What is a Michigan Durable Power of Attorney?

A Michigan Durable Power of Attorney is a legal document that allows an individual, known as the principal, to appoint another person, called the agent or attorney-in-fact, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated, ensuring that their financial and legal affairs can be managed without interruption.

Why should I consider creating a Durable Power of Attorney?

Creating a Durable Power of Attorney is a proactive step in ensuring that your wishes are respected and your affairs are handled according to your preferences. Some reasons to consider this document include:

-

Maintaining control over your financial decisions even if you become unable to make them yourself.

-

Designating someone you trust to manage your affairs, which can alleviate stress for family members during difficult times.

-

Preventing the need for a court-appointed guardian or conservator, which can be a lengthy and costly process.

Who can be appointed as my agent in a Durable Power of Attorney?

In Michigan, you can appoint any adult as your agent, provided they are of sound mind and not under a legal disability. This person can be a family member, friend, or even a professional, such as an attorney or financial advisor. It’s crucial to choose someone who understands your values and will act in your best interests.

What powers can I grant to my agent?

The powers granted to your agent can be broad or limited, depending on your preferences. Common powers include:

-

Managing bank accounts and financial transactions.

-

Making decisions regarding real estate, including buying or selling property.

-

Handling tax matters and filing tax returns.

-

Managing investments and retirement accounts.

-

Making healthcare decisions if specified in a separate healthcare directive.

It’s important to clearly outline the scope of authority you wish to grant to avoid any confusion later on.

