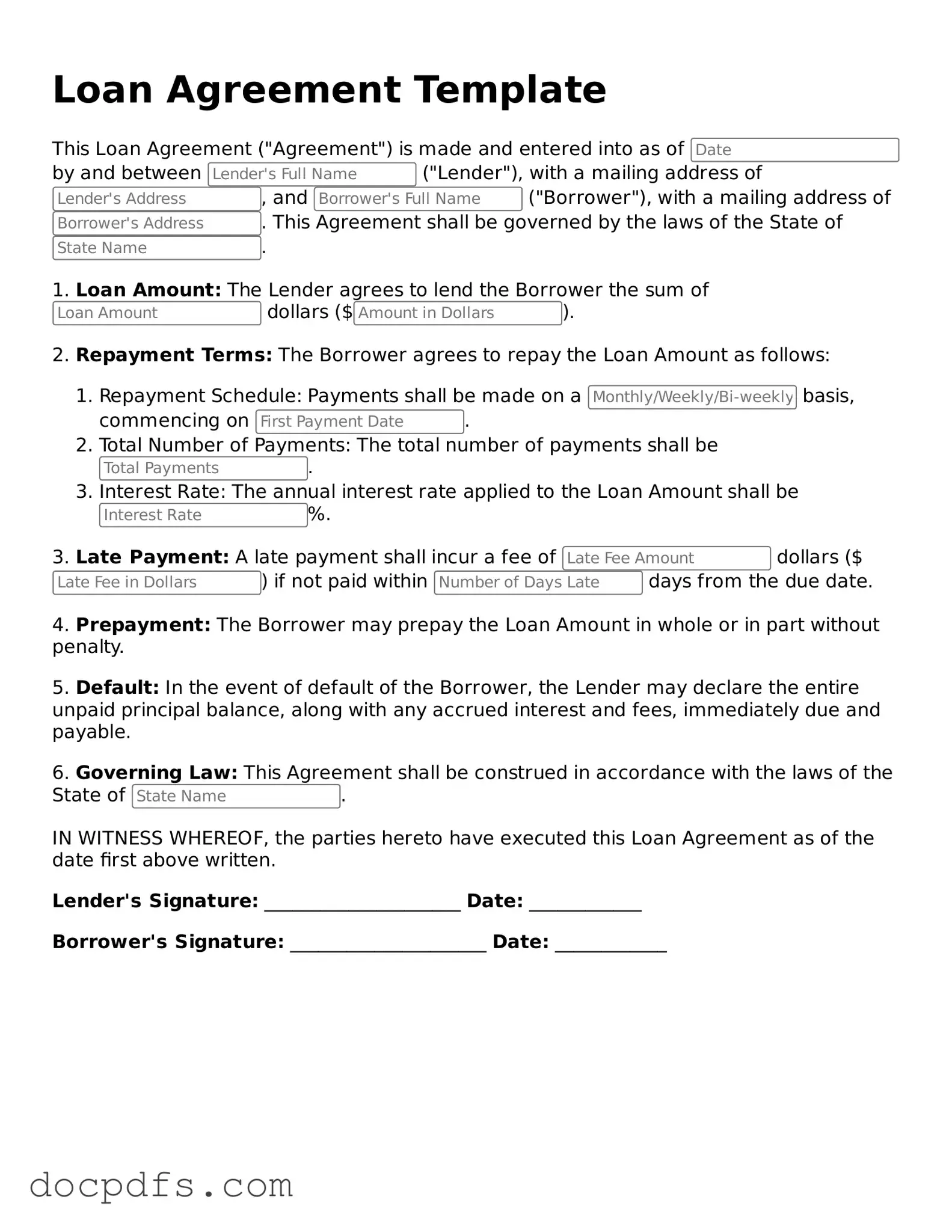

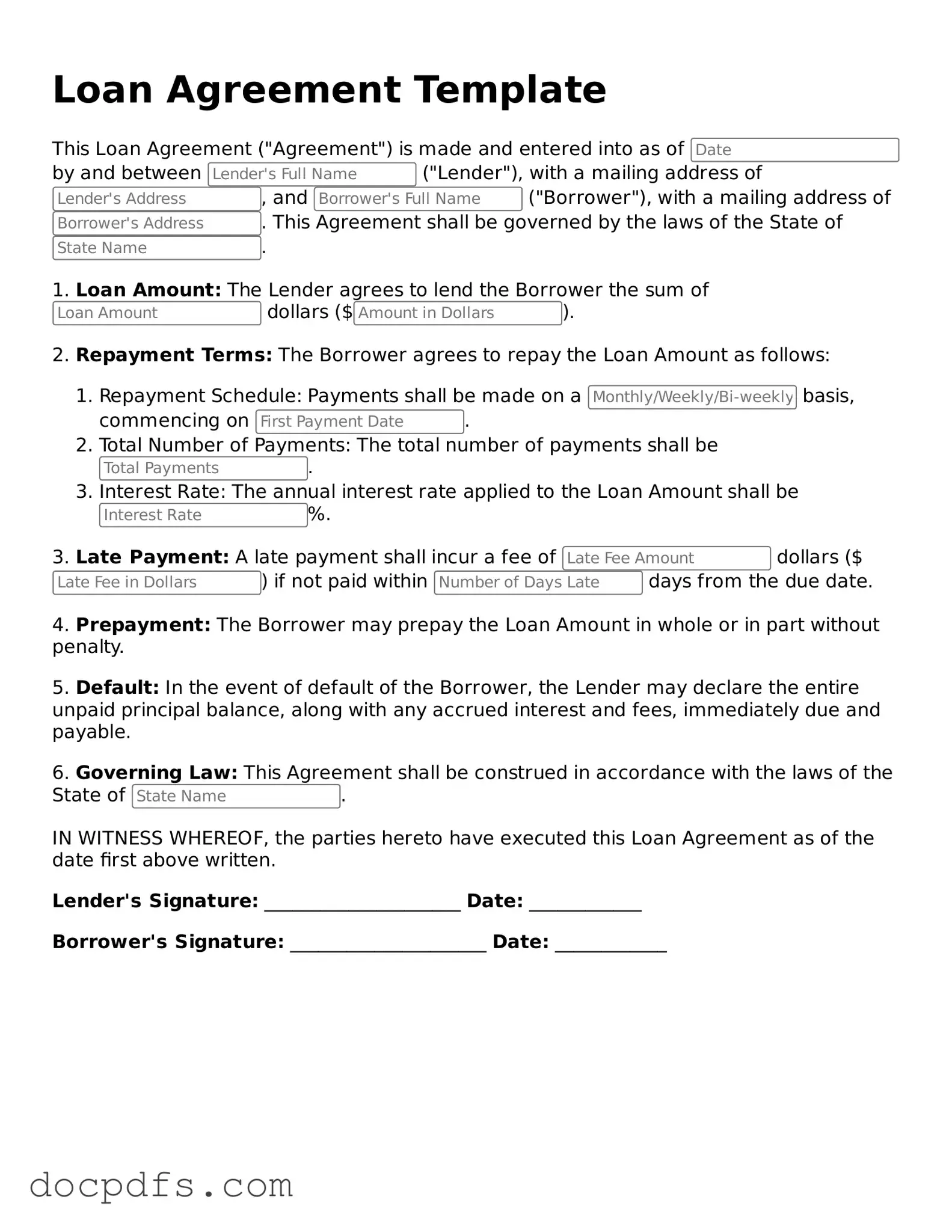

Legal Loan Agreement Document

A Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower. This form typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Understanding this form is essential for both parties to ensure clarity and protect their rights throughout the loan process.

Open Loan Agreement Editor Now

Legal Loan Agreement Document

Open Loan Agreement Editor Now

Open Loan Agreement Editor Now

or

⇓ Loan Agreement

Finish this form the fast way

Complete Loan Agreement online with a smooth editing experience.