Free Michigan Deed Form

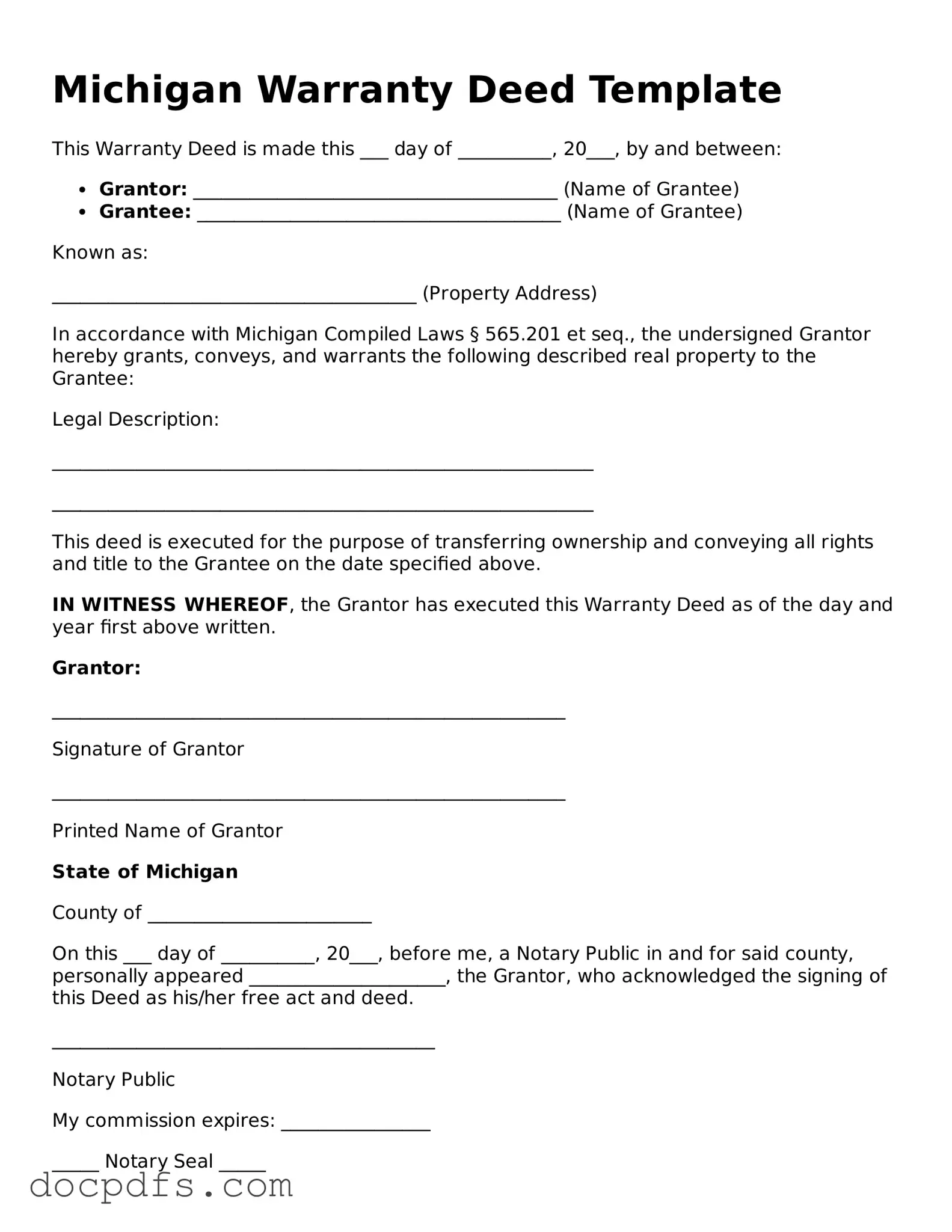

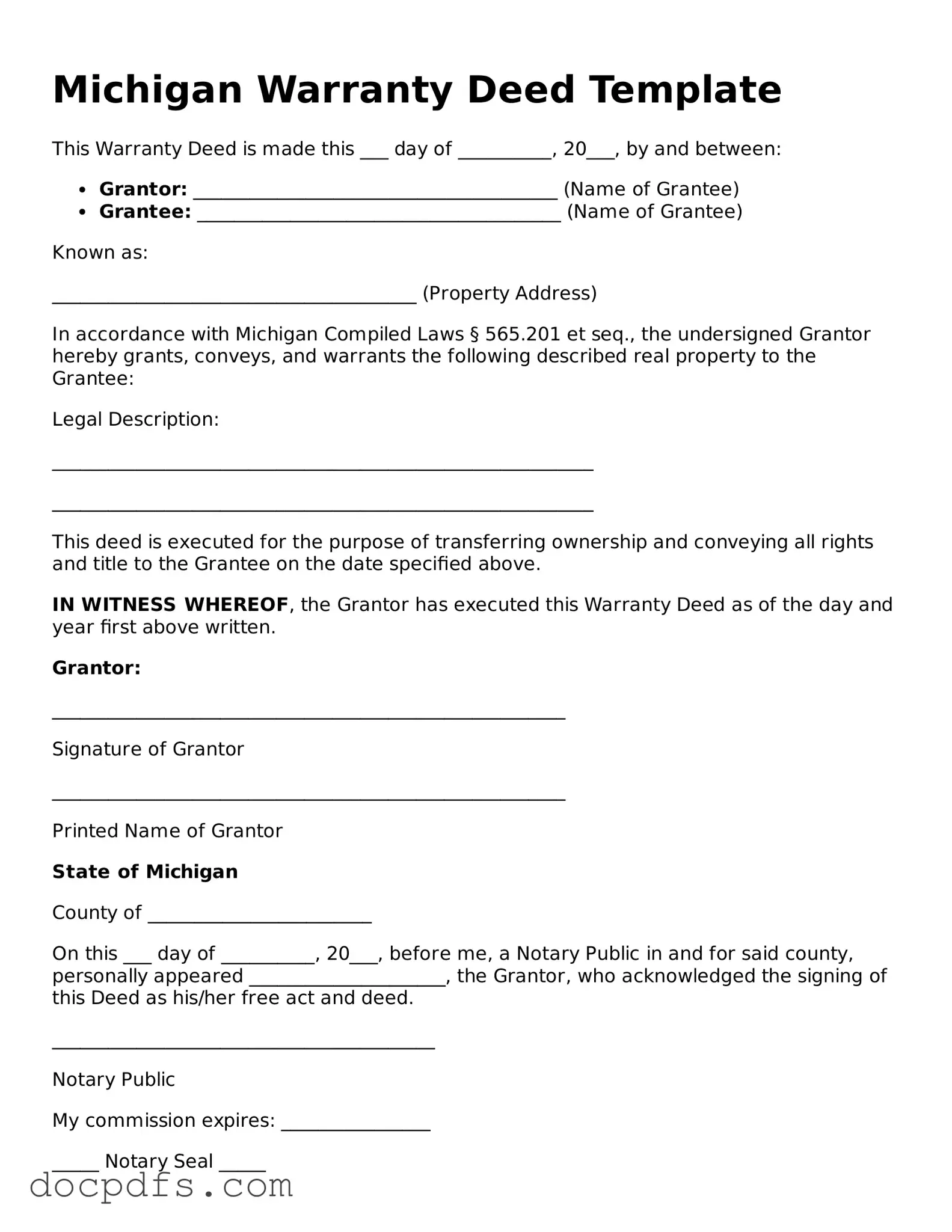

A Michigan Deed form is a legal document used to transfer ownership of real property from one party to another. This form is essential for ensuring that the transfer is recognized by the state and provides a clear record of ownership. Understanding the specific requirements and types of deeds available in Michigan can help individuals navigate the property transfer process effectively.

Open Deed Editor Now

Free Michigan Deed Form

Open Deed Editor Now

Open Deed Editor Now

or

⇓ Deed

Finish this form the fast way

Complete Deed online with a smooth editing experience.