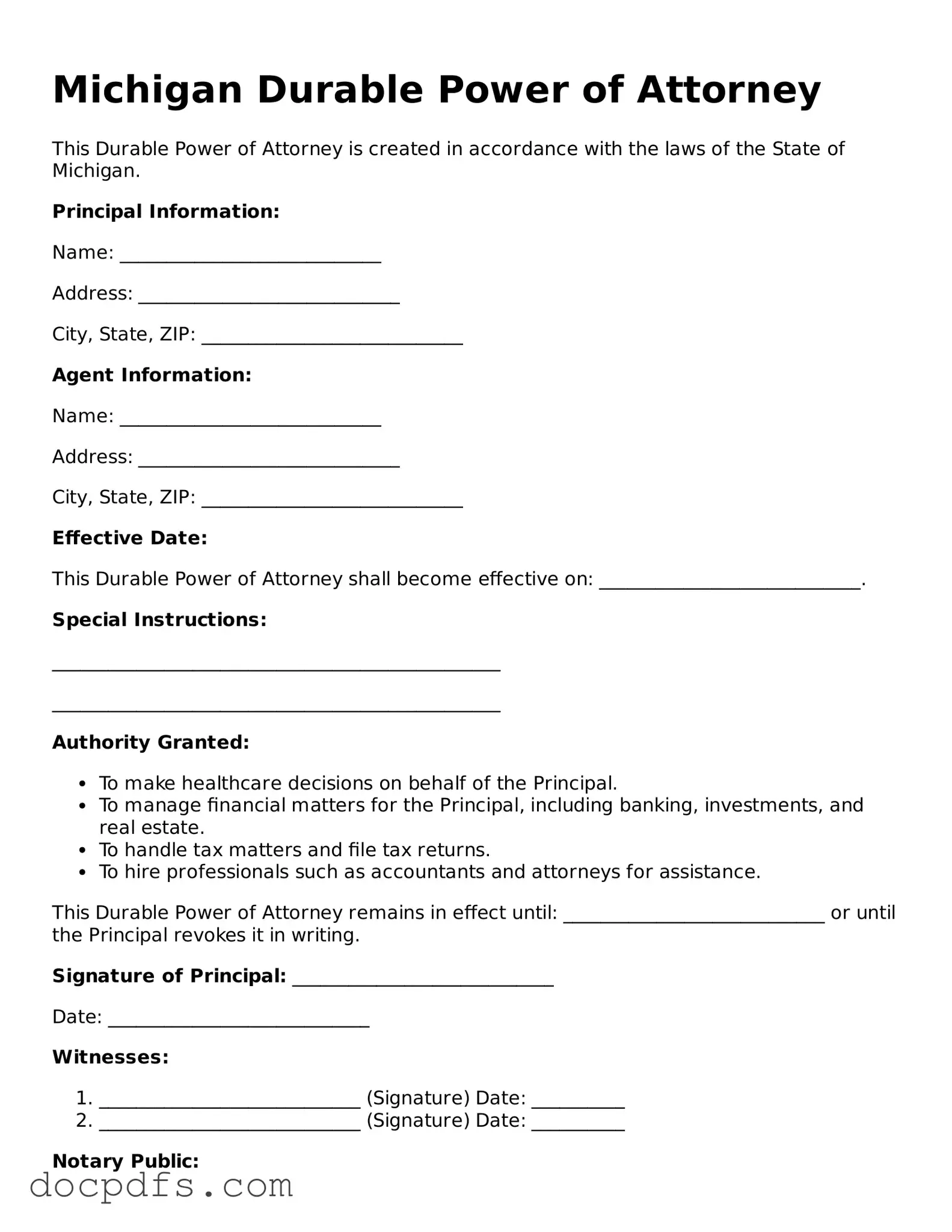

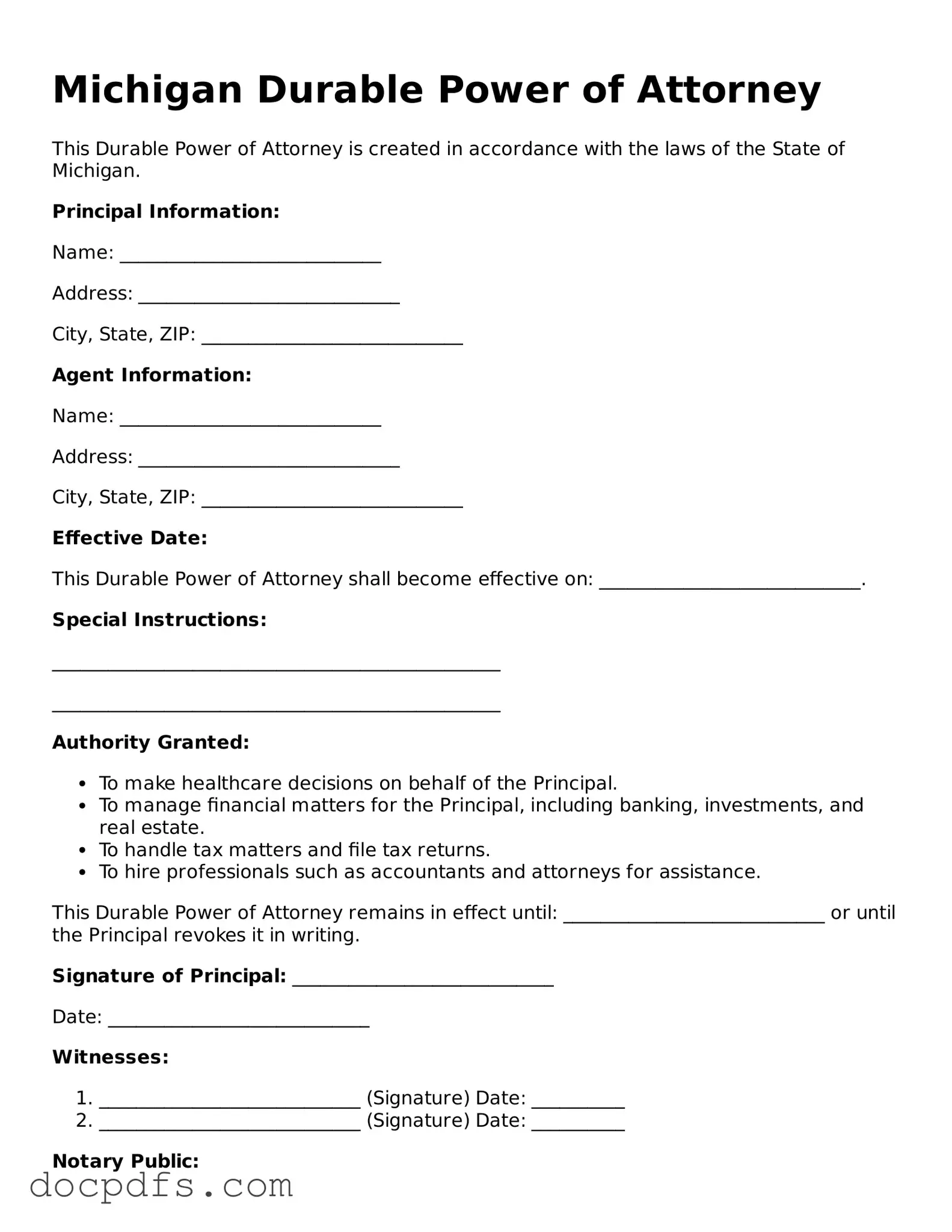

Does a Durable Power of Attorney need to be notarized?

Yes, in Michigan, a Durable Power of Attorney must be signed by the principal in the presence of a notary public. This ensures that the document is legally binding and helps prevent any disputes regarding its validity. Additionally, having witnesses can add an extra layer of protection, though it is not strictly required.

Can I revoke or change my Durable Power of Attorney?

Absolutely. As long as you are of sound mind, you can revoke or modify your Durable Power of Attorney at any time. To do this effectively, you should create a written revocation document and notify your agent and any institutions that may have a copy of the original document. It’s also wise to destroy any copies of the previous Power of Attorney to avoid confusion.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, your family may need to go through a legal process to appoint a guardian or conservator. This process can be lengthy, costly, and emotionally taxing for your loved ones. Having a Durable Power of Attorney in place allows you to avoid this situation and ensures that your wishes are followed.

Is a Durable Power of Attorney the same as a Living Will?

No, a Durable Power of Attorney and a Living Will serve different purposes. A Durable Power of Attorney focuses on financial and legal decisions, while a Living Will, or advance directive, specifically addresses your healthcare preferences in case you become unable to communicate your wishes. It’s advisable to have both documents in place for comprehensive planning.