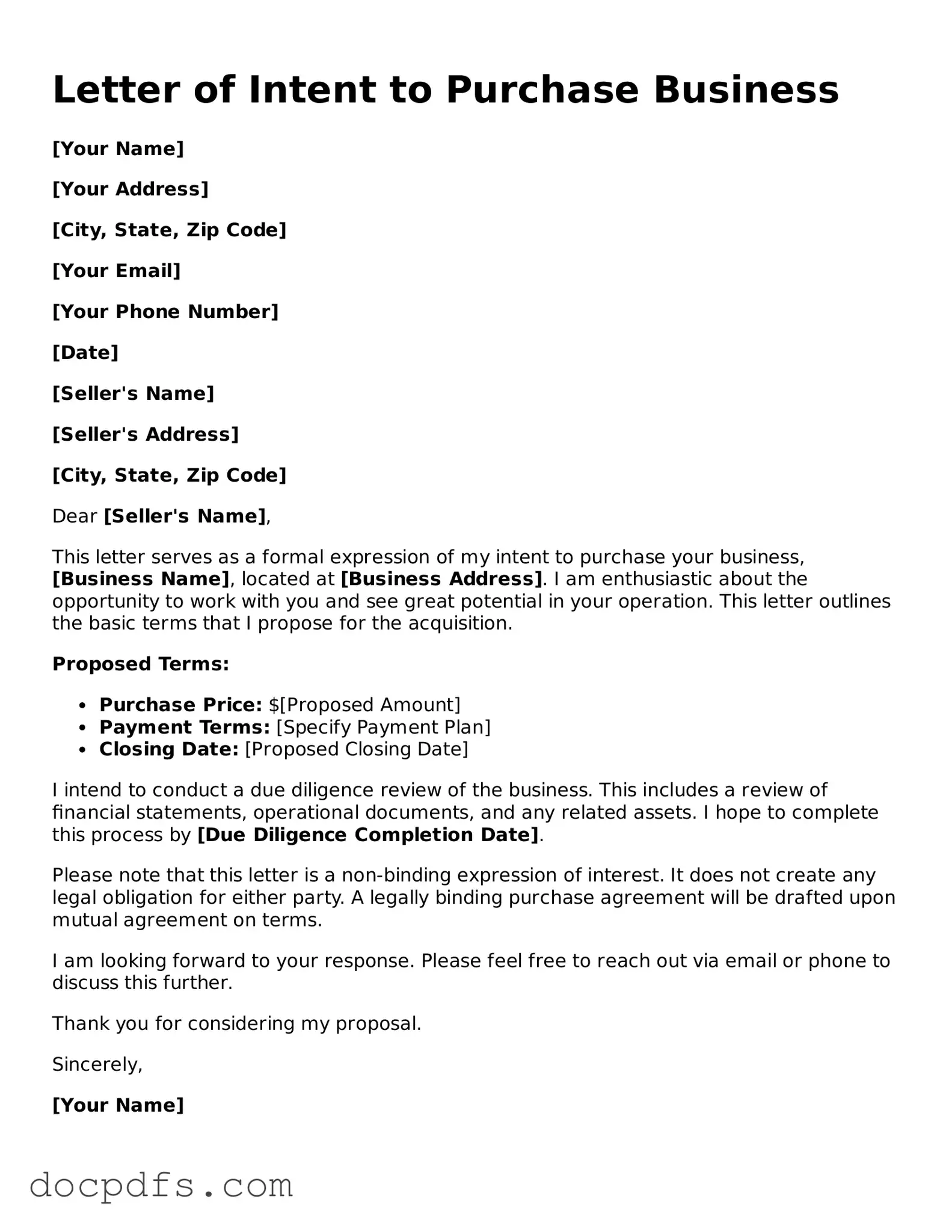

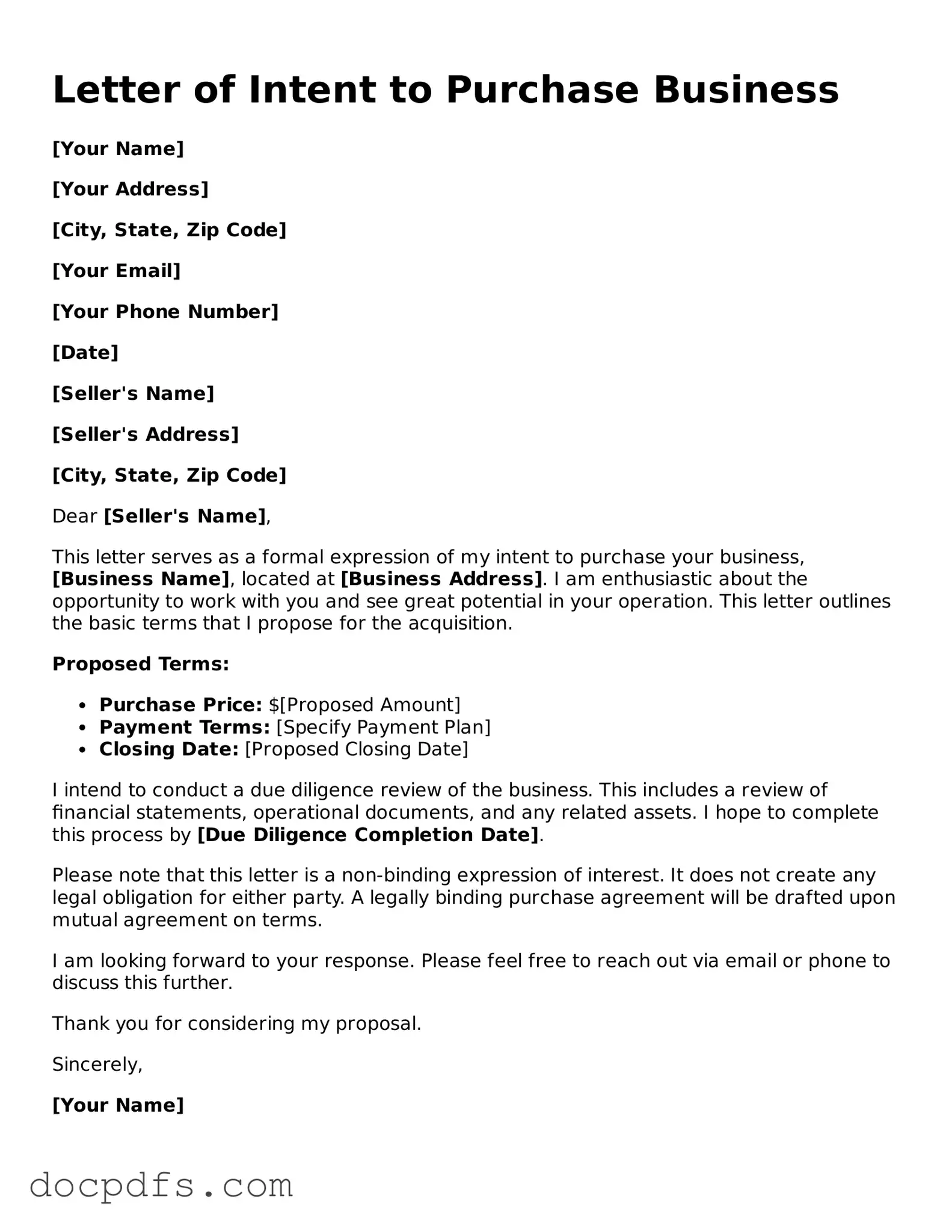

Legal Letter of Intent to Purchase Business Document

A Letter of Intent to Purchase Business is a document that outlines the preliminary agreement between a buyer and a seller regarding the purchase of a business. This form serves as a starting point for negotiations, detailing key terms and conditions before a formal purchase agreement is drafted. Understanding this document is essential for both parties to ensure clarity and mutual agreement moving forward.

Open Letter of Intent to Purchase Business Editor Now

Legal Letter of Intent to Purchase Business Document

Open Letter of Intent to Purchase Business Editor Now

Open Letter of Intent to Purchase Business Editor Now

or

⇓ Letter of Intent to Purchase Business

Finish this form the fast way

Complete Letter of Intent to Purchase Business online with a smooth editing experience.