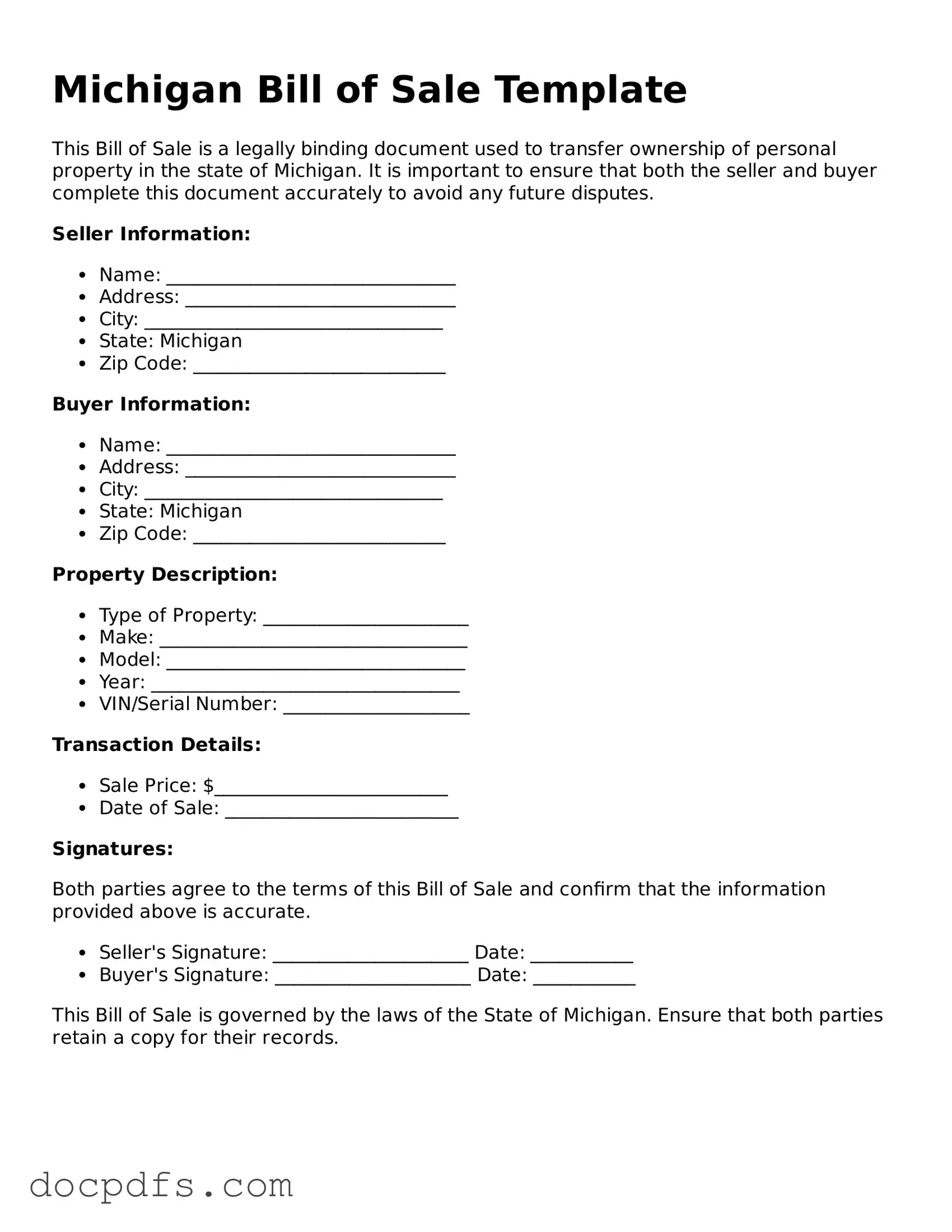

A Michigan Bill of Sale form is a legal document that records the sale of personal property. It serves as proof of the transaction between the seller and the buyer. This form can be used for various items, including vehicles, boats, and other personal goods. It outlines important details about the sale, such as the item description, sale price, and the names of both parties involved.

Do I need a Bill of Sale for every transaction in Michigan?

While a Bill of Sale is not required for every transaction, it is highly recommended for significant purchases. For example, if you are buying or selling a vehicle, a Bill of Sale is essential for registering the vehicle and transferring ownership. For smaller items, it may not be necessary, but having one can help prevent disputes in the future.

A complete Bill of Sale should include the following information:

-

The names and addresses of both the seller and the buyer.

-

A detailed description of the item being sold, including its make, model, year, and VIN (for vehicles).

-

The sale price of the item.

-

The date of the transaction.

-

Any warranties or guarantees provided by the seller.

Is a Bill of Sale legally binding in Michigan?

Yes, a Bill of Sale is legally binding in Michigan as long as it is properly filled out and signed by both parties. It acts as a contract, ensuring that both the seller and buyer have agreed to the terms of the sale. If a dispute arises, this document can serve as evidence in court.

Can I create my own Bill of Sale in Michigan?

Absolutely! You can create your own Bill of Sale as long as it includes all the necessary information. Many templates are available online to help you get started. Just ensure that it is clear, concise, and covers all essential details to protect both parties involved in the transaction.

How do I notarize a Bill of Sale in Michigan?

Notarizing a Bill of Sale is not mandatory in Michigan, but it can add an extra layer of security. To notarize, both the seller and buyer should sign the document in the presence of a notary public. The notary will then add their seal and signature, confirming that the signatures are authentic. This can help prevent fraud and establish the legitimacy of the transaction.

What should I do after completing a Bill of Sale?

After completing the Bill of Sale, both the seller and buyer should keep a copy for their records. If the item is a vehicle, the buyer will need to take the Bill of Sale to the local Secretary of State office to register the vehicle in their name. It’s also wise to notify any relevant authorities, especially if the item is subject to registration or licensing.